Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Things novice traders should know

Why 72 is the magic number when it comes to doubling your money

Learn what is the rule of 72 and how it can help your investments.

- What is the rule of 72

- How does the rule work

- How the type of investor you are affects the rule

We all have dreams. Some wish to own a yacht, others dream of a summer cottage, while others wish they can travel more. Whatever your dream may be, you’ll likely need money to get there. Investing is a great way to earn extra income, but most investors simply don’t know how long it would take them to reach their goals which makes it hard to turn a dream into reality.

But what if we told you that with the rule of 72, you can estimate how many years it would take for your initial investment to double itself? Would it have an effect on the way you think about your money?

Here's how it works

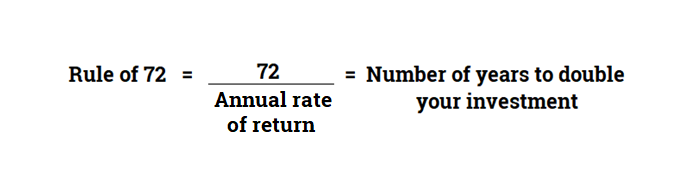

The rule of 72 states that by dividing 72 by a fixed annual rate of return, you’ll receive the approximate number of years it would take to double your initial investment.

Formula

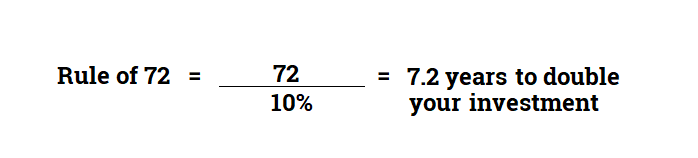

Example

Suppose you invest $1,000 and receive a fixed annual 10% return. In this example, it would take 7.2 years [(72/10) = 7.2] to double your investment to $2,000 with the compound interest.

Here is the year by year breakdown

| Number of years | Balance after return |

|---|---|

| Year 1 | $1,100 |

| Year 2 | $1,210 |

| Year 3 | $1,331 |

| Year 4 | $1,464.10 |

| Year 5 | $1,610.51 |

| Year 6 | $1,771.56 |

| Year 7 | $1,948.72 |

| Year 7 + 2.4 months | $2,000 |

Variation of annual rate of returns

The chart below compares the number of years it takes for an investment to double itself given a variety of different annual rates of return.

| Number of years | Rate of return |

|---|---|

| 24 years | 3% |

| 18 years | 4% |

| 14 years | 5% |

| 12 years | 6% |

| 10.3 years | 7% |

| 9 years | 8% |

| 8 years | 9% |

| 7.2 years | 10% |

| 6.5 years | 11% |

| 6 years | 12% |

| 5.5 years | 13% |

What kind of investor are you?

No doubt people have to invest according to their risk tolerance. But for illustration purposes, here is a return comparison between a conservative investor vs. someone who is willing to accept higher risk.

Suppose Joe, conservative investor, buys a $15,000 guaranteed fixed-income product that pays 2% interest annually. According to the rule of 72, it will take him 36 years to double his money (to $30,000).

[72/2% (annual rate of return) = 36 years]

On the other hand, Steve who’s willing to accept a higher risk for higher potential returns, invested in the stock market and managed to achieve a consistent 8% return year after year. Giving the 8% annual rate of return, it took him only 9 years to double his initial $15,000 investment in comparison to Joe’s 36 years to do so from his 2% return investment.

[72/8% (annual rate of return) = 9 years]

From this comparison, we see that investing in products that have a better potential return will lower the time required to double the investment. However, this higher risk can result in higher losses. Just because you now have a better idea of how long it’ll take your investments to double, make sure you don’t go chasing that number and take on risk you’re not comfortable with.

Everyone wants to double, triple, or quadruple their money but that doesn’t happen overnight. Using the rule of 72 can at least help you plan for the years ahead. And it’ll keep your eye on the horizon, looking forward to days when your portfolio is much larger than it is now. With sound investing, that time will be here before you know it.

If you enjoyed this post, please consider sharing it on Facebook or Twitter!

Ready to get started?

Take control of your financial future and start investing today.

Related lessons

Want to dive deeper?

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lessonRead next

Accounts 101

Explore the different account types available in Questrade and determine the right account for you.

View lessonExplore

Choosing the right products for your portfolio

Discover the different investment products offered at Questrade.

View lesson