Welcome to your Questrade account! Let us make it easy for you to navigate.

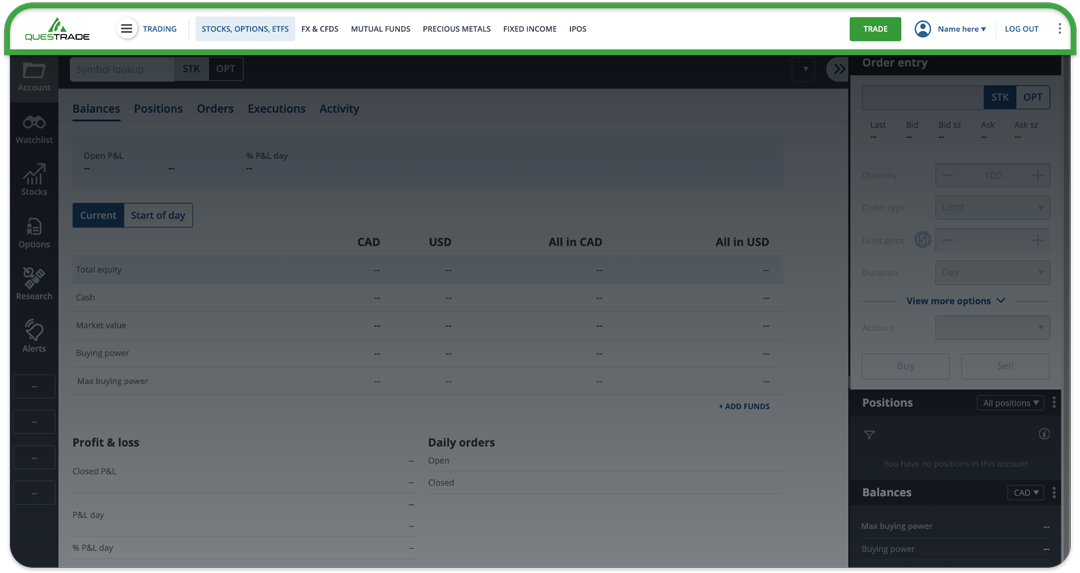

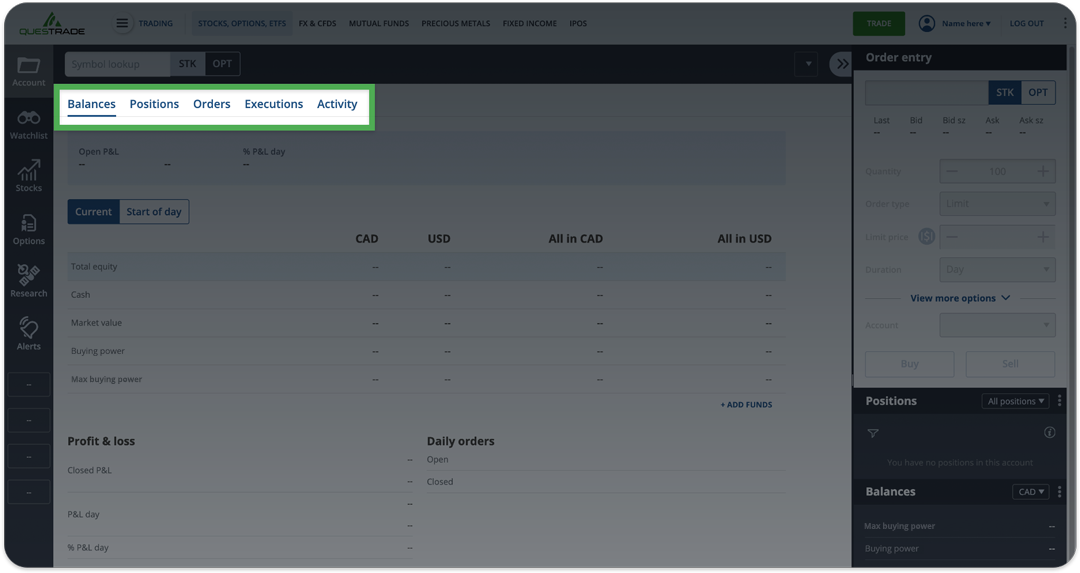

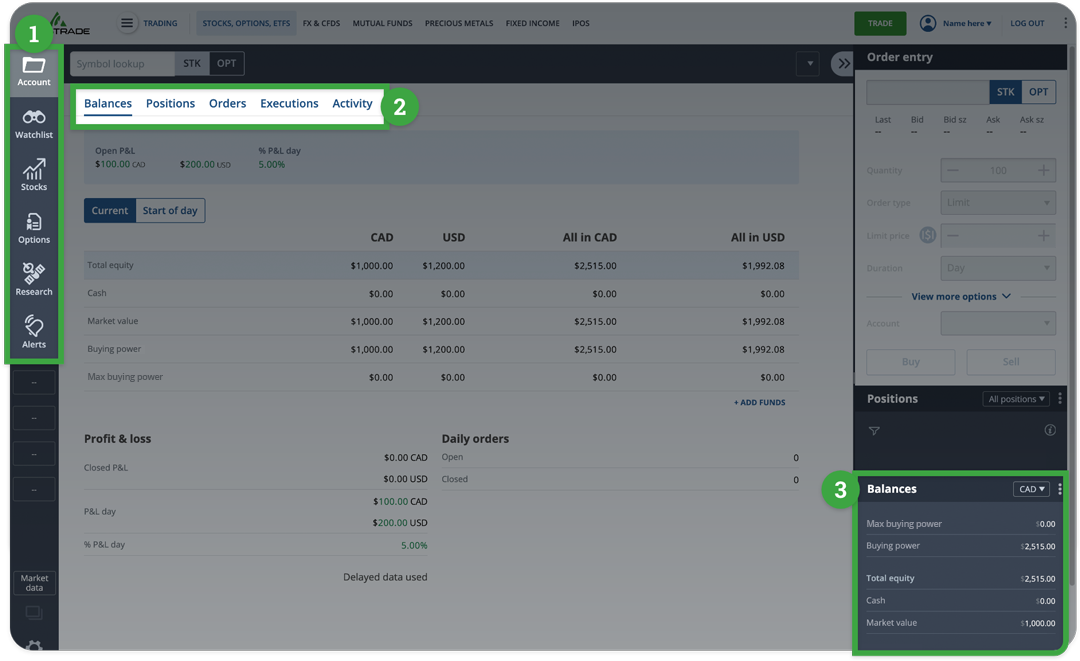

