Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Rebalancing your portfolio

Rebalancing your portfolio

Learn about the benefits of rebalancing your portfolio.

Typically when you build and allocate your portfolio, you consider your risk and investment goals. One way to stay on track with these things is to manage or “rebalance” your portfolio. This is also because investments grow at different rates, and over time your portfolio could drift away from your strategy. When you rebalance your portfolio, you’re reorganizing your investments to fit your target asset allocation.

Please note: The information prepared in this section is for educational purposes only, and should not be taken as any form of trading or investment advice.

How a portfolio can become unbalanced

Since investments have different levels of risk and returns, it may “unbalance” your target portfolio over time if not checked and rebalanced accordingly. Let’s look at a hypothetical example below.

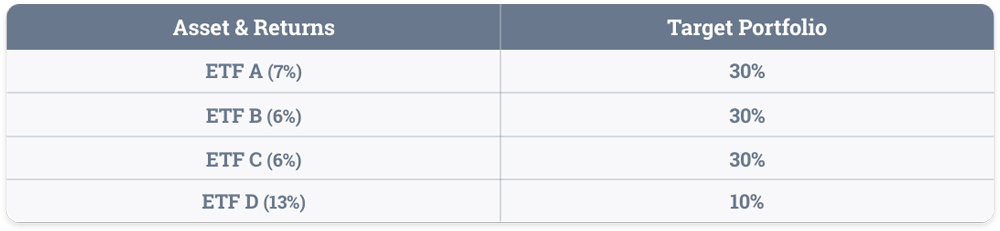

Say your target portfolio allocation is split into four ETFs (30/30/30/10 split) with different levels of risk and return. The first three assets (“ETF A” to ”ETF C”) have 30% allocation. However, the last one (ETF D) has only a 10% weighting because despite its higher return, it comes with more risk. Please note that this asset allocation will depend mostly on your investment goals and risk tolerance.

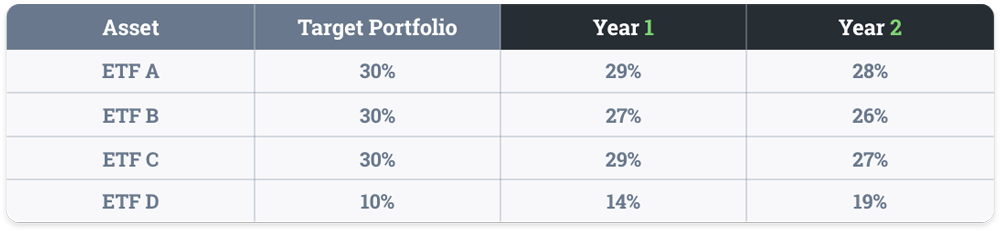

Since ETF D has a higher return, it may eventually take up more of your asset allocation. In this case a year later, ETF D increases to 14% while the rest of your assets went down a bit. The second year comes and ETF D continues to increase to 19% of your asset allocation while the others continue to decrease their weightings. This exposes you to more risk as your higher risk asset (ETF D) is now taking up more of your portfolio. If this happens, you may want to rebalance your portfolio (manually or with an automated rebalancing tool) to readjust it to your target asset allocation.

One way to manage your portfolio is rebalancing it manually. This means selling some shares of your assets that have had a higher return and reinvesting to match your targets. Using the same example above, in year one you’ll have to sell 4% (or 9% in year two) of ETF D shares and reinvest the rest to ETF A-ETF C. This process will rebalance your portfolio to your original portfolio allocation.

Please note: Selling shares may be subject to capital gains taxes or capital losses upon liquidation. Please ensure to consult with a tax advisor when liquidating your investments.

So how often should you rebalance? The frequency varies from person to person and may change if your investment goals and risk tolerance change.

You can also automate the rebalancing process with our partner Passiv. Passiv lets you track, rebalance and send you alerts when your portfolio’s target allocation is not in the right proportion.

How you’re going to rebalance your portfolio is solely going to depend on your investment goals and situation. There is no one-size-fits-all method on this process but understanding the importance of implementing it could help in your investment journey.

Disclaimer: The information in this article is for information purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade Group of Companies, its affiliates or any other person to its accuracy.

Related lessons

Read next

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lessonExplore

Questrade trading platforms

Discover all of Questrade’s trading platforms and decide which one is best suited for you, and your investment style.

View lesson