Note: The information in this blog is for information purposes only and should not be used or construed as financial, investment, or tax advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Introduction to options trading

Introduction to options trading

Introduction to options trading

Options trading has a perception that it’s only reserved for expert traders, but in reality, can be an effective tool for many investors of all experience levels.

Let’s dive into the world of options so we can understand how these complex investments work, and how to trade them using the Questrade Edge platforms.

What are options?

Options are known as "derivative investments." A derivative is something that gets (derives) its value from another asset, like a stock or ETF (something called the underlying.)

Options are contracts with 3 components:

- The option or obligation to buy or sell an investment in the future

- The specific price called the strike price, that the investment will be bought or sold at

- An expiration date after which the contract becomes worthless

An option contract is created when it’s written by a seller in the market in return for a premium (money). Option writers can be individual traders, or sometimes ‘market makers’ or institutions.

- Writers are said to be taking the “short position” in an options trade, and will take on certain obligations that we’ll cover in detail below.

Option buyers (who pay the premium) receive the right, but not the obligation to buy or sell 100 shares of the underlying investment at a set price called the strike price, on or before the expiration date of the contract from the writer/seller.

- Buying an option is also commonly referred to as a “long position”.

Options contracts are also based on 100 shares of the underlying investment, and when viewing a quote for an options contract, you must multiply the price by 100 to obtain the true market value.

Let’s break it down.

There are actually two types of option contracts, Calls and Puts, each with their own rights and obligations.

Calls

A call option gives the buyer the right (but not the obligation) to buy 100 shares of the underlying (usually a stock or ETF) at the strike price, on or before the expiration date.

The buyer pays a premium to the seller for the contract.

The writer of a call option takes on the obligation to sell 100 shares of the underlying at the strike price, if called upon to do so by the buyer of the option. The writer receives a premium from the buyer for the contract.

Puts

A put option gives the buyer the right (but not the obligation) to sell 100 shares of the underlying (usually a stock or ETF) at the strike price, on or before the expiration date.

The buyer pays a premium to the seller for the contract.

The writer of a put option takes on the obligation to buy 100 shares of the underlying at the strike price, if called upon to do so by the buyer of the option. The writer receives a premium from the buyer for the contract.

Calls and Puts are exact opposites when it comes to the rights and obligations of the writer versus the buyer.

There are four basic option positions, depending on if you’re the buyer or seller, and whether it’s a Call or a Put, here’s a handy chart showing all the types of options trades.

| Call option | Put option | |

|---|---|---|

| Buying options (long position) | Pays a premium (money) to the writer. Has the right to buy the underlying security at the strike price on or before the expiration date.

Call buyers usually expect the price of a security to rise in value. |

Pays a premium (money) to the writer. Has the right to sell the underlying security at the strike price on or before the expiration date.

Put buyers usually expect the price of a security to decline in value. |

| Selling or Writing options (short position) | Receives a premium (money) from the buyer of the contract. The writer has the obligation to sell the underlying security at the strike price if called upon to do so (by

the buyer of the option).

Call writers generally expect the price of the underlying security to stay the same or fall in value. |

Receives a premium (money) from the buyer of the contract. The writer has the obligation to buy the underlying security at the strike price if called upon to do so (by

the buyer of the option).

Put writers generally expect the price of the underlying security to stay the same or rise in value. |

Exercising and Assignment

Exercising and Assignment are two important terms to familiarize yourself with before jumping into the world of trading options.

- Exercising:

Option buyers can exercise (use) their rights to either buy or sell shares of the underlying asset. When the buyer exercises this right, the writer of the option is said to be assigned.

- Assignment:

The writer who has been assigned has the obligation to either buy or sell shares of the underlying asset to/from the buyer of the option contract.

In real-world scenarios, most options contracts are never exercised, and will expire worthless, or are bought or sold before the end of the trading day on expiration day.

Many traders will often buy or sell their option contracts prior to expiration for a profit, to limit a loss, or to prevent them from being assigned.

American vs European options

The vast majority of Equity (Stock or ETF) options, are considered to be American style options.

