Savings

Save 57% or more on services like online journaling and market data.

Unlock up to 4% cashback

Transfer your account to Questrade and get 4% cashback. Use code QT4CASHBACK. Terms apply. Learn more

$0 commission stocks & ETFs, options as low as $0 3,

no hidden fees -plus the tools to trade smarter and stay in control.

$0 commission stocks & ETFs, options as low as $0 3, no hidden fees - plus the tools to trade smarter and stay in control.

Seamless US Trading. Avoid FX conversion fees

Zero Commission Trading

Get a Competitive Edge with Advanced tools, real-time data, and a customizable platform

Broad range of registered accounts like RRSP, TFSA, RESPs and LIRAS with low-cost investing

More than just Stocks & ETFs. Trade options, precious metals, and IPOs on one powerful platform.

Transfer your account to Questrade for free 5

Ready to open an account and take charge of your financial future?

Get startedSaving for your first home, retirement, or simply looking to grow your wealth?

Questrade has an account to help you get there, confidently.

Save and invest for any goal with this flexible and tax-free account

Increase your buying power by leveraging the assets you already own

A tax-advantaged account that helps you build your nest egg for retirement

An investing account that lets you trade without the restrictions of contribution limits

A tax-free account that you can use to save up to $40,000 towards your first home

Save for your child’s education and get access to government grants

At Questrade, $0 trading comes standard 2

Trade stocks for

Trade ETFs for

Trade options for as low as

per contract 3

Trade fractional shares in real-time, commission-free and get the most out of every dollar.

Building your own portfolio means choosing the investments that suit your goals and preferences.

You can invest commission-free 2 and maximize your money's potential.

The classic investing product. Own shares in a company for potential growth and dividend income.

Diversify your portfolio with ETFs that invest in multiple companies, commodities and more.

Enjoy the flexibility of buying or selling an investment at a set price at a later date.

Maintain full ownership of your stocks and ETFs while making extra money by loaning them out.

Combine your drive with better value, tools and guidance. Cancel anytime.

Save 57% or more on services like online journaling and market data.

Execute your strategy more effectively and efficiently with advanced tools.

Accelerate your growth as an investor with the help of our learning sessions.

Take advantage of innovative, intuitive and easy-to-use trading platforms to build your portfolio.

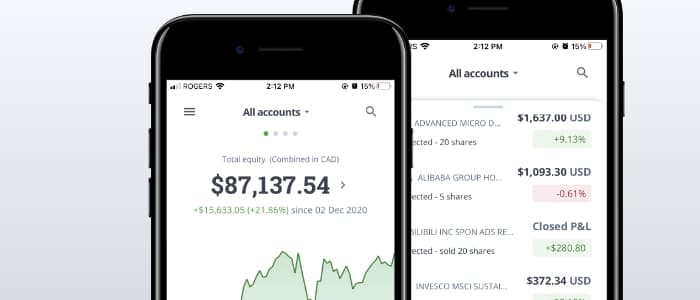

Trade, manage your account, check your performance and research stocks all in one place.

Never miss an opportunity. Trade wherever you are with this easy-to-use mobile app.

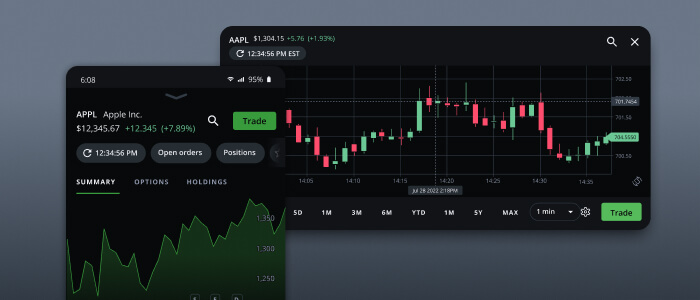

Designed for the active trader, Questrade Edge Mobile puts the power of our advanced platform in the palm of your hand.

