Journaling shares refers to exchanging equivalent, dual-listed shares from different exchanges. When an investment trades on two different exchanges, you’re able to exchange shares from one exchange to another. Typically, this is done with exchanges that use different currencies (the TSX being in CAD and the NYSE being in USD, for example), so by journaling your shares you can also exchange the currency of your asset.

Journaling shares in order to avoid currency conversion fees is commonly referred to as “Norbert’s Gambit”, due to its popularization by Norbert Schlenker, an investment advisor in BC.

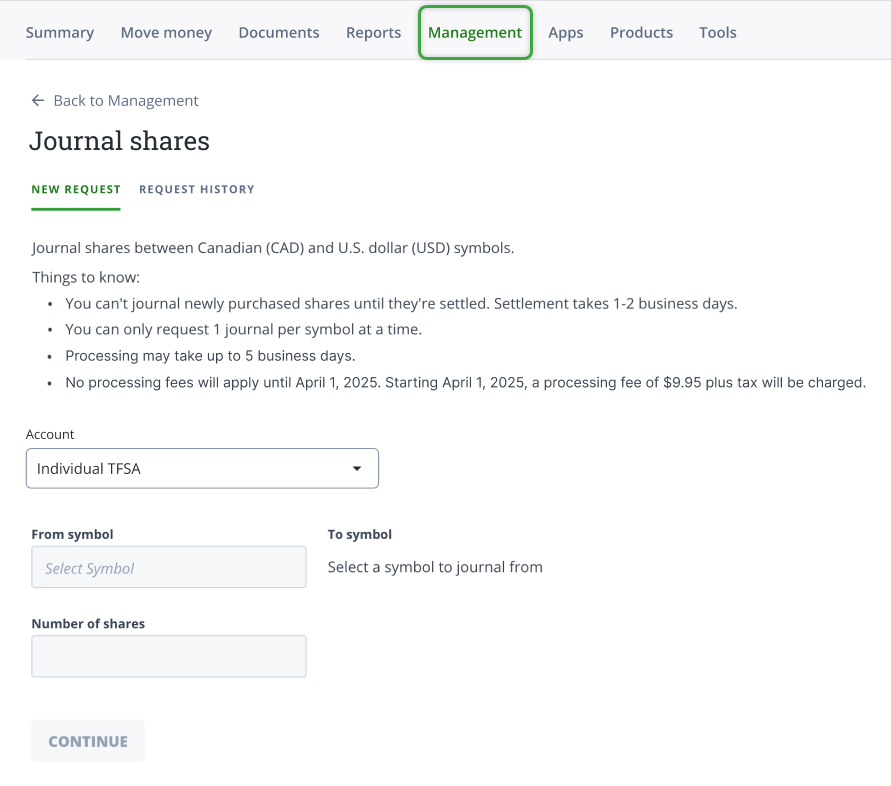

At Questrade this process can be done entirely online, and normally costs $9.95/request—unless you have Questrade Plus. By signing up, you’ll unlock unlimited free online journaling requests, letting you perform Norbert’s Gambit as often as you want without any charge.