These types of options can be exercised (when the buyer assigns the writer to buy/sell) at any time on, or before the expiration date of the option contract. Exercising involves the exchange of shares of the underlying asset.

Most Index options (when the underlying is an Index like the SP500, or TSX60), are considered to be European style options.

These types of options can only be exercised or assigned on the expiration date, not before. Exercising does not involve any shares, but rather the cash difference is settled (since you can’t buy/sell shares of an index directly).

You can check the “Style” of any option contract in the Level 1 quote window in the Questrade Edge platforms.

Why do people trade options?

While there’s no single answer to why a trader starts trading options, 3 key advantages stand out:

- Higher leverage

- Since option contracts are based on 100 shares of the underlying investment, there’s an aspect of leverage “built in” compared to buying or selling regular shares.

- For example: Buying 200 shares of a stock is usually more expensive than simply buying 2 Call contracts. If the price of the stock increases significantly, the percentage gain with the call contracts would be higher than the gain on the shares alone. This can reduce the amount of capital, or money that needs to be used for the trade.

- Help limit risk (hedging)

- Options can be used as a form of “insurance” or hedging for regular stock positions. In a long position where you own shares, you could buy a Put contract to establish a price “floor”. If the price of your shares ever drops below the strike price of your put, you’re still able to sell your shares at the strike price.

- Alternatively, in a short position, you could buy a Call contract to establish a price “ceiling”, if the price of your shares goes above your strike price, you’re still able to cover your short position at the strike price.

- Alternative strategies

- Options are an extremely flexible tool, and there are many strategies used to recreate or mimic other types of investments or asset classes, these are sometimes called synthetics.

- Traders can participate in much more than just price increases or decreases. The passage of time and movements in volatility can also affect the value of an option contract.

- Options can also allow for more flexibility in registered accounts. In RRSPs, and TFSAs, and FHSAs for example, shorting is not allowed due to CRA rules. A trader who wants to take advantage of a price decrease could buy a Put contract as an alternative to a short position for example.

Where do option contracts get their value?

Options get their value from two sources:

- How much time is left until expiration (Extrinsic, or Time-value)

- Is the option profitable to exercise? (Intrinsic value)

Time value

The longer an option contract has until it’s expiration, the more time value it will have “built in” to the market price of the contract.

This is because with a longer expiration time, the odds that the contract will end up profitable will increase. This is especially the case when the underlying asset has high implied volatility (big swings in price).

As the contract gets closer to expiration, this time value will decrease as the odds of the contract becoming profitable (or more profitable) decrease. This daily decrease in time value is often called Theta or time-decay.

Intrinsic value

Intrinsic value is measured as the difference between an option’s Strike price and the current price per share of the underlying asset.

With a Call option:

- If the price per share is above the strike price, the option will have intrinsic value equal to the difference in prices.

- If the price per share is below the strike price, the option is considered to be ‘out of the money’ and has no intrinsic value.

With a Put option:

- If the price per share is below the strike price, the option will have intrinsic value equal to the difference in prices.

- If the price per share is above the strike price, the option is considered to be ‘out of the money’ and has no intrinsic value.

Tip: Remember, Calls and Puts are opposites when it comes to calculating intrinsic value.

Options that can immediately be exercised for a profit are considered to be ‘in the money’, and will always have some intrinsic value.

Let's look at 2 quick examples:

- A ‘XYZ’ call has a strike price of $100, and the stock is currently trading for $120. The option buyer can exercise the call to purchase 100 shares for $100, and immediately sell them for a $20 profit in the open market. This call option is ‘in-the-money’ and has a $20 intrinsic value.

- An ‘ABC’ put has a strike price of $80, and the stock is currently trading for $95. The option buyer would not exercise their put to sell shares at $80 while they are able to sell them in the open market for $95. This put option is ‘out of the money’ and has no intrinsic value.

In the money (ITM)

An option is considered to be in the money or “ITM” if it can be exercised profitably (ignoring the premium paid). ITM options will always have some amount of intrinsic value, the amount is determined by the difference in share price vs strike price.