Powerful software made by traders for traders. Trade like a pro with our advanced trading platforms.

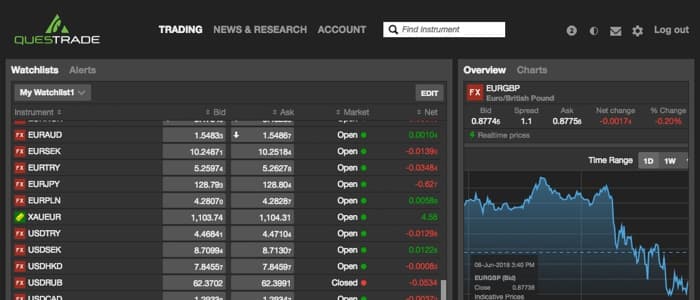

Take on the global markets and trade currencies, commodities and more on desktop, tablet or smartphone.

Questrade is much more than just a trading platform. Free, powerful tools like OptionsPlay, Seeking Alpha,

Passiv and more can help you track your investments – and find new opportunities.

Take your trading research deeper with advanced technical analysis, customizable charts, and more—all in one place.

Discover TradingViewKeep your trades on track towards your investment goals with Passiv's easy portfolio management platform.

Discover PassivCreate your own portfolio with self-directed investing and hand-pick the assets you’re most interested in.

Want someone to invest for you? With Questwealth Portfolios, experts handle all the portfolio management for you.

Capitalize on tools to find new trading ideas.

Get matched with a portfolio suited to you in 15 minutes or less

Mobile, web or desktop—trade your way on powerful platforms.

Invest in companies focused on social, environmental and governance qualities

Create your own portfolio with self-directed investing and hand-pick the assets you’re most interested in.

Trade stocks and ETFs commission-free 2. And options for 99¢/contract 3.

Capitalize on tools to find new trading ideas.

Mobile, web or desktop—trade your way on powerful platforms

Want someone to invest for you? With Questwealth Portfolios, experts handle all the portfolio management for you.

Earn up to 50% more 4 and get account management fees starting at only 0.25%

Get matched with a portfolio suited to you in 15 minutes or less

Invest in companies focused on social, environmental and governance qualities

Check out these learning articles to find out more about how managed

investing can help you save for retirement.

Understand the different benefits of TFSAs and RRSPs.

Read article

Discover the different investment products offered at Questrade.

Read article

Follow these easy steps to start opening a Questwealth Portfolios account.

Read articleBy bringing investing online, we reduce overhead and eliminate the layers between you and the market. We then pass those savings onto you.

With Questwealth Portfolios, you get a portfolio managed by our team of experts. With Self-Directed Investing, you're buying and selling the investments yourself.

1 Questrade won Best online broker by MoneySense for 2025.

2 Zero commission trades', '$0 commissions', '$0 trading', 'trade commission-free' and similar messages, refer to commission-free trading for trades placed online through Questrade, Inc.'s website or mobile apps for stocks and ETFs that are listed on a stock exchange in the United States or Canada. Other fees may still apply.

*By claiming your 30-day free trial, you commit to a Questrade Plus subscription at the specified monthly cost ($11.95) that starts immediately after the Trial Period and automatically renews until cancelled. You can cancel your free trial at any time during your Trial Period before the renewal date. If you cancel during your Trial Period, you will retain access to Questrade Plus features for the remainder of your free trial. You cannot reactivate this trial. See Questrade Plus Trial Offer Terms for full terms and conditions.

Average monthly savings are based on the monthly price not including tax for each subscription included (Passiv Elite, real-time data package) and performing at least one journaling request per month. Actual savings may vary based on journaling usage.

