Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Stocks 201

Short-selling stocks

Learn what it means to short a stock, how short-selling fits into some strategies, and learn about the risks associated with shorting stocks.

Short selling is a bit like opposite-day on the markets: you sell shares to get in, you buy them back to get out, and the more your chosen stock goes down, the happier you are. Of course, it’s not quite as simple as that, but you do have to switch your mindset to understand how short selling works.

What is short selling?

Short selling is when you borrow shares from Questrade and sell them on the open market, essentially selling stock you don’t own. If the stock price falls, you can buy the shares at the lower price and return them to Questrade. The difference in price would be your profit, minus commission and borrow rates (if applicable).

Margin requirements of short selling

Shares have a ”Short MR” margin requirement percentage that is used to calculate your margin requirement. Proceeds received from the short sale are not applied to the margin requirement of the trade.

For example, if you short $100 dollars worth of shares that have a 30% short MR, you need $30 worth of buying power in your account prior to making the trade. The $100 you receive as proceeds of shorting doesn’t count against the $30 margin requirement.

You can learn more about how margin works in the Margin 101 lesson of our learning centre.

Why do investors short sell?

There are two main strategic reasons you might short sell a stock:

- Speculation: you believe the stock price will fall, and you can cover the sale by buying the stock at a lower price. For example, after researching a stock, you conclude that it is overvalued and believe the price will fall. In this scenario, short selling the stock allows you to make a profit by borrowing and selling at the higher price, then buying back to return the shares you owe when the price drops.

- Hedge: you want to protect a long position with an offsetting short position. This practice is often employed if you want to protect your stock against risk. For example, investors typically employ this strategy when they’re expecting a downturn in the market. To protect your other long positions, you would short sell a correlated stock in the same sector that you expect to fall. If the market falls, the short gains could help to offset the losses in your long position.

