Things you should know when switching your mortgage

Understand the important things when renewing or switching your mortgage.

What should you do when your mortgage is up for renewal?

4 min

What you’ll learn:

- How to get more favourable terms and a lower interest rate

- When to change your mortgage type to save money

- How to switch to QuestMortgage to get BetterRate ®

An envelope arrives in your mailbox or you receive a lengthy email from your mortgage provider. Your mortgage renewal documents are in. What do you do?

Your first thought might be to just sign the papers and call it a day. But if you do, you might be losing out on thousands of dollars over the long term. If your goal is to save money for the future, it might be time to review your current deal.

You may have a few questions. Should you try to renegotiate your terms? Switch mortgage providers? Stick with the same type of mortgage? The point is, you have options and you’re in the driver’s seat. So before you return the offer sheet without giving it a second thought, let’s evaluate your options together.

Below is what you may need to know about making the mortgage switch or moving your mortgage to another bank.

Why you should switch mortgage providers

When your mortgage is up for renewal, it’s an opportunity to save money. The end of your term is the best time to shop around because it’s the only time it costs less to switch if you have a closed mortgage. There may, however, be legal costs when switching your mortgage, such as an appraisal fee or legal fees. So now’s the time to seek out options that can better suit you and your family’s needs.

Switching to get a lower interest rate

Your interest rate is one of the most important things to look for when deciding whether to switch, as a lower interest rate can save you thousands over the term of your mortgage. Even what looks like a small difference in percentage points could lead to massive savings over your next mortgage term. Let’s look at an example where your mortgage is coming up for renewal after 5 years, with $450,000 and an amortization period of 20 years left. Please note these figures are for illustrative purposes only.

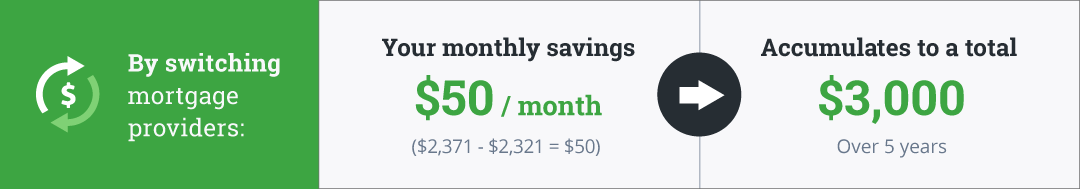

So, you would save $50/month by switching mortgage providers. This by itself may already be worth switching for, but see what this $50 can turn into after 5 years.

You could save $3,000 over the 5 year term of your mortgage simply by switching from a 2.45% to 2.22%.

Switching to get more favourable terms

A lower mortgage rate is one way you can save. But switching to a mortgage with more favourable terms and conditions can also help you keep more of your money.

When evaluating different mortgage options, look into the provider’s prepayment privilege (where you can make ad-hoc lump sum payments to your mortgage anytime throughout the year, in addition to your regular payments). Also, keep an eye out for payment increase options (where you can increase your regularly scheduled mortgage payments anytime, up to 100% of the original of the original monthly payment).

Choosing a provider with better prepayment options can help you save on interest and ultimately help you be mortgage-free sooner. For example, with QuestMortgage, you can enjoy some of the best prepayment privileges on the market, of up to 20% of the balance at the start of the term, per year. Our payment increase option also allows you to increase your mortgage payments at any time (up to 100% of the original payment amount) so you can pay off your mortgage faster.

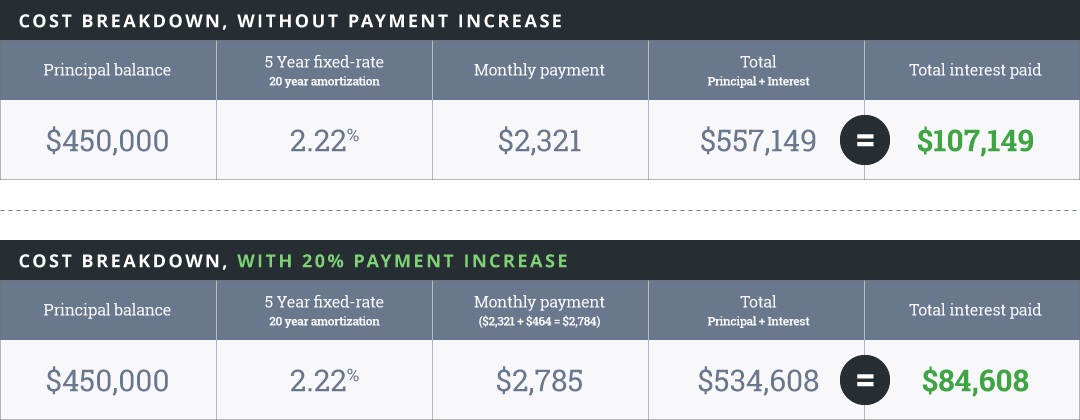

Let’s take a look at how much even a 20% increase to your mortgage payments can save you. Say you have a $450,000 property and you get a mortgage rate of 2.22%, and you have an amortization period of 20 years. Your monthly mortgage payment would be $2,321. With a 20% prepayment privilege, add 20% of your monthly mortgage payment ($2,321 x 20% =$464) on top of your regular payment. So, your total monthly payment would be $2,785.

