OPTIONS TRADING

Your Guide to Cash-Secured Puts

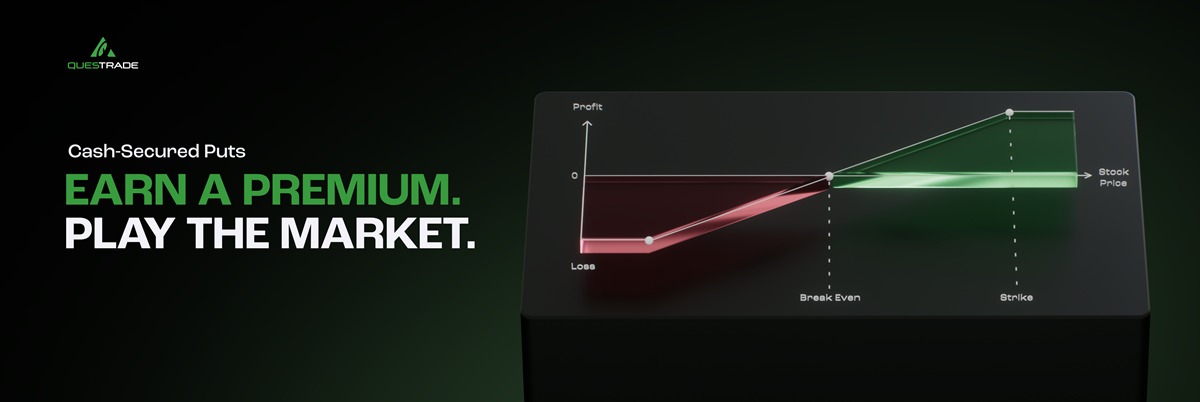

An options strategy for generating income and potentially buying stocks at a target price.

Key details

- A Cash-Secured Put (CSP) is a defined-risk options strategy used to generate income (the premium) by selling a put option.

- The premium is an upfront, non-refundable cash payment you receive as the option seller.

- It also creates an obligation to buy 100 shares of the underlying stock per option contract at a specific price (the strike price), if exercised by the buyer.

- This strategy is often used when you have a neutral-to-bullish outlook on a stock you would like to own, but at a price lower than its current market value.

- The primary risk is that if the stock's price falls significantly below your strike price, you are still obligated to buy the shares at that higher strike price. This risk is similar to owning the stock itself.

- All Non-Registered and Registered Accounts (except RESP) with Level 2 options access are eligible to trade CSPs.

- For Registered Accounts, please note that trading CSPs on indices (SPX, VIX, NDX, etc.) is prohibited.

What is a Cash-Secured Put Option Strategy?

A Cash-Secured Put is an options strategy used by investors who may want to purchase a stock at a price lower than its current market value.

Imagine there's a stock you'd like to own, but you feel its current price is just a bit too high. What if you could set the price you're willing to pay and get paid a small amount of cash just for waiting?

To understand this strategy, let's first break down the "put" option itself. Every option contract involves a buyer and a seller:

- The Put Seller (You): You agree to an obligation to buy 100 shares of a stock at a set price (the strike price) until a set date (the expiry).

- The Put Buyer: They have the right to sell you those shares at that same strike price.

For taking on this obligation, the buyer pays you an upfront fee called a premium. This payment is yours to keep, no matter the outcome—whether the option is eventually assigned or expires.

The "cash-secured" part simply means you must have enough cash in your account to cover the purchase of the underlying stock if you are assigned the contract(s). In such a scenario, you would be obligated to buy the applicable number of shares at the agreed-upon strike price. That dollar amount is the cash we secure, as it helps define your risk at the outset of the trade, so you’re never on the hook for more than you planned.

What to expect on expiry day?

When you sell a Cash-Secured Put, there are two main outcomes that can happen by the expiration date.

Scenario 1: The stock price stays above your strike price.

If the stock's market price is higher than your strike price, the option buyer has no reason to exercise their right as they are not in-the-money and doing so would mean they sell the stock for less than market value.

- Result: You keep 100% of the premium you collected as profit. The option expires worthless. Your obligation ends, and you do not have to buy any shares.

Scenario 2: The stock price falls below your strike price.

