Getting into homeownership is one of the biggest life events anyone can have. Starting early on saving for a down payment can help ensure you’re well prepared when you start actively searching for that dream home.

When it comes to homeownership, one of the biggest first steps is the down payment. No wonder people take years saving for it and it’s a huge achievement for anyone. The good news is that the Government of Canada offers two special options to help Canadians save for a future home purchase.

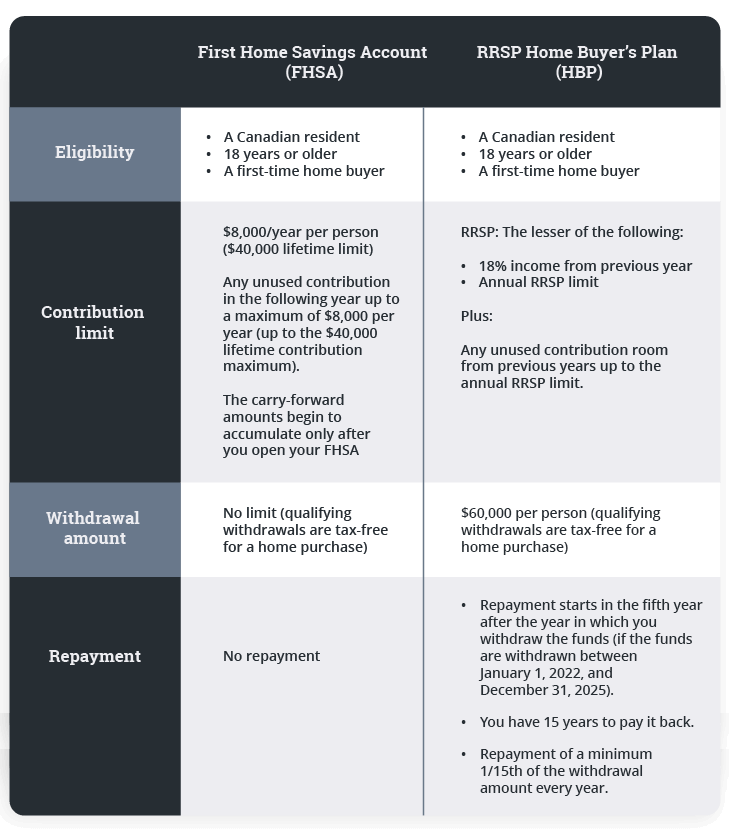

These are the First Home Savings Account (FHSA) and RRSP’s Home Buyers’ Plan (HBP). In this article, we’ll cover each of these powerful tools and their differences to help guide what’s right for you.