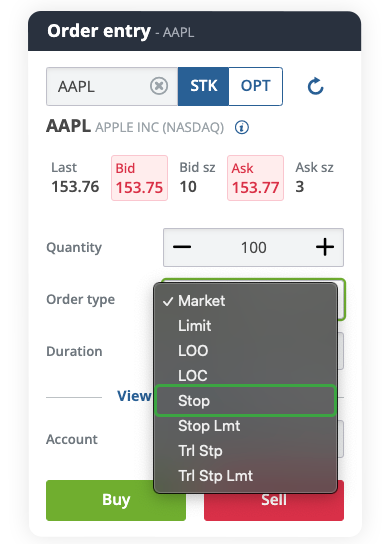

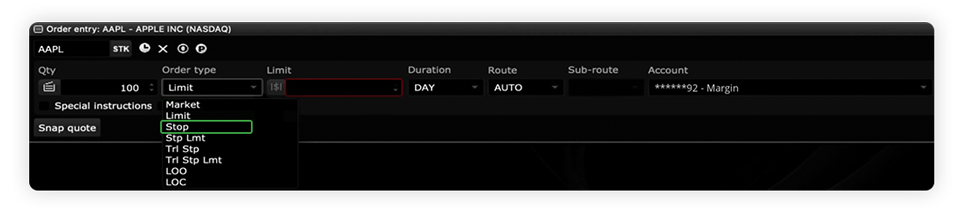

A stop order is a type of order used to buy or sell securities when the market price reaches a specified value, known as the stop price.

Stop orders are also often known as “stop-loss orders” because they’re generally used to limit losses or protect profits, and are very commonly used to protect short positions which can have extremely high loss potential. You can think of them as the emergency brakes on an elevator–they’re there to trigger in case of any sudden, unexpected movement.