Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Advanced order types and durations

Trailing stop orders

Trailing stop-loss and trailing stop-limit orders are advanced order types that automatically adjust according to a security’s price movement. Learn all about these advanced order types.

A trailing stop order is a type of conditional stop order that is set to trigger at a specific percentage or dollar amount away from a security’s current market price. Trailing stop orders can be entered by themselves for either long or short positions, but are also commonly used in bracket orders.

Trailing stops can also be entered as stop limit orders.

Please note: Trailing stop and other more advanced order types and durations are only available through the Questrade Edge Web and Edge Desktop platforms.

Trailing stop sell orders can be used to restrict potential downside, without capping potential gains. This is because as the security’s market price moves up, the stop order ‘trails’ the market price by a specific dollar amount or percentage.

Trailing stop buy orders can also be used in short positions, they just work in the opposite direction: the ‘trail’ is above the market price, rather than below it.

How trailing stops differ from ‘regular’ stop (loss) orders

Suppose you buy shares of company ‘XYZ’ at $140/share, and would like to use a stop-order as ‘downside protection’ in case the price of the security falls.

You could use a ‘regular’ stop-sell order at a specific set price like $125, but then if the price of XYZ moves up to $160, your stop order will stay at $125. This causes extra work for you to constantly modify your existing stop order and move it up ‘manually’ to continue limiting losses, while maximizing gains.

If you don’t modify your stop order, and move it up from $125, and the price falls from $160, with this strategy, you could lose out on the potential gains from $140-$160.

This is exactly where trailing stop orders come in, and can help you ‘automate’ parts of your trading or investing strategy.

Let’s check out how a trailing stop works:

Sticking with this example, if you bought shares of XYZ at $120, you could enter a trailing stop order to sell your shares with a specific price, or percentage offset. This offset determines how far away the stop order trails the market price. If we set the offset to $10, this would mean our stop order ‘starts’ at $110. If XYZ falls by our offset amount ($10) at any time after placing your trade, our sell order will be triggered.

If XYZ moves up to $130, our trailing stop order will also move up to $120 ($10 offset).

If XYZ continues to increase in share price to $150, our trailing stop will also move up to $140.

Once the share price has risen to $155, if it drops suddenly by $10 or more (our offset amount), our trailing stop would trigger at $145, and a market order would be sent to sell the stock.

Just like a regular stop order (also known as a stop-loss, or sometimes a stop-market), a trailing stop order becomes a Market order once the stop is triggered. This means your order is executed at the best available Bid or Ask at the time. Due to this, your order isn’t necessarily executed at your exact stop or trigger price.

In the previous example, if your trailing stop order was triggered at $145, your market sell order will fill at the best Bid (I.e. $144.97). This depends on how many shares are being traded (Volume and liquidity) and how rapid the price changes are (volatility). In a fast moving volatile market, or for securities that trade in low volumes with wide bid-ask spreads, this can lead to an undesirable order execution price.

This is where trailing stop limit orders come in

Due to this uncertainty in ‘fill’ or execution price, some investors use a Trailing stop limit order. With this type of trailing stop, a limit offset is entered in addition to a ‘trigger’ or stop price. The limit offset/price is what is sent to the exchange after your stop price is triggered. Keep in mind that depending where you set your limit offset, prices may gap past it in fast-moving markets.

The limit of a trailing stop limit order is set as an offset from the trailing stop, either by dollar value or by percentage.

So, for example, if you have a $100 share with a trailing stop of $10 and a limit offset of $5, and the share price dropped immediately, it would trigger at $90 with a limit price of $85. However, if the price jumped to $120 before dropping, the stop would trigger at $110 with a limit price of $105.

Percentages work the same, only the difference is a percentage of the price instead of a static number. In the above example if your $100 per share security had a trailing stop of 10% and an offset limit of 5%, it would still trigger at $90 ($100 - 10%) with a slightly higher order of $85.50 ($90 - 5%). However, if the price jumped to $120 before dropping, the stop would trigger at $108 ($120 - 10%) with a limit order of $102.60 ($108 - 5%).