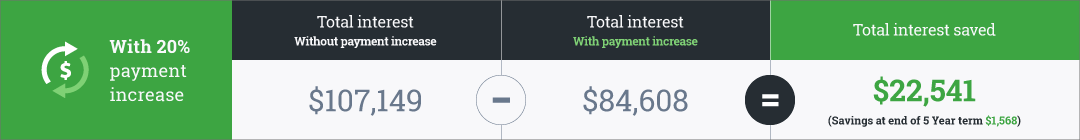

Over the 20-year amortization period, you would save $22,541 in interest.

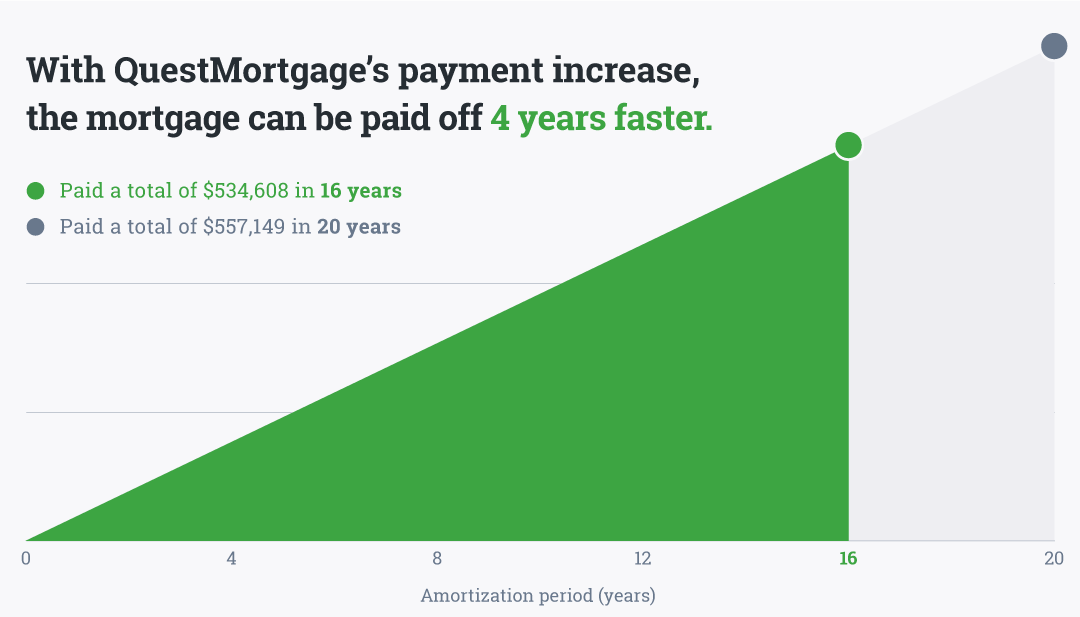

You could also pay off your mortgage four years earlier than if you had the same mortgage without the prepayment privilege, which could shorten your amortization period. Just keep in mind the privilege alone doesn’t help pay off the mortgage faster or save money, as you’ll need to exercise the privilege.

Other conditions may also be important to you, like the length of your term. But these depend on your personal preferences, so be sure you take the time to review and evaluate your options.

What about changing my type of mortgage?

If your mortgage term is up, you may also be considering changing the type of mortgage you have. If you find yourself in an increasing-rate environment, it might make sense to switch from a variable-rate mortgage to a fixed-rate option.

With a variable-rate mortgage, your payments and interest rate will fluctuate based on a prime rate. A variable-rate mortgage is attractive if rates decline, which may help you save over the term of your mortgage. However, if the prime rate increases, so will your rate and payments. If the prime rate is something that keeps you up at night, then it might be better to switch to a fixed-rate mortgage. See our mortgages to help you find the one that best suits your needs.

Switching to QuestMortgage

QuestMortgage is the easy, online way to get a mortgage. Our mortgages offer greater flexibility than the banks and can help you save thousands over the life of your mortgage. You can apply online and access your mortgage any time you’d like with full transparency.

Have questions about QuestMortgage? If your mortgage is up for renewal within the next 120 days, we can start the application and set the closing date for 120 days or less to match your current maturity date. Then, we’ll complete the switch on that day. Plus, we have a team of dedicated Mortgage Advisors available if you need them to help walk you through the process.

Get started today to see what rate you could get.

Get my rateThe information in this blog is for information purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade Group of Companies, its affiliates or any other person to its accuracy.

Should I break my mortgage term?

