Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Stocks 101

Dividend-paying securities

What are dividends? Why do some stocks offer them and others do not? How are they decided? We answer these questions and more

Typically, in the early stages of a new business, profits are reinvested into the company to increase growth. Later on, once the business is profitable and well-established, the board of directors of publicly-listed companies could elect to distribute some of their profits among their shareholders on record.

These payments are known as dividends.

When considering dividends, it’s important to keep in mind that dividend payments aren’t guaranteed to remain static. It is up to the board of directors to determine what amount (if any) should be allocated to paying dividends, and may elect to change the amount paid in each quarter.

Let's use an example:

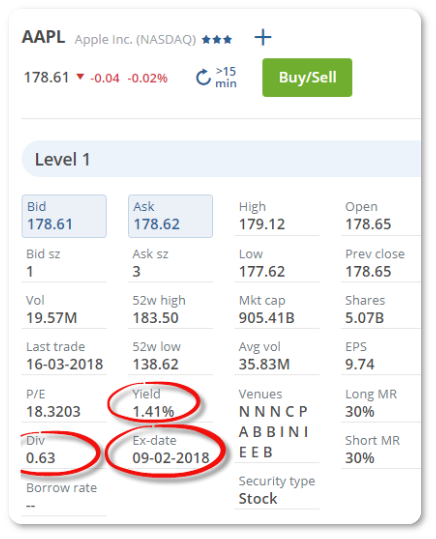

Dividend-paying stocks will pay investors a certain amount of money for every share they own. Let’s use an old Apple stock quote as an example.

As you can see below, Apple was paying $0.63 USD for every share owned. So an investor that owned 100 shares will have received $63.00 USD every quarter [100 (shares) x 0.63 (Dividend per share) = $63.00 USD].

In the example, you’ll also see a Yield percentage.

This is the annual payments (the sum of all dividend payments throughout the year) compared to the current stock price, and is a useful consideration for many dividend investors.

In the example, you can see a 1.41% yield.

Note: Securities shown are for example educational purposes only, screenshots are not current and do not represent current market conditions.

We understand how this is calculated by taking the listed price of $178.62, multiplying by 1.41% to get an annual dividend of $2.52 per share, split into 4 quarterly installments of $0.63.

In other words, you can currently expect to see a 1.41% return on your investment, in addition to any profits garnered from growth-related share price increases.

Ex-Dividend date

To receive dividend payments, you must own the shares at least 1 business day before the Ex-Dividend date (Ex-date) as highlighted above.

The Ex-date in the screenshot is February 9, 2018, so anyone who owned shares by February 8, 2018 would have qualified to receive the dividends payment for that quarter (even if the shares were sold on February 9).

Within 2-3 business days after the Payment date, dividends will automatically be paid to your account and added to your cash balance or, if you have a Dividend Reinvestment Plan, they will be used to automatically purchase whole shares, and the remainder will be paid to your account as cash.

Payment dates are determined by the company paying the dividends. Dividends are typically paid quarterly, but can also be monthly, semi-annually, annually, or even one-time payments.

Important to know

Here are some important things to know about dividends:

- You can easily track dividend payments by logging in to your Questrade account and going to the Account Activity page

- ETFs (exchange-traded funds) pay distributions in a similar way to how stock dividends are paid

- If you have a short position one day before the ex-date, you will be responsible for paying the dividends

- The value of the stock typically drops by the amount of the dividend on the payment date

- You can enroll your stocks, ETFs, and other securities in the Dividend Reinvestment Plan (DRIP) at no cost

Glossary

Here are some important terms to know:

Ex-dividend date: the date on or after which a stock trades without its dividend.

Record date: the date the company uses to determine its shareholders or “holders of record”.

Payment date: the date a declared dividend is scheduled to be paid.

Stock dividend: dividends paid in the form of additional shares of stock instead of cash.

One-time dividend: a special dividend paid in addition to regular cash dividends

Related lessons

Want to dive deeper?

Choosing the right products for your portfolio

Discover the different investment products offered at Questrade.

View lessonRead next

ETFs 101

Discover what Exchange Traded Funds are in the articles below, how they work, and how they can potentially benefit your portfolio.

View lessonExplore

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lesson