What you'll learn:

- What is the First Home Savings Account?

- Eligibility and how it works

- How it's different from the RRSP Home Buyers' Plan (HBP)

Lesson FHSA 101

The tax-free First Home Savings Account (FHSA) is a new registered savings account announced by the government of Canada last year to help qualified Canadians save for a down payment for their first home.

The FHSA will allow you to contribute an annual tax-deductible amount of up to $8,000 with a lifetime contribution maximum of $40,000 per person. It combines the power of both RRSP and TFSA, where your contributions are tax deductible and any qualifying withdrawals from the account are tax-free.

Please note: The information provided in this article is based on CRA guidelines and may be subject to change. The information in this article is for educational purposes only and should not be used or construed as financial or investment advice by any individual.

The FHSA combines the best benefits of both an RRSP and a TFSA to help you save a down payment for your home. To start, contributions to the FHSA are tax deductible when you file your taxes. This is similar to an RRSP where contributions can be used to lower your net income.

When it comes to withdrawing money, any qualifying withdrawals from the FHSA (including investment returns) are tax-free, much like a TFSA. Note that to be considered qualifying, the withdrawal must be used for a first home purchase under the rules laid out by the government.

You can contribute up to $8,000 to your FHSA each year with a lifetime contribution limit of $40,000. If you have a spouse or common-law partner, you can each use your FHSA when you’re ready to purchase a first home.

You can also carry forward any unused contribution in the subsequent year up to a maximum of $8,000 per year on top of the contribution limit of $8,000. Note that carry-forward amounts begin to accumulate only after you open your FHSA. This may be an option to consider if you’re planning to purchase a home in the future but not looking to contribute to the account immediately.

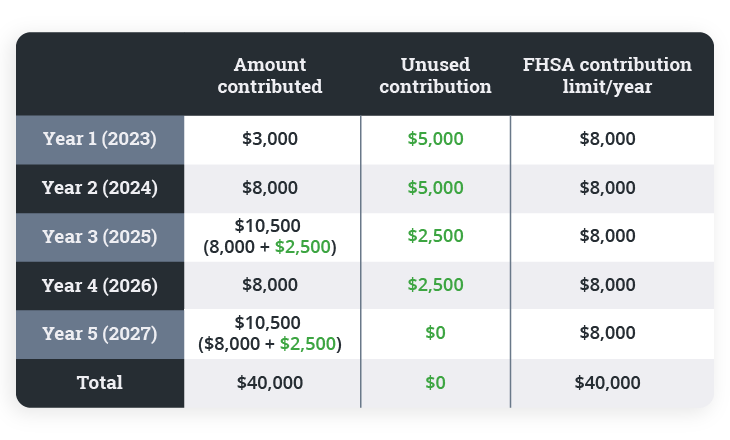

Let’s look at an example below:

Jessie has opened an FHSA account in the first year (2023) and contributed $3,000. This gives her an unused contribution room of $5,000. Since she just started seriously saving for a down payment, her first year’s contribution isn’t as much as she had wanted.

In the second year, she contributes $8,000 which is the maximum FHSA contribution amount per year. Her unused contribution remains the same at $5,000. In the third year, she set aside some bonus from work and contributed a total of $10,500. This includes her annual contribution limit of $8,000 plus $2,500 from her unused contributions.

In the fourth year, she contributes another $8,000 for her annual contribution. Finally in the fifth year, she moved back with her parents to save more and contributed a total of $10,500 to her account carrying forward the remaining $2,500 from her unused contributions. In her five years of saving, Jessie was able to contribute a total of $40,000 for her FHSA account.

You have an option to hold more than one FHSA but the total amount you can contribute to all of your FHSA accounts can not exceed your annual and lifetime contribution limit.

Similar to an RRSP contribution, you can carry forward any unused deductions indefinitely (throughout the account's lifespan of 15 years) and use them in subsequent years. For instance, if you make a $8,000 contribution to your FHSA in 2023, you can claim some or all of the deduction to your taxes next year (2024) or in later years.

Please note: Ensure you consult with a tax professional for any questions regarding claiming tax deductions for your registered accounts.

If you over contribute, your over contribution amount is subject to a 1% tax on the highest excess amount for each month it is over the limit. This will continue to apply each month until the excess amount is removed from your FHSA, which stops accruing when:

You can deduct from your income any over-contributed amount in the year it is no longer considered an over-contribution, but not the year before that.

To be eligible for the FHSA, you must be:

You are considered a first-time home buyer if you have not owned and occupied a home in the current calendar year or any of the preceding four calendar years.

Just like an RRSP and TFSA, an FHSA is a registered savings account that can hold multiple investment securities. This includes equity-based investments like stocks, fixed-income investments (bonds and GICs), and other investments such as options, ETFs, and precious metals.

This can be beneficial if you’re looking to grow your money by compounding interest and help you save for a future down payment.

Please note that whatever investment instruments you use in an FHSA, you have to understand your time horizon before purchasing a home.

To view a full list of qualified investments available in a registered account, please explore this helpful article from the CRA’s page.

Note: At the current time, mutual funds can be traded or transferred in your FHSA account. However, some restrictions on fund eligibility might still occur at the fund provider level. Please contact our Customer Service team if you have any questions.

For you to make a qualifying withdrawal from your FHSA, the following criteria must be met:

To learn more about how to withdraw from your FHSA for a qualifying home purchase, please take a look at this helpful article.

