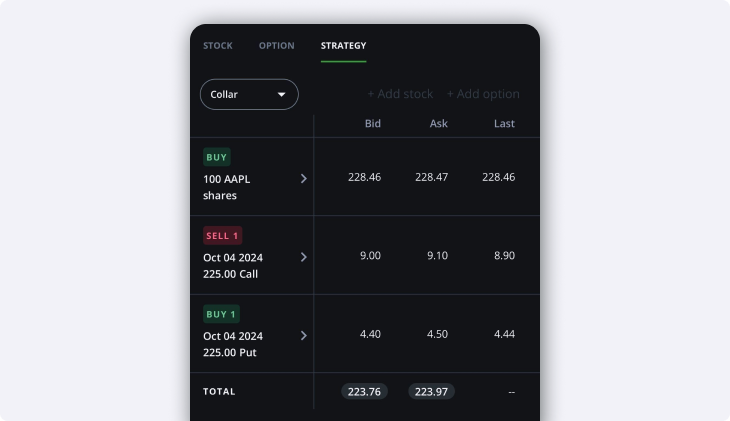

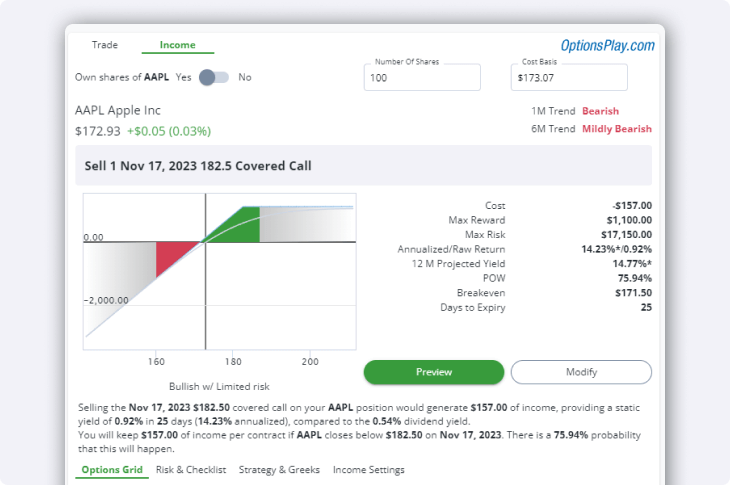

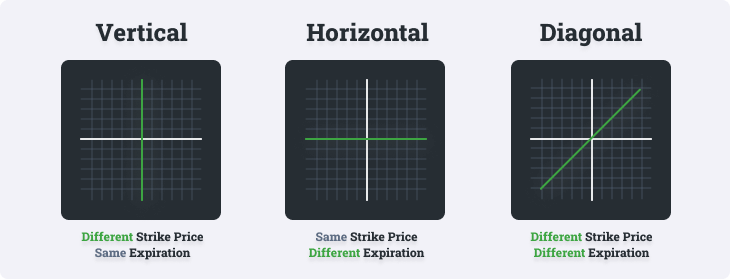

Whether you’re aiming to maximize profits or minimize risks, multi-leg options trading can help unlock more strategies with additional precision and order flexibility.

At Questrade, we’re proud to offer multi-leg options trading with both pre-built and fully custom strategies in our suite of Questrade Edge platforms.