To learn more about the difference between a stop order and a stop limit order, see our article on stop limit orders.

Let’s take a look at another example using a percentage offset:

Suppose you’ve bought shares of company ABC at $50 per share and would like to use a trailing stop as downside protection. You enter a trailing stop sell order with a 10% offset (trigger price). If ABC continues to trade at $50, your stop or ‘trigger’ is currently set to $45 (10% offset).

If ABC moves up to $70, your trailing stop would also move up to $63 ($70 - 10%). But if ABC then declines to $65, your trailing stop would stay at $63. Trailing stops only move in one direction, so once the shares drop by 10% from any new ‘peaks’ in price, the shares would be sold.

In this scenario, rather than continuing to drop to $63, instead our shares of ABC increase to $80 per share, before suddenly dropping to $70. What price would our sell order trigger at? In this case, it would be $72, which is 10% less than the ‘peak’ or high price of $80.

This demonstrates how trailing stops can be used as an effective tool to help ‘automate’ parts of your investing strategy. You can create a ‘set-it and forget-it’ solution that essentially monitors your positions and sells accordingly. But with any strategy, there are always downsides. We’ll cover some common watchouts and tips in the sections below.

Please note: Even though trailing stops, and other stop orders can act as downside/upside protection, we highly recommend keeping an eye on your active positions and orders. There are a number of reasons an order may be cancelled including:

- GTC orders expiring at the 90-day mark

- Corporate actions, such as:

- Mergers and acquisitions

- Splits, or reverse-splits (consolidation)

As with any trading strategy, or order type, we highly recommend monitoring your positions regularly. This is especially the case for very volatile securities, or securities undergoing corporate actions.

Reminder: This article is for educational purposes only, no information contained here should be taken as any form of trading or investment advice.

In addition to being used as ‘downside protection’ as a sell order, trailing stops are also commonly used as buy orders.

These can be used to buy an investment during an opportune time, or to reduce risk during a short position.

Trailing stop buy orders work the exact same way as trailing stop sell orders, except the trigger price will be above the current market price, not below it.

Let’s check out an example:

Suppose you’re looking to buy shares of company XYZ that trades at $20 per share, and are looking for an opportunity to catch an ‘upswing’ in price after a long decline. You could enter a trailing stop buy order with a 5% offset, and this ensures that your order will execute once XYZ has moved more than 5% upwards from the time you placed the order. (If XYZ rises immediately, your buy order would execute at $21, a 5% offset.)

If XYZ continues to decline to $15, your buy order will move downwards along with the market price to $15.75. If XYZ drops to $12, your buy order also moves down to $12.60. But if XYZ then rises to $15 right away, your buy order will trigger at your offset price of $12.60. (Since this was a more than 5% rise in market price.)

And one more example if you're shorting:

Suppose you’ve shorted shares of ABC at $10 per share, and would like to use a trailing stop buy order to protect your investment from an unexpected rise in price. You could set a trailing stop buy order with a $2 offset, this means if ABC rises by $2 at any time after you placed your trade, your shares would be ‘bought to cover’ your short position.

If ABC declines to $7 a share, your trailing stop buy order follows the market price down by the offset amount to $9, and if ABC declines even more to $5 a share, your trailing stop also moves to $7. But if then ABC suddenly rises to $8, your trailing stop order will trigger at $7, and become a market order to ‘buy to cover’ your short position, at the best available ask price.

Follow these easy steps to place a trailing stop order using our Edge web platform:

- Log in, and navigate to Questrade Edge web using the top left hand menu.