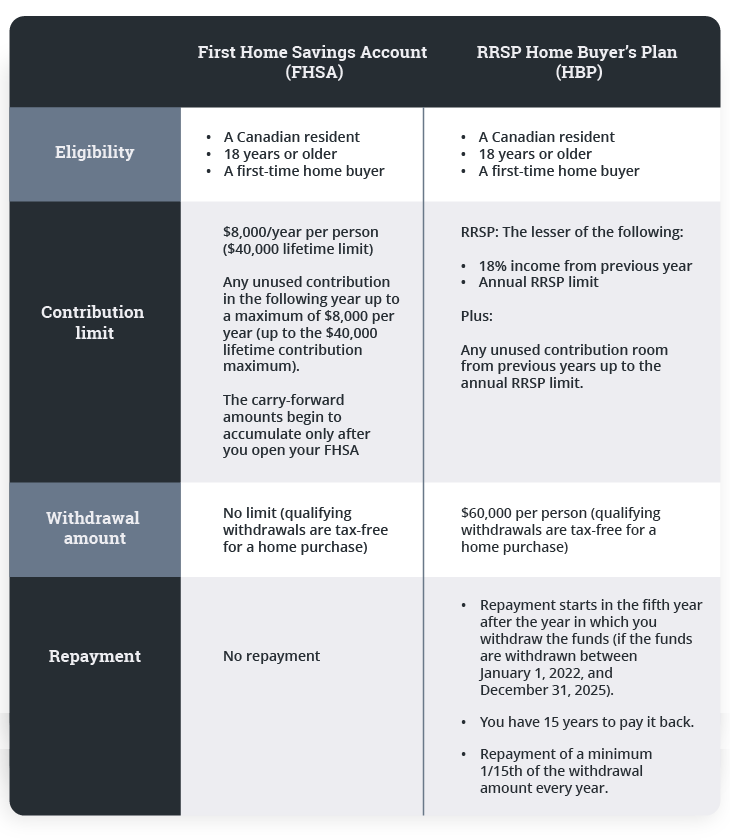

You may ask, what’s the difference between FHSA and RRSP Home Buyers' Plan? While they both share similarities in helping you save for a down payment, they have a few key differences.

Please note: The RRSP contribution limit should be the lesser of 18% of earned income from previous year or the annual RRSP limit ($29,210 as of 2022) plus any unused contribution up to the annual RRSP limit. To learn more about the annual RRSP limit on previous years, please head over to the CRA website.

The FSHA allows you to contribute to $8,000 per year with a lifetime limit of $40,000. On the other hand, you can contribute 18% of your earned income from a previous year (plus any unused contribution room from previous years) to an RRSP.

Withdrawals from both FHSA and HBP are tax-free for a qualifying home purchase. While HBP allows you to withdraw $60,000 per person, the FHSA allows you to withdraw $40,000 (plus any funds earned from investments). As for repayment, you don’t need to pay back the withdrawn money from an FHSA. On the other hand, you have 15 years to repay the funds back to your RRSP from an HBP withdrawal.

Wondering if you can use both the FHSA and HBP for a down payment? You can make both an FHSA withdrawal and an HBP withdrawal for the same qualifying home purchase. For more information, please visit this article from the government website.

The FHSA has to be closed by December 31 in the year in which the earliest of these scenarios occur:

Your FHSA will also need to be closed by December 31 of the year following a qualifying withdrawal for a home purchase.

Once it closes, any unused funds in the account can be transferred to an RRSP or a RRIF tax-free. You have the option to withdraw any unused funds but be aware that this withdrawal will be added to your yearly income for tax purposes.

You can transfer funds from an FHSA to another FHSA account, RRSP or a RRIF tax free. When you transfer from an FHSA to an RRSP or RRIF, the transfer will not reduce, or limited by, your available RRSP contribution or restore your FHSA annual contribution limit.

Once you transfer from an FHSA, the funds will be subject to the rules for RRSPs and RRIFs, which include paying taxes when you withdraw from the account. In addition, you can transfer funds from RRSP to an FHSA tax-free, but the transfer is not deductible and will not restore your RRSP contribution room.

For more information and frequently asked questions (FAQs) about FHSA, please visit our helpful FAQ article.

Open an FHSA account today and start saving for your down payment.

Please note: The information provided in this article is based on CRA guidelines and may be subject to change.

Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Want to dive deeper?

Learn about Registered Retirement Savings Plans, how you can use it for your investments, and other benefits it can offer to your investment goals in the future.

View lessonRead next

Discover what a Tax-Free Savings Account is and how it can benefit your investment goals.

View lessonExplore

Learn about using a non-registered account and important information when leveraging it for your investments.

View lessonNeed help? We're here.

Tip: Questrade employees will never ask for your username and password.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday - Friday 7:30 AM to 8 PM ET

Saturday & Sunday 10 AM - 4 PM ET

Email:

Get in touchVisit the Questrade Centre

5700 Yonge St, North York, ON M2M 4K2

In-Person Hours:

Monday-Friday, 9 AM to 5 PM EST

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday - Friday 7:30 AM to 8 PM ET

Saturday & Sunday 10 AM - 4 PM ET

Email:

Get in touchNeed help? We're here.

Tip: Questrade employees will never ask for your username and password.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday - Friday 7:30 AM to 8 PM ET

Saturday & Sunday 10 AM - 4 PM ET

Email:

Get in touchNeed help? We're here.

Tip: Questrade employees will never ask for your username and password.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday-Friday 4:00 AM to 8 PM EST

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Phone Number:

Toll-free within Canada

Phone Hours:

Monday - Thursday, 8 AM to 8 PM EST

Friday, 8 AM - 5 PM EST

Trading services will only be available from

8 AM to 5 PM EST

Holiday Closures:

Email:

Get in touchWorking on a news story or article about Questrade?

The media team is here to help.

Email:

Get in touchHave a general question? Reach out to us

on social media. We can help you with

questions about investing account types,

deadlines, and more.

For security reasons, we cannot

provide

specific details about individual accounts,

holdings, or funding over social media,

nor can we provide investment advice.

Facebook Messenger:

Twitter: