A Spousal RRSP is an investment account that allows you to help save for your spouse or common-law partner’s retirement. While it is incredibly similar to a regular RRSP, it comes with a few extra perks regarding tax breaks and withdrawals, along with some noteworthy rules to keep in mind.

Lesson RRSPs 201

What is a spousal RRSP?

Learn about Spousal RRSPs and how they can help you and your spouse or common-law partner save money for retirement.

Why should I open a Spousal RRSP?

A spousal RRSP allows two spouses or common-law partners to invest in their future together. Whether you’re the higher or lower-income spouse, this particular RRSP provides valuable tax-related perks to both parties. Some of these benefits include:

- Contributions are tax-deductible and investments within the account, like stocks and ETFs, grow tax-free, much like a standard RRSP.

- A spousal RRSP can allow a couple to make their total retirement income more balanced, in turn reducing their household’s tax bill upon withdrawal.

- If you have a younger spouse, a spousal RRSP allows you to continue making contributions after you turn 71.

- While the higher-income spouse earns tax deductions from contributions made that tax year, the lower-income spouse can reap tax-deferred growth from the spousal RRSP’s investments. Plus, the lower-income spouse would be taxed at a lower rate upon withdrawal from the account.

What are the similarities and differences from a normal RRSP?

Before we go into what sets a spousal RRSP apart from other accounts, here's a quick breakdown of terms you'll see along the way:

- Account Holder/Annuitant: The spouse or partner who owns the spousal RRSP. Typically the lower-income partner, they will be able to make withdrawals.

- Contributor: The spouse or partner who makes tax-deductible contributions to the account. They will not be able to withdraw from the account and are typically the higher-income partner.

Unlike a personal RRSP, a spousal RRSP involves both an account holder and a contributor. The account holder (also known as an annuitant) is the one who owns the RRSP and can make withdrawals from it. Meanwhile, the contributor can make tax-deductible contributions to the account, but cannot withdraw from it.

Otherwise, these two accounts function very similarly - they both come with contribution limits, withdrawal rules, and several investment opportunities (such as stocks and ETFs). However, with a spousal RRSP, there are important considerations to keep

in mind.

Important: For Questrade Spousal RRSPs, contributors can be set on the account management page of your Questrade account - please review and confirm this before making a deposit. Once the deposit is made, the contributor

will receive a tax slip in the amount deposited, and this tax slip cannot be changed after the deposit.

What to know about contribution limits and withdrawals

Contribution limits

When it comes to RRSP contribution limits, your yearly limit applies to the amount you contribute, whether it's to a normal RRSP, a spousal RRSP, or both. For example, if your annual contribution limit is $10,000 and you put $5,000 into a spousal RRSP, you’d have $5,000 left in contribution room for your personal RRSP. However, your spouse’s limit is not impacted by your contributions to the spousal RRSP.

Withdrawals

Withdrawals from a spousal RRSP will be added to the annual income of the account holder/annuitant and taxed accordingly. What’s especially important to know is that if the account holder makes a withdrawal within three years of a contribution, it is the contributor that will be taxed. The amount withdrawn will be added to the contributor’s taxable income for that year.

Also worth noting is that, like a personal RRSP, a spousal RRSP will become a spousal Registered Retirement Income Fund (RRIF) at the end of the year the account holder turns 71. When this happens, you will need to withdraw a certain amount each year, as per the standard RRIF withdrawal minimums.

You can learn more about spousal RRSP withdrawals on the CRA's website.

Let's check out an example:

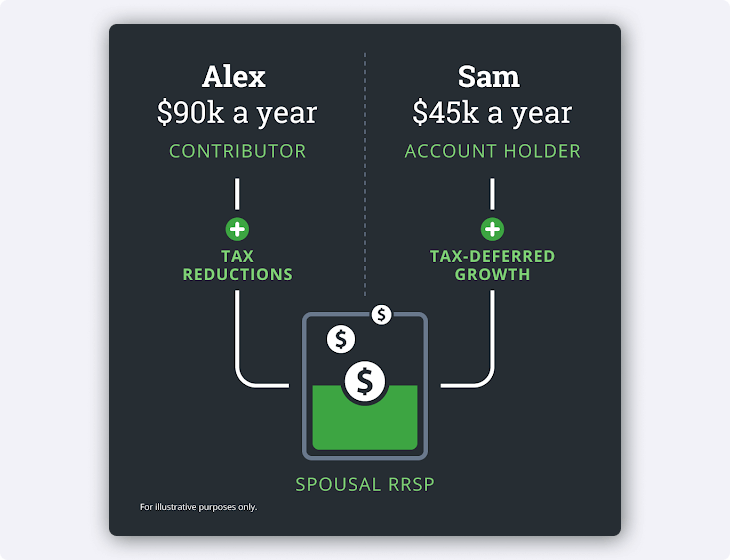

Alex and Sam open a spousal RRSP together, and they name Alex as the contributor because she has a higher salary.

In this case, Sam is named as the account holder (also known as the annuitant) who will be reaping the tax deferred growth till funds are withdrawn.

Since Alex will be in a higher tax bracket, her contributions to the spousal RRSP will provide valuable deductions on her income taxes.

Meanwhile, Sam can reap tax-deferred growth from the spousal RRSP’s investments, which could include stocks, ETFs, or other products available through a standard RRSP.

Why should I open a spousal RRSP?

A spousal RRSP allows two spouses or common-law partners to invest in their future together. Whether you’re the higher or lower-income spouse, this particular RRSP provides valuable tax-related perks to both parties. Some of these benefits include:

- Much like a standard RRSP, contributions are tax-deductible and investments within the account, like stocks and ETFs, grow tax-deferred.

- A spousal RRSP can allow a couple to make their total retirement income more balanced, in turn reducing their household’s tax bill upon withdrawal.

- If you have a younger spouse, a spousal RRSP allows you to continue making contributions after you turn 71.

- While the higher-income spouse earns tax deductions from contributions made that tax year, the lower-income spouse can reap tax-deferred growth from the spousal RRSP’s investments. Plus, the lower-income spouse would be taxed at a lower rate upon withdrawal from the account.

Investments you can hold in a Spousal RRSP

Just like a regular RRSP, a Spousal RRSP can be used as a versatile investment tool to achieve growth through multiple avenues. These avenues include RRSP-eligible investment products such as:

- Stocks (both Canadian and international)

- ETFs

- Options

- Mutual funds

- Bonds

- Gold and silver bars

- GICs

- Cash

For a full list of eligible investments, visit the CRA.

Benefits of a Questrade Spousal RRSP

- No annual account fee. No opening or closing fees.

- Hold both Canadian and U.S. dollars in the account at the same time.

- Open the account in minutes.

- Contribute to your Spousal RRSP quickly and easily online. No need to book an appointment or wait in line.

Start investing confidently

Ready to open an account and take charge of your financial future? It's easy. Get started in minutes.

Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Related lessons

Read next

TFSA 101

Discover what a Tax-Free Savings Account is and how it can benefit your investment goals.

View lessonExplore