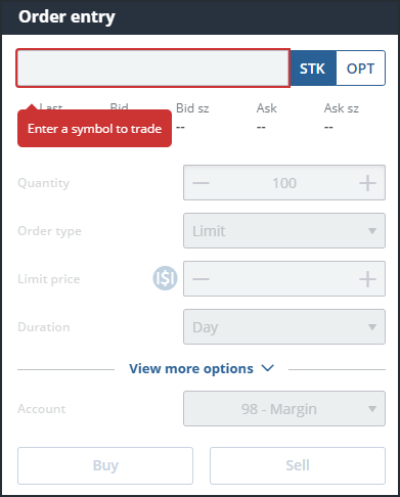

- In the Order entry window on the right side, enter your ticker symbol.

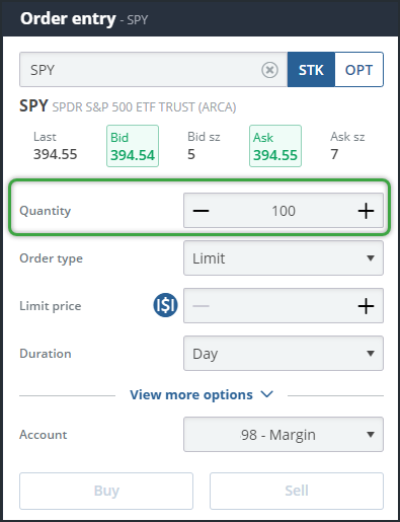

- Add your desired quantity of shares.

- From the Order types menu, select “Trl Stp” for a trailing stop-loss order or “Trl Stp Lmt” for a trailing stop-limit order.

- Enter your Trailing offset and, if it’s a trailing stop limit, your Limit offset.

- You can click the small $ or % icons next to the field to change between a dollar amount offset, or a percentage offset.

- Select your desired duration for the order.

- Learn more about durations in this article.

- In this example, we used ‘GTC’ or ‘good ‘till cancelled’.

- For a Trailing stop buy order, please click buy to proceed, for a sell order, please click sell.

- Double-check your order in the confirmation window for accuracy before sending it to the exchange, and click the green send order button when you’re ready.

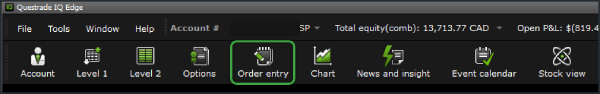

Follow these easy steps to place a trailing stop order using our free, advanced desktop platform, Edge Desktop:

- Log in to Edge desktop on your PC or Mac.

- Open an ‘order entry’ window/widget from the top navigation menu.

- Note: You can also use the order entry window attached to any Level 1 quote as well.

- Enter the ticker symbol at the top right.

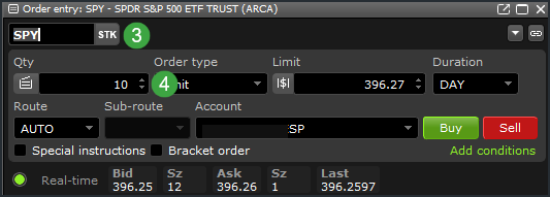

- Add your quantity of shares.

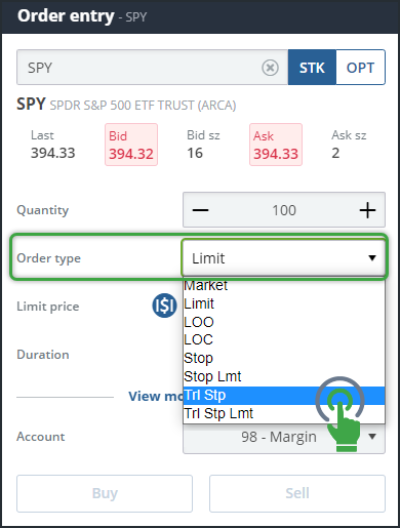

- Select “Trl Stp” as your order type from the drop down menu.

