SECURITIES LENDING PROGRAM

Real upside, no effort. Earn passive income while maintaining full ownership of your stocks and ETFs.

What is Securities Lending?

It’s an easy way to make more money on your investments. We loan them out, you get monthly income.

STEP ONE

Buy and hold eligible U.S. securities

Once opted-in, eligible securities in your Questrade TFSA, Cash, or Margin account can be lent out.

STEP TWO

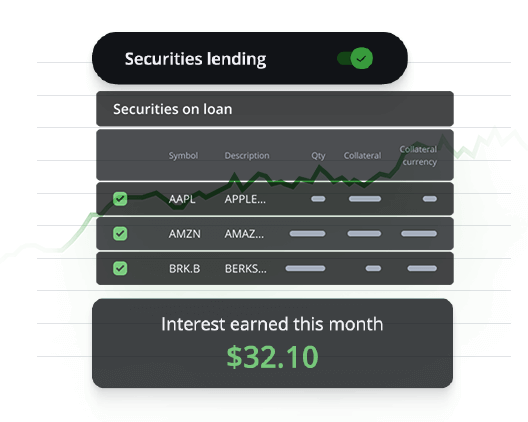

Let Questrade lend your securities to other traders

As long as you’re opted in, we’ll look for borrowers to lend your stocks and ETFs to.

STEP THREE

Get paid monthly while retaining full control

You can trade dividend equivalents and trade as usual while earning monthly income, too.

How our Securities Lending Program benefits you

Earn more money on your investments

Once you’re opted in, Questrade takes care of the rest, and you can receive extra income.

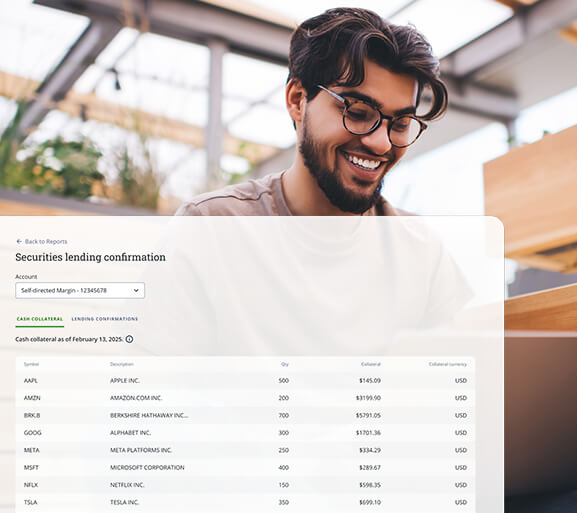

You and your investments are protected

Lending is low risk. But we’ll also hold 100% of your shares’ market value as cash collateral.

Everyone is eligible

All you need is at least one full share of an eligible security in a self-directed Questrade TSFA, Cash, or Margin account.

You've got control

Your securities appear in your portfolio as usual, letting you trade any time.

The math behind Securities Lending

How income is calculated for a stock or ETF

Market value

The current value of the shares you are lending out.

[price per share] × [No. of shares].

Securities lending fee

The fee paid by borrowers to access these shares.

Revenue share

The revenue earned is split 50/50 between Questrade and you.

Potential yearly revenue

How much you could earn from lending in one year.

Calculation for example purposes only: Many factors including market conditions and security supply and demand influence income potential. Past performance is not indicative of future growth potential.

Minimize the trade offs with Questrade

There are a few key things to keep in mind with Securities Lending. We've got solutions for each of them.

| Trade off | How we help | |

|---|---|---|

| Voting rights | You can't vote with shares that are actively loaned out. | You can recall shares before a vote to get your rights back, then opt those shares back into lending after. |

| Insurance | Loaned shares don't qualify for Canadian Investor Protection Fund coverage. | We've got you covered. Questrade will hold 100% of your shares' value as collateral. |

Common Frequently Asked Questions

Money earned from securities lending in a registered account, such as a TFSA, may have different tax implications than earnings in a non-registered account like a Margin or Cash account. We outlined some of the considerations here but, as always, you should consult with a qualified tax advisor for specific guidance.

Is there something else you’re looking for?

See the full Securities Lending Program Frequently Asked Questions.