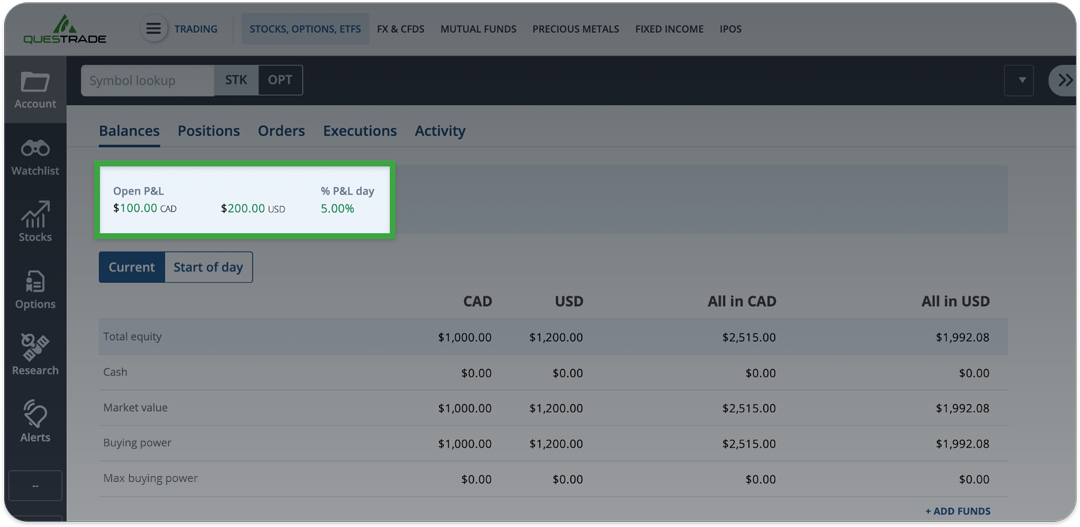

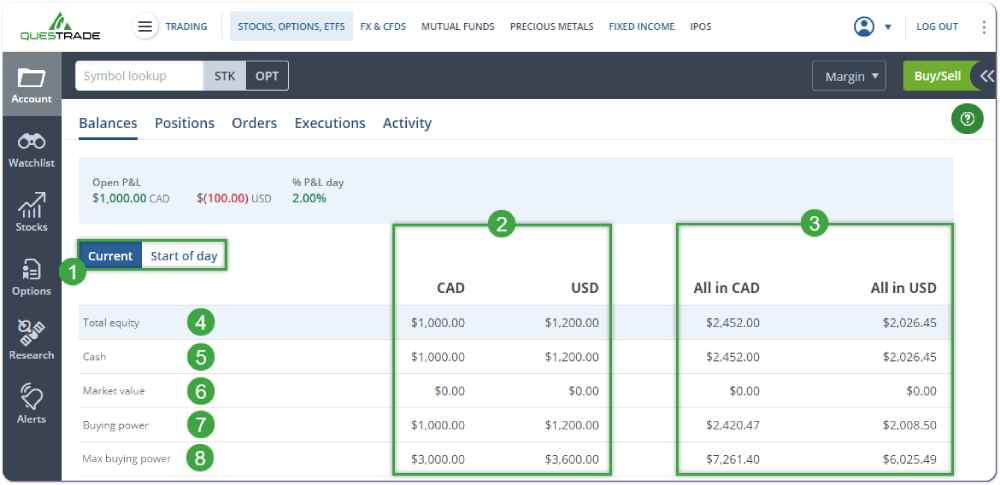

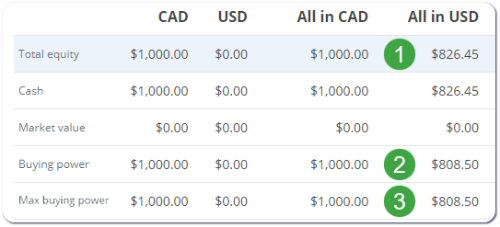

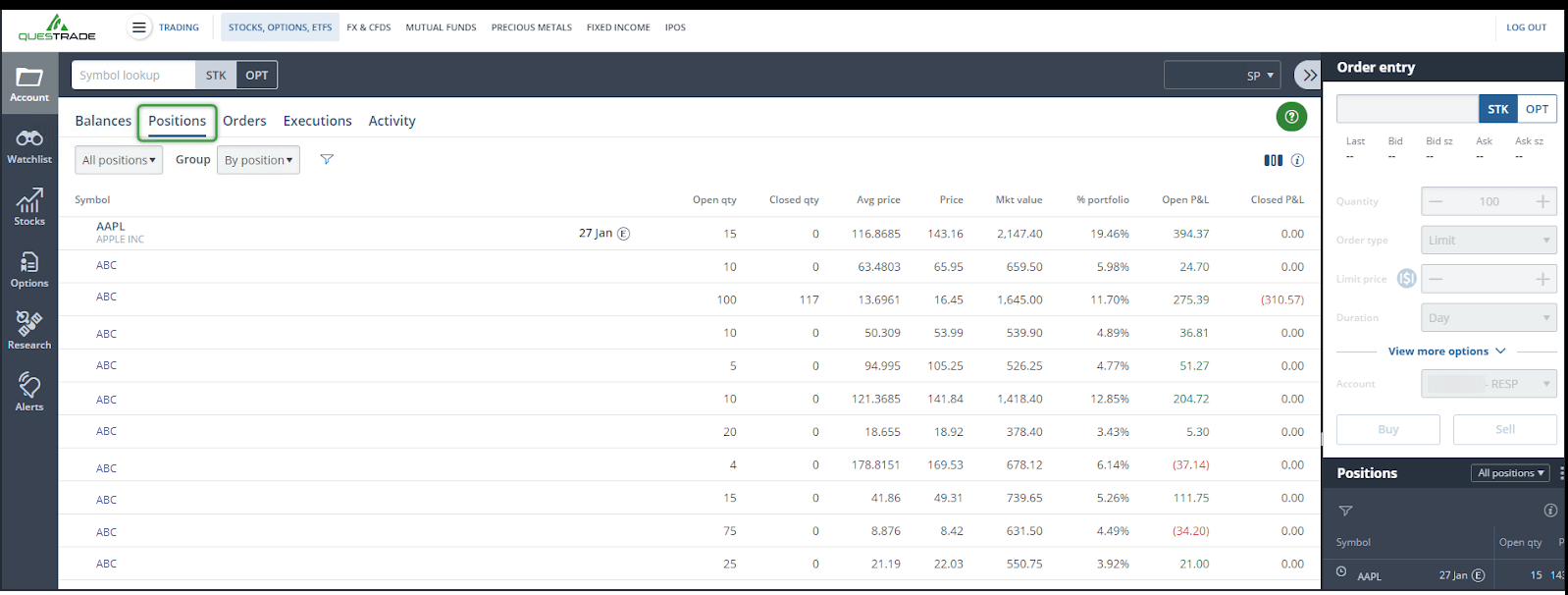

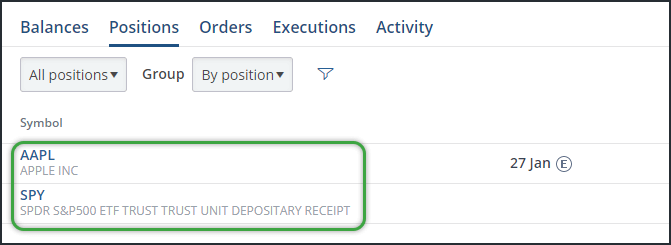

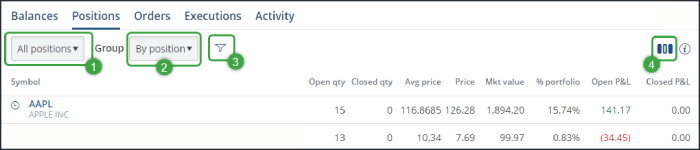