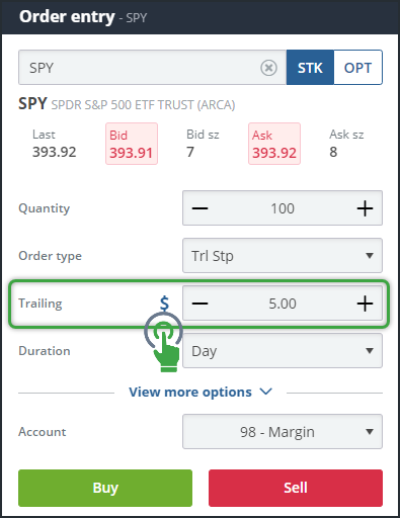

- Set your Trailing offset.

- Please note: You can choose either a dollar amount offset, or a percentage offset by clicking the small $ or % icon next to the trailing offset box.

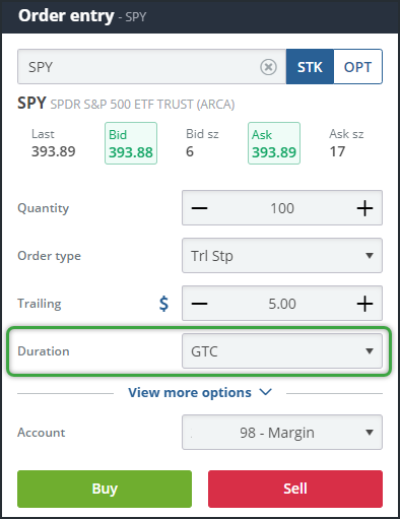

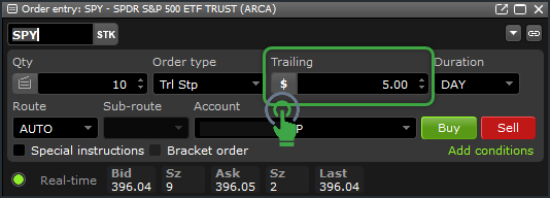

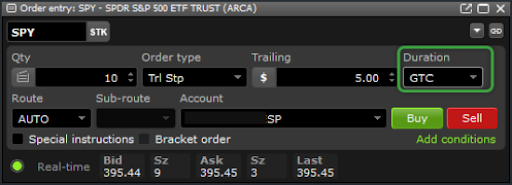

- Select your desired duration for the order.

- Learn more about durations in this article.

- In this example, we used ‘GTC’ or ‘good ‘till cancelled’.

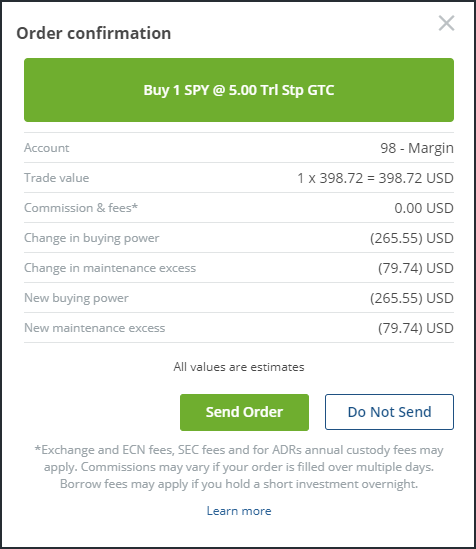

- Click the green buy button to enter a Trailing stop buy order, or click the sell button to enter a Trailing stop sell order

- Double-check your order in the confirmation window for accuracy before sending it to the exchange, and click the green send order button when you’re ready.

When using trailing stop orders to buy or sell shares, there are a few key things to watch out for that can impact your order. We’ve summarized a list of watchouts & tips in this section below so you can familiarize yourself with all the ins and outs of trading with trailing stops.

Please note: The information prepared in this section is for educational purposes only, and should not be taken as any form of trading or investment advice.

Trailing stops come in 2 varieties:

‘Normal’ trailing stops are also known as trailing stop market orders. This is because once a trade in the market takes place at your trigger or offset price, then a market order is sent to the exchange. Due to this, your order may not execute exactly at your trailing price, but rather at the best available bid or ask. This can be a concern if the security you’re trading experiences large fluctuations in price very rapidly (high volatility), or trades in low volumes with ‘wide’ bid-ask spreads.

