- Learning

- Retirement Planning

- Retirement fundamentals

Retirement Fundamentals

What every Canadian should know about retirement planning

Where do you start?

Believe it or not, you’re already on your way to a comfortable retirement: you’ve taken an active interest in planning your financial future. In this guide you’ll learn how to figure out what you need for retirement, some of the basic rules-of-thumb about making a plan to meet those needs, and what accounts are available to help you save on taxes while saving for your future.

How much do you need to retire?

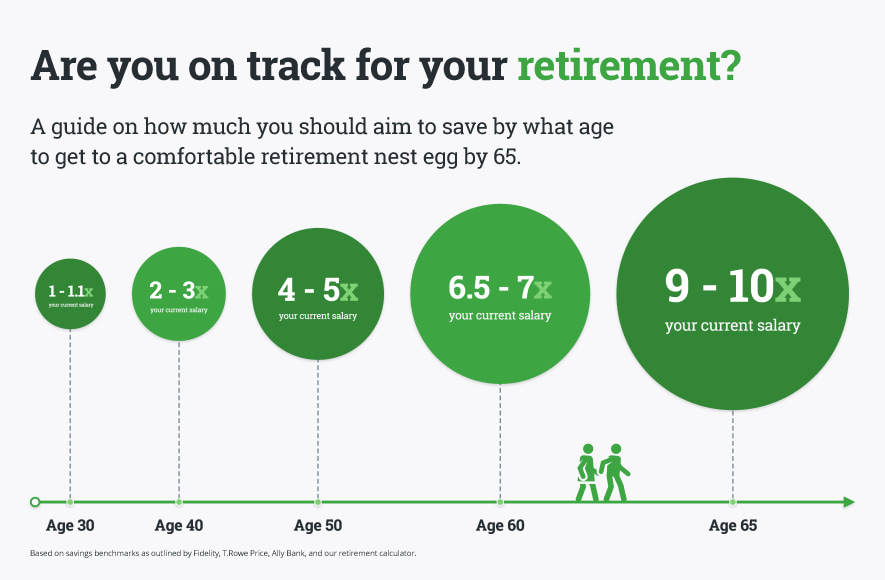

There isn’t one number that works for everyone. Your retirement is going to be as unique as the person you are. However, there is a common rule-of-thumb which can give you some milestones to aim for.

Keep in mind that this is meant to be a high-level guide. Everyone’s needs are different depending on their timeframe and retirement goals.

Popular accounts to use for retirement

There are two big names in accounts that you can use to save for your retirement, each with their own advantages.

Registered Retirement Savings Plan (RRSP)

Typically used when you’re in your prime earning years as the tax refund from contributions can be worth more.

Money you contribute comes off your taxable income, which can give you a yearly tax refund

Can hold a variety of investments (stocks, bonds, ETFs) which grow tax-free while held in the account.

If you withdraw, the amount will be added to your taxable income for the year.

There is an annual limit of how much you can deposit and it is 18% of previous year's earned income (2020 max. $27,230)

Tax-Free Savings Account (TFSA)

Typically opened no matter where you are on your retirement journey as it is a great account for investing tax-free.

Can hold a variety of investments (stocks, bonds, ETFs) which grow tax-free while held in the account.

You can withdraw any amount at any time, without any tax consequences.

There is an annual limit of how much you can deposit and it is $6,000 for 2021 (lifetime max. is $75,5001)

Learn more about using a TFSA for retirement planning

Key retirement planning tips

Fees will drain your savings, so keep them as low as possible. Fees can make a major difference in how much your nest egg grows over the long term. Even a 1% fee, while sounding small, could cost you tens of thousands of dollars. Because what you pay in fees is money that can’t grow and compound over time. Use this calculator to see how big the impact of fees can be on your retirement savings.

Have an idea on what age you want to retire. If you want to retire earlier, you will need to have more savings to enjoy a comfortable lifestyle. It also makes it easier to plan when you have a finish line in mind. You can use our retirement calculator to see how much you would need to retire by a certain age.

Ask yourself how comfortable you are with risk and invest accordingly. When it comes to investing, you need to know how comfortable you are with big swings in the market. If the thought of your retirement nest egg going through big swings makes you nervous, you may want to invest conservatively. Diversification and asset allocation are great strategies to learn so you can choose the investments that get to your goal on your terms.

The benefits of saving for retirement with Questrade

No annual account fees for accounts, including TFSAs and RRSPs.

Your investments are insured for up to $10M so your money is secure, no matter what happens.

Award-winning customer service available through email, phone support, and live chat.

Free to transfer your RRSP or TFSA from your current institution, with no minimum balance restrictions. See terms >

Open an account in minutes from the comfort of your own home. The entire application process is online, whether you want a TFSA or RRSP, and whether you prefer self-directed investing or a pre-built portfolio. Saving for retirement has never been easier.

Build your own portfolio

Self-directed Investing

by Questrade, Inc.

Take matters into your own hands. Build your own investment portfolio with a self-directed account and save on fees. Make your money work harder.

Get a pre-built portfolio

Questwealth Portfolios

by Questrade Wealth Management

The easy way to invest. Intelligent, lower fee portfolios designed by experts to help you achieve your financial goals faster.

Have more questions?

Tell us what you need help with, and we’ll get you in touch with the right specialist.

Opening an Account

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Note: We will be closing early at 6pm ET on December 24th 2025.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday - Friday 7:30 AM to 8 PM ET

Saturday & Sunday 10 AM - 4 PM ET

Email:

Get in touchVisit the Questrade Centre

5700 Yonge St, North York, ON M2M 4K2

In-Person Hours:

Monday-Friday, 9 AM to 5 PM EST

Self-Directed Account Support

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Note: We will be closing early at 6pm ET on December 24th 2025.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday - Friday 7:30 AM to 8 PM ET

Saturday & Sunday 10 AM - 4 PM ET

Email:

Get in touchQuestwealth Account Support

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Note: We will be closing early at 6pm ET on December 24th 2025.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday - Friday 7:30 AM to 8 PM ET

Saturday & Sunday 10 AM - 4 PM ET

Email:

Get in touchTrade Desk

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Toll-free within Canada

From the U.S.

International

Phone Hours:

Monday-Friday 4:00 AM to 8 PM EST

FX & CFDs

Need help? We're here.

Tip: Questrade employees will never ask for your username and password.

Phone Number:

Toll-free within Canada

Phone Hours:

Monday - Thursday, 8 AM to 8 PM EST

Friday, 8 AM - 5 PM EST

Trading services will only be available from

8 AM to 5 PM EST

Holiday Closures:

- New Year's Day

- Family Day

- Good Friday

- Labour Day

- Christmas Day

Email:

Get in touchMedia

Working on a news story or article about Questrade?

The media team is here to help.

Email:

Get in touchGeneral Information

Have a general question? Reach out to us

on social media. We can help you with

questions about investing account types,

deadlines, and more.

For security reasons, we cannot

provide

specific details about individual accounts,

holdings, or funding over social media,

nor can we provide investment advice.

Facebook Messenger:

Twitter:

1$75,500 is your lifetime max if you were eligible to contribute to your TFSA every year since it was first introduced in 2009. Your actual contribution room may vary.

Get answers to frequently asked questions

Yes! Setting up an account is quick and easy, and can be done entirely from the comfort of your own home. Get started

No. It’s your money. You can move your RRSP anywhere you want. If you have an RRSP elsewhere, you can transfer it to Questrade for free. See terms >

If you have any questions about setting up an account, please feel free to reach out to us at 1.888.298.4515 or through live chat. Our friendly agents are more than happy to help.