Index

- What is a margin call and how do I know if I am in a margin call?

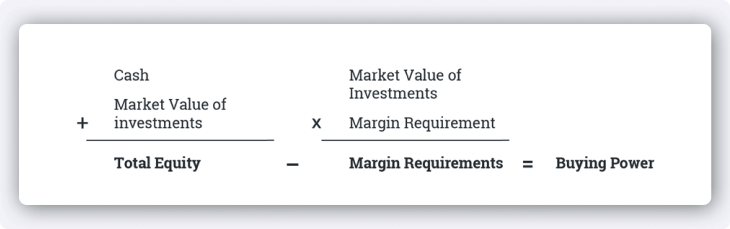

- How is a margin call calculated?

- What can cause a margin call?

- How can I cover my margin call?

- What are the acceptable funding methods to satisfy a margin call, and what do I do after a deposit is made?

- Why is a PAD not accepted as a method to cover my margin call?

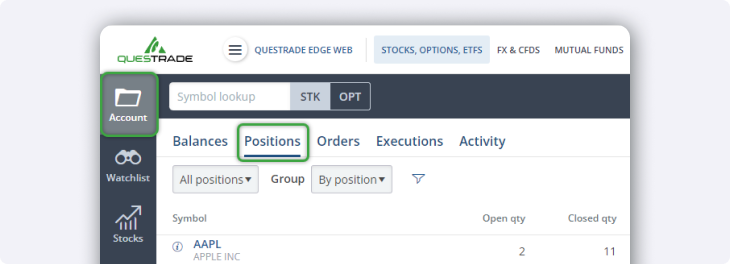

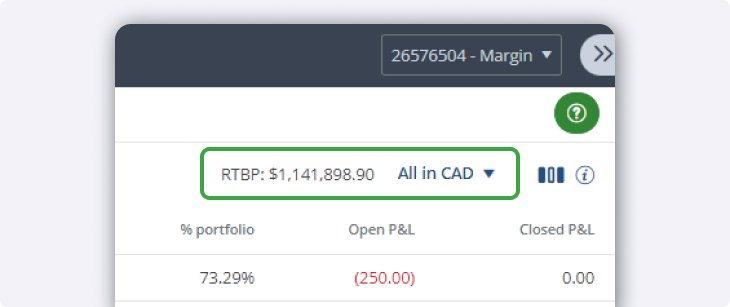

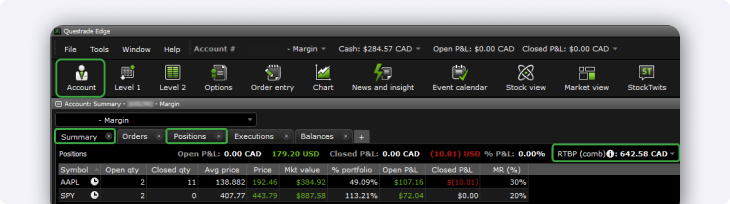

- Why doesn't my buying power change throughout the day with my positions? Where can I see my Real-Time Buying Power (RTBP)?

- What happens if I don't cover my margin call by the due date? How much do I have to sell to cover the margin call?

- Can I transfer money from my Margin Power linked TFSA to cover the margin call? Can I sell positions in my linked TFSA to cover the margin call?

- Why did my positions get liquidated before the due date?

- How am I notified about a margin call? Why are you asking me to cover my margin call on short notice?

- Why does the margin call due date vary?

- I didn't receive a margin call notification, yet my positions were liquidated. Why?

- How can I avoid using margin?