Trailing stops also exist as limit orders, these are known as trailing stop limits. With this type of order, in addition to setting a trigger-stop price, you are also setting a specific limit offset (which determines the limit price). Once your trailing price (trigger) fills, a limit order is sent to the exchange at your specific offset.

Both trailing stop market and limit orders have their upsides and downsides. For securities dealing with high volatility for example, a trailing stop market order may not execute at your preferred price.

And for example with a trailing stop limit order, if you’re looking to sell shares at a specific price, you run the risk of your trail being triggered, but then if no trades take place at your limit price, your order will not fill and execute.

Price gaps

‘Gaps’ in price action for stocks and other securities can happen during times of high volatility. A gap in price is when the previous day’s closing price is significantly higher or lower than the start of day price, and there’s a ‘gap’ where no trades have taken place between the 2 prices.

For example: ‘XYZ’ closed yesterday at $20 a share, but after a poor after-hours earnings report, on the following day the first trade at market open is significantly lower at $16. No trades have taken place between $20 and $16, the price simply ‘gapped down’ due to the poor earnings report the previous day. If you own shares of XYZ, and are using a trailing stop sell order as downside protection, this gap in price can have a significant impact.

For example: let’s say we had a trailing stop order placed on XYZ with a $2 offset. If XYZ was trading at $20 when we placed the order, our offset or trigger price is $2 lower at $18. If XYZ ‘gaps down’ in price to $16, and no trades have taken place at our trailing price of $18, our order will trigger much lower than intended.

Your trailing stop sell will trigger if trades have taken place at your stop price, or below. At which point it becomes a market order, and can result in an undesirable execution price.

Choosing your trailing or trigger price

When trading with trailing stops, it’s important to think about your specific trailing price or percentage. Using a trailing stop that’s too “tight” or close in price to the market price may have the unintended consequence of being triggered by normal daily price movements, causing you to miss out on potential gains if the price continues to climb. However, setting a trailing stop that’s too “wide” or far away from the market price, may lead to unnecessary losses before the order triggers.

For example: suppose you own shares of XYZ trading at $20 per share, and would like to use a trailing stop sell order to protect your investment. If you see that XYZ regularly ‘pulls back’ by 2-3% before moving higher again, we can use this information to help us make a more informed decision of what trailing percentage to use.

In this example, a 1-2% trailing percentage may be ‘too tight’, as this can be triggered by minor pullbacks in price. But choosing a 10% trailing stop may be excessive, or ‘too wide’. Since you would have to wait for XYZ to drop an amount far beyond what you have decided is its standard characteristic movement before your order was triggered, it’s possible that a large price drop will cause you unnecessary losses.

In this example, an appropriate trailing stop percentage could potentially be in the 4-8% range. This allows for the security to trade in its ‘normal or average ranges’ while also protecting your order from an unexpected drop in price.

Important to know:

- A trailing stop order is triggered by the last trade, not the bid or ask price.

- Trailing stop-limit orders cannot be used with the GTEM or Overnight order durations

- Trailing stop orders only execute during normal trading hours between 9:30am and 4:00pm ET. Pre and post market price movements will not trigger a trailing stop.

- Questrade cannot place trailing stop orders on Canadian exchanges, only trailing stop limit orders.

- For trailing stop limit orders, there is no maximum allowable spread between the limit offset and the trailing stop price for the U.S. markets, but there is a maximum of 9% allowable spread between the limit offset and trailing stop price for CAD markets.

- Setting your stop price above the current market price of the stock (when selling) or below the current market price (when buying) will cause the order to fill immediately.

- Trailing stop orders are not a guaranteed method of stopping potential losses.

- Trailing stop orders can be modified or canceled just like regular limit orders.

Related lessons

Want to dive deeper?

Margin 101

Learn about using a non-registered account and important information when leveraging it for your investments.

View lessonRead next

Basic order types and durations

Discover the different order types and durations that you can use in investing.

View lesson