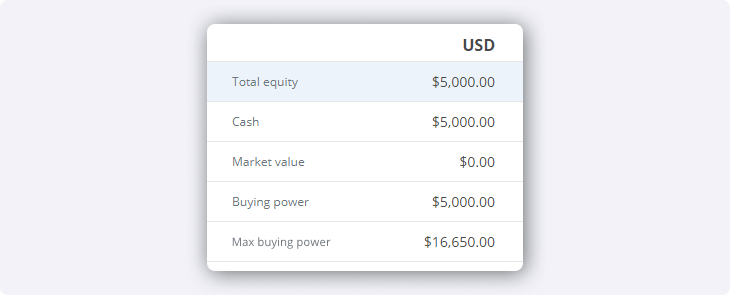

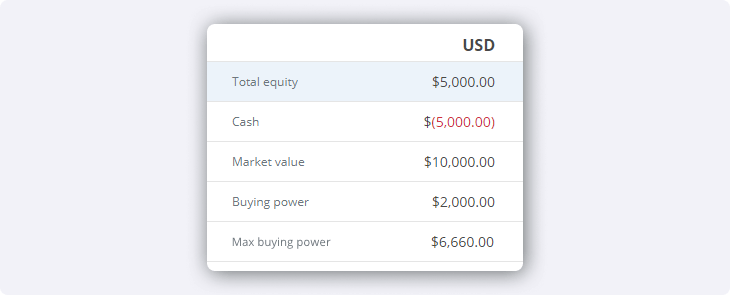

With a self-directed Margin account, you are able to leverage your investments to borrow money to trade/invest. When you place a trade in a Margin account, your available cash is used first. If your order’s dollar amount exceeds your available cash, that’s when ‘borrowing’ starts.

Important to note: Margin accounts do not automatically convert your currency from CAD to USD (or vice-versa). All of your trades are settled in the currency of the investment, (whether you’re buying or selling) with no automatic conversion. This allows you to keep your CAD & USD balances separate, and only convert when you need to. Registered accounts like a TFSA and an RRSP have different currency settlement options available.

Check out this great guide on currency conversions for more information.