4 min

What you'll learn:

- What it means to break your mortgage term

- How to determine a mortgage penalty associated with breaking your mortgage

- How to determine your monthly payments and savings

You found the right home for you a few years back. And at the time, you certainly thought you had secured a fair rate on your mortgage. But now, some time has passed and rates are looking a little different than what they used to be – so what do you do?

With the current low-rate environment, many people are questioning their current mortgage deal. Is it worth it to break your mortgage term? Should you wait until it’s renewal time and your term is over? How do you figure out how much you’ll have to pay as a mortgage penalty? These are all valid questions and we’re here to help answer them.

What does it mean to break my mortgage term?

When you first applied for your mortgage, you would have chosen a mortgage term (typically 5 years in Canada). If you’re looking to end your mortgage term early and switch to a new provider, this would mean you’re breaking your mortgage term.

There are many reasons why you would want to break a mortgage contract. For example, if today’s rates are lower than your current rate, and you feel as if you’re overpaying on interest. Or, if your current contract is simply no longer meeting your needs and its prepayment privileges are too limiting.

Breaking your mortgage term allows you to get a better rate and renegotiate the things you dislike about your mortgage, however, there are some penalties associated with breaking a contract (which depend on the provider). But, getting a lower rate and better prepayment privileges may outweigh the breakage costs.

Think about your goals

Most are looking to accomplish three things when breaking their mortgage term that fall into the same general category of saving money.

- Lock in a lower rate

- Reduce the cost of the overall mortgage

- Reduce your monthly mortgage payments.

Our Mortgage Advisors can help you determine how much you could save with a new deal and how your savings compare to any penalties associated with your mortgage.

Determine penalties

It’s a legal requirement for mortgage lenders to provide a mortgage penalty calculator which can be found on the provider’s website. You can easily use these calculators to help determine the approximate cost of breaking your mortgage term.

The penalties for a fixed-rate closed mortgage is an amount equal to 3 months’ interest on what you still owe, or the interest rate differential (IRD) – whichever is greater. This penalty is a charge that may apply if you pay off your mortgage before the term is over or pay the mortgage principal down beyond the amount of your prepayment privileges. Since the IRD may be quite large, fixed-rate mortgages can be more expensive to end.

For variable-rate closed mortgages, the penalty is only the equivalent of three months’ interest, making them less expensive to end. Your dedicated Mortgage Advisor can help with your review of the costs and benefits of breaking your mortgage term early.

Review your contract

It’s also a good idea to review the specific terms of your contract with a fine-tooth comb to make sure there aren’t any additional costs that may apply. While the fees for a fixed-rate and variable mortgage are usually similar, it’s best to review your contract and penalty terms carefully. You can confirm the exact penalty amount and any additional costs of breaking your mortgage term with your current mortgage lender before proceeding.

A Mortgage Advisor can help subtract these costs from your savings and will factor in the time remaining in your current term.

Determine your new monthly payments

If you’re thinking about ending your mortgage term early, you’ll want to determine just how much you can save on your monthly payments by switching.

Give us a call today to see if you could get a better rate with QuestMortgage. Our team of expert Mortgage Advisors can help determine your new rate and monthly payments.

Call us at 1.888.909.5588 and press 3 to speak with a Mortgage Advisor.

Switch to our BetterRate ® mortgage

Once you’ve gone over the above factors with a Mortgage Advisor, only you can decide whether it makes sense for you to break your mortgage term. Even if your term isn’t up yet, you could potentially be leaving money on the table by staying with your current provider.

Our BetterRate ® mortgages are our commitment to you that you’ll receive a great, low rate right from the start. You can enjoy the best prepayment privileges of up to 20% of the original mortgage balance at the start of the term, per anniversary year. And, you can increase your mortgage payments at any time (up to 100% of the original monthly payment) to help you pay off your mortgage sooner.

If you’re ready to switch and save with QuestMortgage, our team of expert Mortgage Advisors are here to help. And if you’re a little uneasy about any fees associated with switching your mortgage – don’t worry. We may be able to help cover some of the costs of switching and we’d love to tell you how.

Call us at 1.888.909.5588 and press 3 to speak with a Mortgage Advisor or send us an email.

Learn more about QuestMortgage.

All rates are subject to borrowers meeting QuestMortgage standard credit criteria and are subject to change at any time without notice. The interest rate is guaranteed for up to 120 days from the date the application is approved. If the mortgage is not funded within 120 days from the date the application is approved, the interest rate guarantee expires.

The information in this blog is for information purposes only and should not be used or construed as financial or investment advice. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade Group of Companies, its affiliates or any other person to its accuracy.

Ready to get started?

In just a few clicks see our current rates, then apply for a mortgage in minutes!

Related Lessons

Want to dive deeper?

Mortgage affordability and down payment

Understand how much you can afford and your down payment options.

View lessonRead next

Ways to pay off your mortgage faster

Explore the different ways to pay off your mortgage faster.

View lessonExplore

Home repairs and maintenance

Learn about the major home repairs and maintenance you need in your home.

View lesson