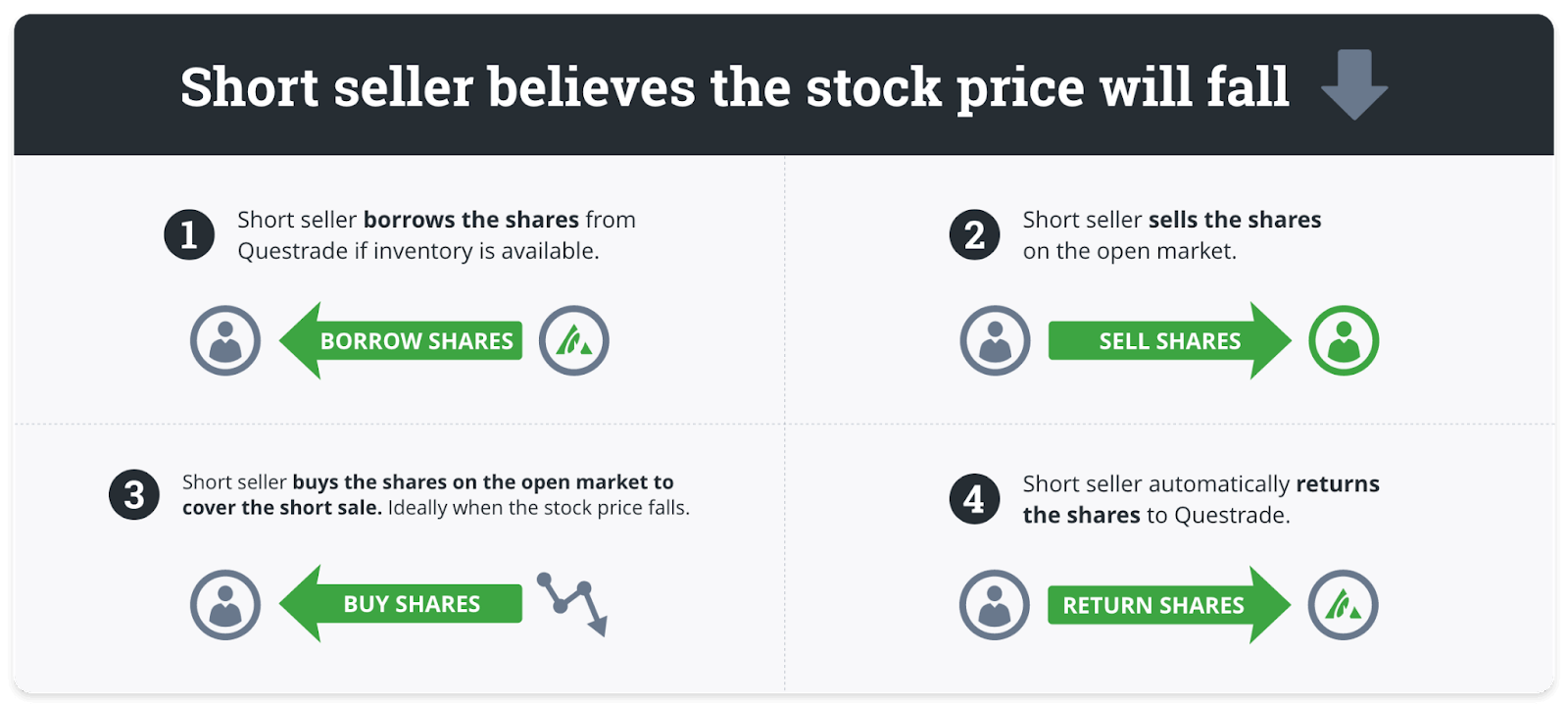

Now that you’ve learned what short selling is, why people short sell, and how the process works, learn about some of the core rules of short selling. Here is a visual demonstration of the short selling process:

A warning about short selling

Short selling can be a helpful tool, but it’s important to understand the associated risks: for example, if you short a stock that costs $100 and its price drops to $10, you can buy it back and keep the $90 difference as profit. However, if you short a stock that costs $100 and its price suddenly shoots up to $1,000, then you will be required to pay full price for the stock when you close the position, suffering a $900 loss for the transaction. For this reason, shorts are said to have infinite loss potential.

While such dramatic price spikes are uncommon, some investors either incorporate stop-loss orders into their strategy to minimize their loss potential by automatically buying shares if the price hits a certain threshold or set alerts to make sure that they’re immediately made aware of significant price movements so they can act quickly.

Shorting stocks in your Questrade account

You can short stocks through any trading platform. Just place a sell order for shares you don’t currently hold in an account that allows shorting. A pop-up will warn you that you’re attempting to short sell, remind you of the cost and risks, and give you any further instructions needed to short that particular stock.

When shorting stocks, there are a couple of things to keep in mind:

- You must use a margin account. Questrade will closely monitor the account to ensure you’ll be able to meet the minimum credit requirements on your short position.

- You must borrow the shares from Questrade. Fees may apply when borrowing securities to short.

- Generally, there are no rules governing how long you can borrow shares before having to return them to Questrade. However, please be aware that loaned shares can be recalled at any time by Questrade, requiring you to cover your short sale by re-purchasing and returning the shares immediately.

- Cash you receive from shorting shares will not offset a negative cash balance in your account when it comes to calculating interest charges

Elevate short-selling with Questrade Plus.

To successfully navigate the complexities and risks of short selling, traders often rely on advanced analytical tools. Here's how Questrade supports your short-selling strategies, with key enhancements for Questrade Plus customers:

Advanced Charting: unlock a wider range of charting tools, including advanced chart types (like Heikin-Ashi) and a greater selection of over 50 technical studies, for deeper market analysis with Questrade Plus.

Real-Time Data: Access to more in-depth market data, including level 1 data on U.S. equities and options, for more informed decision-making.

Related lessons

Want to dive deeper?

RRSPs 201

Read about finding other ways to use your Registered Retirement Savings Plan (RRSP) based on your situation and goals.

View lessonRead next