3 As low as $0/contract pricing applies to US Options only.

Questrade, Inc. will provide a refund on your 99¢ USD options contract fees, charged in United States Dollars (“USD”), based on the progressive options pricing tiers you get to during the calendar month of trading. The refund for each tier applies only to contracts executed within that tier. For example, fees for contracts that fall into tier 2 are refunded based on the tier 2 rate, and fees for subsequent contracts that fall into tier 3 are refunded based on the tier 3 rate, and so on. Please see our options pricing for details on each tier.

Contract fee refunds will be paid out on the first business day of the month following the month in which the trades occurred. Refunds will be credited to the account(s) in which the eligible trades were executed. Other fees may still apply and are not covered by the refund. If a refund is paid into an individual RESP or Family RESP account, it will be credited in CAD equivalent of USD, as USD deposits are not available for RESP accounts.

4 "Earn up to 50% more", "make up to 50% more", "up to 50% more", "up to 50% more money", "lower fees for better returns", “Become/get up to 50% wealthier”, “Trade high fees for better returns”, “high fees that lower your returns” and similar messages, are references and equivalents to our "earn up to 50% more" claim (and together or individually these may be referred to as the "up to 50% claim"). The 'up to 50%' claim excludes the Questwealth Conservative Portfolio. The up to 50% claim illustrates how investing with 4 out of the 5 Questwealth Portfolios ('QWP') could improve your retirement savings using a hypothetical example. The example assumes $50,000 compounds annually over 30 years at a growth rate equal to the average 5-year historical return of comparable mutual fund categories. Potential savings are based on a comparison of the highest MER charged by QWP versus the average MER of the Series 'A' mutual funds in the respective fund categories. Fees may change over time and actual results may vary. No representations and warranties are made as to the reasonableness of these assumptions. QWP is a service provided by Questrade Wealth Management Inc. Learn more at questrade.com/questwealth-portfolios.

5 You can transfer any account to Questrade from another financial institution, regardless of the balance, and get your transfer fees rebated (maximum rebate $150/account). No limit to the number of accounts you bring over. For a rebate, submit a statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade. For Questwealth™ accounts, all-in-kind and partial transfers of your securities will be liquidated. Transfers from cash accounts may be subject to capital gains taxes or provide capital losses upon liquidation. Exchange and ECN fees may apply. Terms and conditions are subject to change without notice.

Extended hours are available for US markets (NYSE and NASDAQ) 7am-8pm ET and Canadian markets (TSX) 4:15pm-5pm ET.

Dual Currency

Questrade accounts allow clients to hold US dollars. Please visit our pricing page for further details.

In 2024, Questrade was awarded the DALBAR Seal of Service Excellence for the sixth consecutive year. The recognition is given to firms across the financial services industry that demonstrate standout customer service and an exceptional standard of care, including telephone interactions and service delivery.

Socially Responsible Investing (SRI)

For Questwealth SRI portfolios, as there is no universal Socially Responsible Investing (“SRI”) methodology, the selection of the underlying

securities in the Questwealth SRI portfolios is based on inputs from various industry sources, including Environmental, Social, Governance, and SRI methodologies. Certain portions of the fixed income component of the Questwealth

SRI portfolios may not be recognized by these methodologies as exclusively SRI investments.

Stock tools, insights, and guidance ('Services') are provided by a third-party service provider - TipRanks. The availability of these Services and the information that may be conveyed through them do not constitute any form of advice or recommendation by Questrade, Inc. (Questrade). Questrade cannot guarantee the timeliness, accuracy, and reliability of these Services and the information that may be conveyed through their use. Questrade will not be held liable nor assume any liability for any loss or damages arising directly or indirectly from the use of these Services. Any liability, whether direct or indirect, or consequential loss or damage, is explicitly disclaimed. The TipRanks display image is provided for informational purposes only and is not based on a real stock.

Orders placed outside of standard market hours are processed immediately upon market opening. Excludes market closures and unforeseen events.

Questrade may close or modify fractional share positions in stocks or ETFs no longer eligible for fractional trading at any given time. Questrade Fractional Shares Disclosure Statement