What Are Recurring Investments?

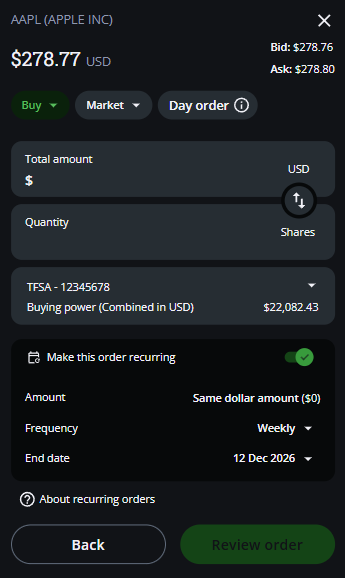

Recurring Investments is a Questrade feature that allows you to automatically invest a fixed dollar amount into eligible fractional stocks and ETFs on a schedule you choose. Instead of manually placing buy orders, you can set up automated, commission-free purchases that run monthly, bi-weekly, weekly, or even daily. This helps you build consistent investing habits, stay disciplined through market ups and downs, and reduce the need to constantly watch the market.