Out of the money (OTM)

Out of the money or “OTM” options have no intrinsic value since it would not be profitable for the buyer to exercise the option. The value of an OTM option is solely determined by the Time Value (time to expiration).

Check out the table below for a handy breakdown:

Note: Any securities, or tickers shown are for example, educational purposes only and should not be taken as any form of trading or investment advice.

| Call option | Put option | |

|---|---|---|

| ITM | Strike price is below the price per share of the underlying asset.

Option can be exercised profitably. Example: DIS is trading for $50, and the strike price is $40. The Call can be exercised for an immediate $10 profit. |

Strike price is above the price per share of the underlying asset.

Option can be exercised profitably. Example: AAPL is trading for $150, and the strike price is $180. The Put can be exercised for an immediate $30 profit. |

| OTM | Strike price is above the price per share of the underlying asset.

Option has no intrinsic value. Example: AMZN is trading for $3000, and the strike price is $3200. The Call is not profitable to exercise, but may contain some time value depending on the expiry date. |

Strike price is below the price per share of the underlying asset.

Option has no intrinsic value. Example: TSLA is trading for $850, and the strike price is $800. The Put is not profitable to exercise, but may contain some time value depending on the expiry date. |

Tip: At the money or “ATM” refers to an option when the strike price is the exact same as the stock price.

Reading an option quote

When you first view a quote for an option contract, it might seem intimidating compared to a regular stock or ETF.

Check out the section below for an overview, and rest assured, you’ll be reading and understanding options quotes in no time.

Depending on the Questrade Edge platform of your choice, options quotes might look a little different, let’s check them both out:

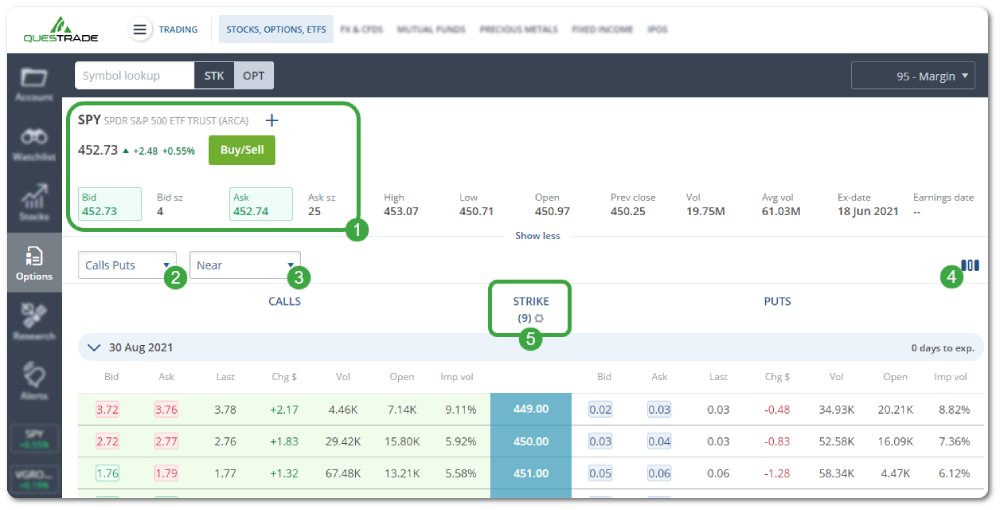

Questrade Edge Web

Looking up an option quote (sometimes called an option “chain”) using the Edge web platform is easy. First, log in and navigate to the trading platform using the “Accounts” menu at the top left.

Then, click the Options button from the left navigation menu, and enter the ticker symbol of the underlying asset. You can also toggle between Stock (STK) and Option (OPT) in the main symbol lookup window.

- At the top of the page, you’ll see a simplified level 1 quote with important information about the underlying asset like the Bid, Ask, Volume and change in price.

- The menu on the left allows you to switch between viewing single-leg options (buying or selling a call or put), or complex multi-leg multi-leg options strategies which involve combining different types of options or stock ownership.

- Check out this article on Option levels for more information about the different types of strategies available.

- The menu here allows you to switch between viewing different expiration dates.

- You can choose to view only options expiring soon (near), in a long time (far), All expirations, or a select date.