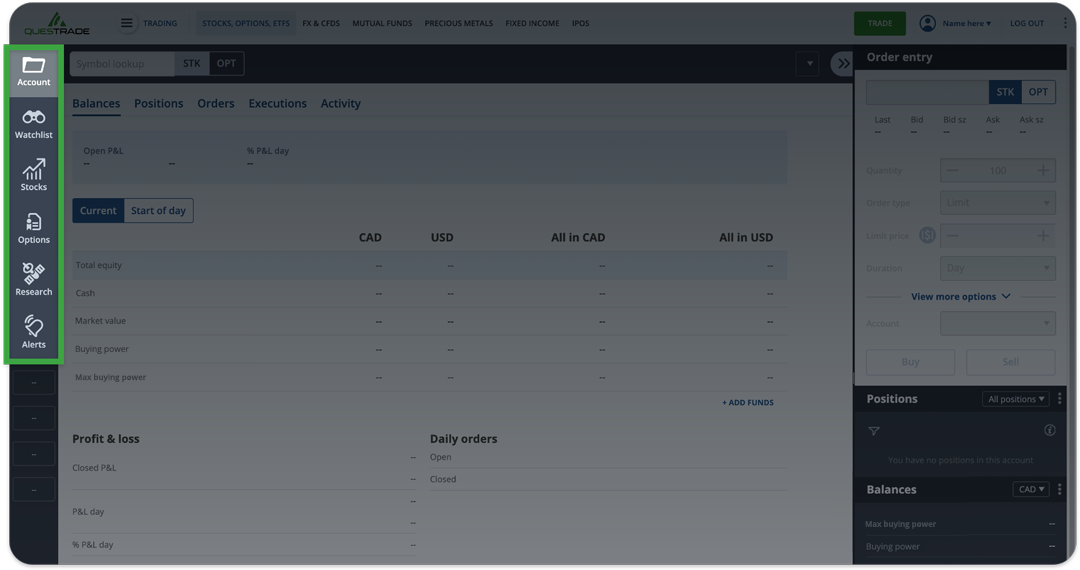

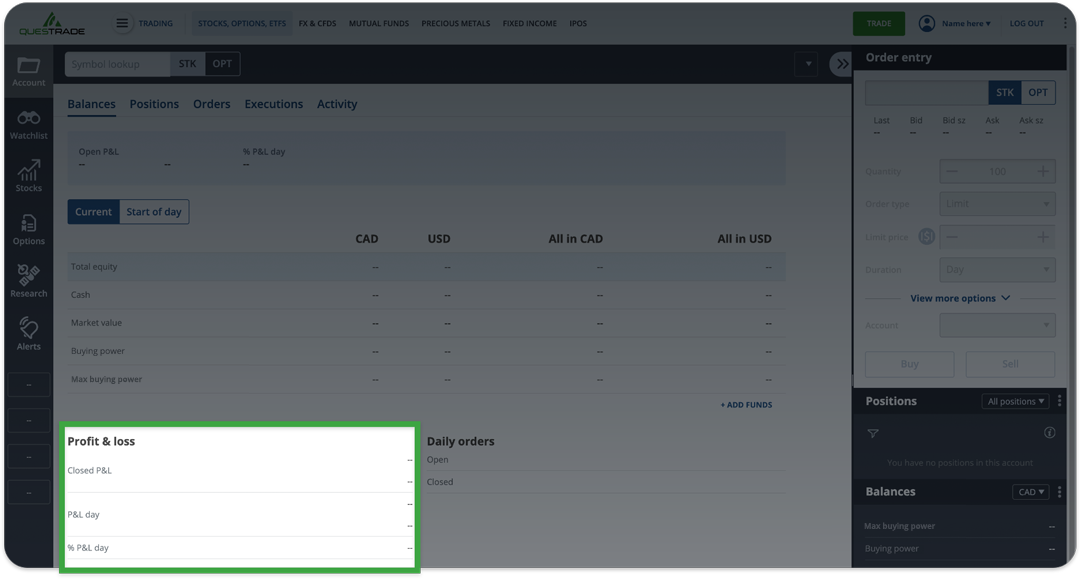

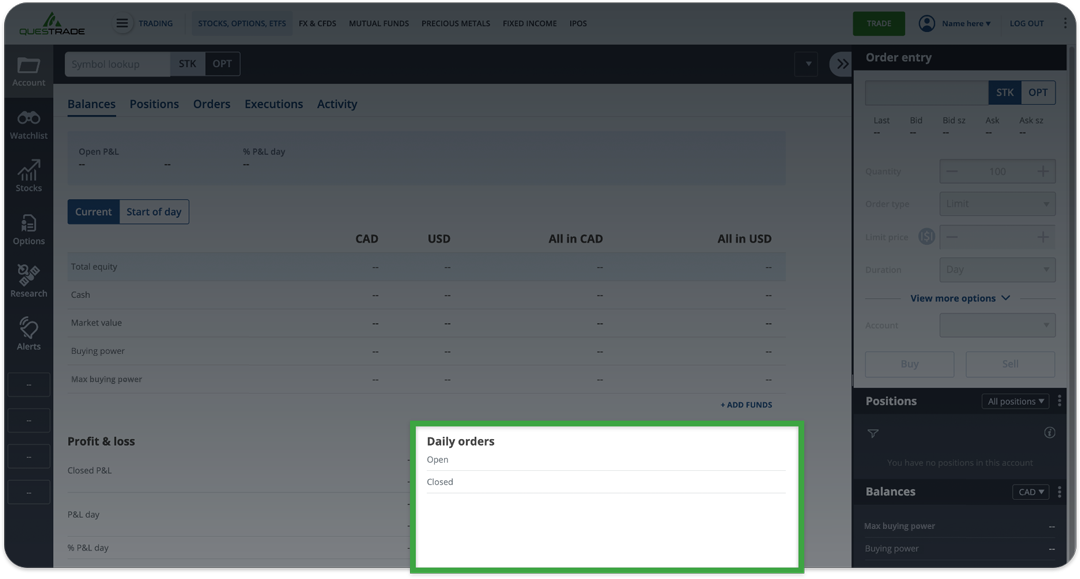

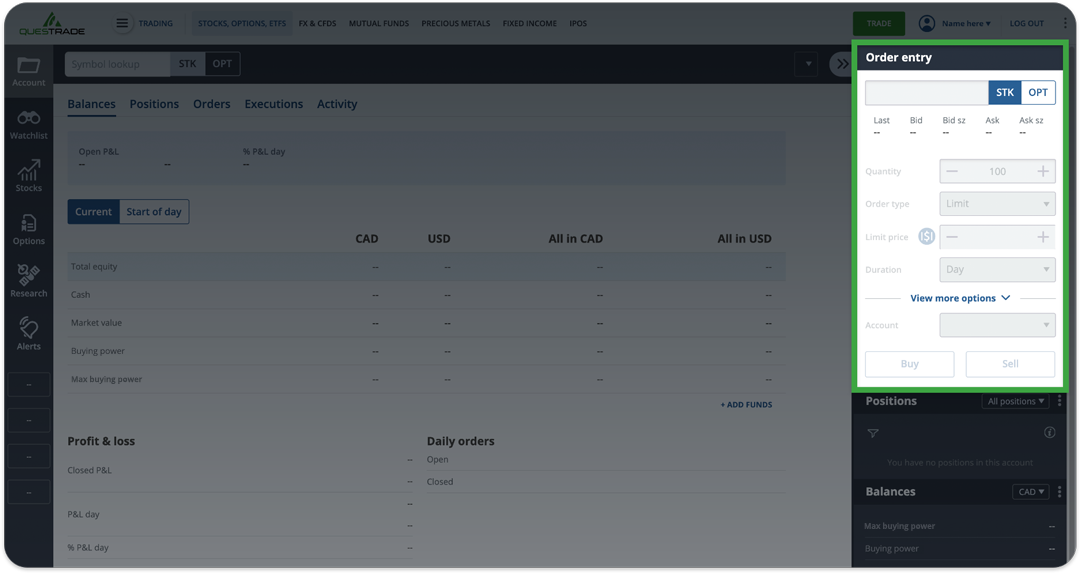

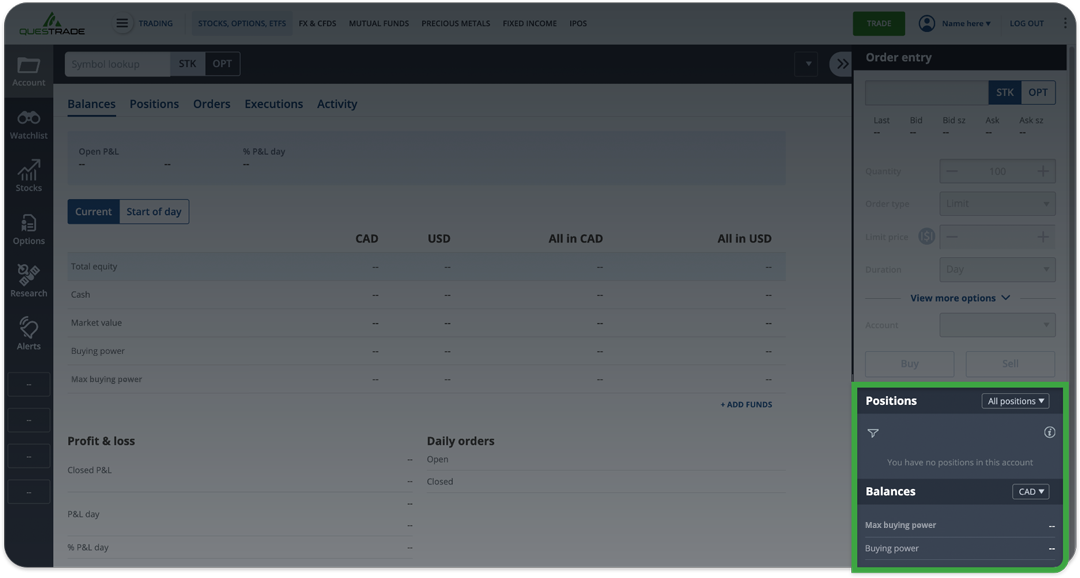

Below you will learn where to place a trade, view current positions, access watchlists, view current and previous orders, and more.

For more information about account information, deposits and withdrawals and other account-related information, visit Introduction to your account.

, and

then edit this watchlist. To add, remove or manage your watchlists, click/ tap

, and

then edit this watchlist. To add, remove or manage your watchlists, click/ tap , and then click/tap Manage watchlists.

, and then click/tap Manage watchlists. . For an explanation of the different

data feeds, see below.

. For an explanation of the different

data feeds, see below.