If the stock's market price is lower than your strike price, the buyer will likely "exercise" their right to sell you the shares at the higher, agreed-upon strike price.

- Result: You keep 100% of the premium you collected as profit. However, you are now "assigned" the contract. To fulfill your obligation, we will buy 100 shares at the strike price, using the cash that was already set aside. The premium collected is what effectively lowers your cost basis for the stock.

An example of a Cash-Secured Put

Let's walk through an example trade.

You're interested in ABC, which is currently trading at $85 per share. You like the company, but would prefer to buy it at $80 per share.

You decide to sell one Cash-Secured Put contract with an $80 strike price that expires in 30 days.

- Cash-Secured: You must have $8,000 in your account ($80 strike price x 100 shares).

- Premium Received: For selling this put, you immediately receive a premium of $2 per share, for a total of $200 ($2 x 100 shares).

Now, let's look at the possible outcomes when the contract expires:

Outcome A: ABC closes at $82 per share.

The stock price is above your $80 strike price. The option expires worthless.

- You keep the $200 premium: your goal of generating income was successful!

- You do not buy the shares.

Outcome B: ABC closes at $79 per share.

The stock price is below your $80 strike price. You are assigned the contract.

- You still keep the $200 premium: your goal of generating income was successful!

- You must buy 100 shares of ABC at your $80 strike price, costing you $8,000.

- Your effective cost for the shares is $78 per share ($80 strike price – $2 premium).

- You successfully bought the stock you wanted at a net price below your original $80 target.

Outcome C (The Risk): ABC closes at $70 per share.

The stock price is significantly below your $80 strike price. You are assigned the contract.

- You still keep the $200 premium; your goal of generating income was successful!

- You must buy 100 shares at $80, costing $8,000.

- Your effective cost is still $78 per share (after factoring in your $200 premium).

- The stock is now trading at $70, meaning your new position has an "unrealized loss" of $8 per share. This highlights the main risk: you must buy at the strike price, no matter how far the stock has fallen.

Your breakeven price on this trade is $78 per share (Strike Price – Premium).

Benefits and Advantages of the Cash-Secured Put Strategy

The potential benefits that appeal to investors:

- Generate income: As the seller, you receive the premium upfront. This is yours to keep. This can be a way to generate a return from stocks you are simply waiting to buy at the right price.

- Defined risk: The "cash-secured" part of the name is key. Because you've already set aside the cash needed to cover the potential purchase, your maximum risk is clearly defined from the moment you enter the trade. This provides a level of clarity and control you don't get with non-secured strategies.

- Buy stocks at a target price: This strategy allows you to set the price you're willing to pay. If the stock drops to or below your strike price and you are assigned, you end up owning the shares you may have wanted. The premium you collected acts as an immediate discount, lowering your effective cost basis.

Potential Considerations for Cash-Secured Puts

Some things to keep in mind.

- Risk of significant loss: With this options strategy, your risk may be similar to owning the stock outright. If the stock price falls far below your strike price and you are assigned, you are obligated to buy the shares at that higher price with the premium collected serving as a discount.

- You might not get the stock: If your main goal is to buy the stock right away, this strategy isn't a guarantee. If the stock price never drops to or below your strike price, you may not be assigned the contract(s). In such cases, you'll simply keep collecting the premium, which may not be the shares but allows you to generate income.

How to sell a Cash-Secured Put at Questrade

If you've weighed the risks and benefits and believe this strategy fits your goals, here are the general steps:

- Enable options trading. You can trade Cash-Secured Puts in all eligible accounts (listed above) with Level 2 options enabled.

- Choose a stock. While this strategy can be applied to any stock, it is generally used for stocks people may already want to own at a lower price.

- Secure your cash. You must have enough cash in your account to secure the full purchase obligation (100 shares x your strike price).

- “Sell to open” a put contract. Select the sell option once you define your order type, duration and price.

Securing the funds

Once your “sell to open” order is accepted, your account's buying power will be reduced by the full cash amount required for the obligation (100 shares x strike price). This cash is "secured"—meaning it is set aside—for as long as the put position remains open. This ensures the funds are available if the option is exercised and you are assigned the contract(s).