- The Edit columns button on the top right allows you to change the default columns of information displayed here in the options quote table.

- By default, you’ll see the Bid, Ask, Last traded price, Change in $, Volume, Open interest, and Implied volatility.

- The additional columns available are: Ask size, Bid size, Change in %, and the various Options “Greeks”:

- The “Greeks” (Delta, Gamma, Rho, Theta, and Vega) are explained in more detail in the section down below.

- You can also choose to change how many Strike prices are shown in the quote table below.

- You can view any amount from 4-9, or choose to view All strike prices

- Please note: If you choose All strike prices, and All expiration dates, depending on the speed and performance of your computer, you may experience slowdowns due to the amount of information streaming and processing in the background.

You can also click on the Calls or Puts buttons at the top of the table to show only that type of option.

Let’s take a deeper look at the options quote table:

With the default view, Calls are shown on the left, and Puts are shown on the right side.

Options highlighted in green are considered to be In-the-money, in this example, SPY’s price per share is $452.73.

- On the top left, we’ll see the expiration date for the 4 strike prices shown.

- On the top right, we’ll see the amount of days left until expiry.

- Click on any of the Bid or Ask prices to quickly add this specific option to your order entry screen on the right side.

- Clicking the Bid or Ask will set up a limit order with that specific price.

- Click on any of the rows in the table to view a detailed quote for that specific option.

- In this example above, clicking would bring up a quote for the $453 Put expiring Sept 1 ‘21.

You can also expand, or hide specific expiration dates from the table by clicking on the blue arrow on the left beside the expiration date.

Can’t see the strike price you’re looking for? Try changing the view using the button at the top. If the strike price still isn’t available, it’s possible there are no options contracts available at that price, and the open interest might be zero.

Options quotes on the web

It’s also important to understand the basics of how an option is quoted in popular media, or other online investing tools. All options quotes will usually contain at least the Strike price, underlying asset, the type (call or put), and the expiration date.

Not every website, or platform will quote these in the same order, but generally you’ll see the following:

|

Underlying asset

|

Expiry Date

|

Strike price

|

Option type

|

|---|---|---|---|

|

XYZ

|

November 10, 2021

|

$120

|

Call

|

Sometimes this is shortened to: “XYZ10Nov’21$120C” but may appear in another order like: “XYZ$120PNov10’21” depending on the source.

Check out the sections below for an overview of option quotes in Edge Desktop, important options terminology, practical examples of trading options, and a section for common watchouts and tips.

Looking up an option quote table (sometimes called an option chain) using Questrade Edge desktop is easy..

First, launch the application on your PC or Mac, and log in.

Next, click Options from the top menu, and enter the ticker symbol of the underlying security.

- The Symbol lookup box here allows you to switch between different underlying securities.

- The menu on the left allows you to switch between viewing single-leg options (buying or selling a call or put), or complex multi-leg options strategies which involve combining different types of options or stock ownership.

- Check out this article on Option levels for more information about the different types of strategies available.

- The menu here allows you to switch between viewing different expiration dates.

- You can choose to view only options expiring soon (near), in a long time (far), All expirations, or a select date.

- You can also choose to change how many Strike prices are shown in the quote table below.

- You can view any amount from 4-9, or choose to view All strike prices

- Please note: If you choose All strike prices, and All expiration dates, depending on the speed and performance of your computer, you may experience slowdowns due to the amount of information streaming and processing in the background.

- Below the menus and symbol lookup, you’ll see a simplified level 1 quote with important information about the underlying asset like the Bid, Ask, Volume and change in price.

- The Settings button on the top right allows you to edit the default columns of information displayed here in the options quote table.

- By default, you’ll see the Bid, Ask, Last traded price, Change in $, Volume, Open interest, and Implied volatility.

- The additional columns available are: Ask size, Bid size, Change in %, and the various Options “Greeks”:

- The “Greeks” (Delta, Gamma, Rho, Theta, and Vega) are explained in more detail in the section down below.

Let’s take a deeper look at the options quote table:

With the default view, Calls are shown on the left, and Puts are shown on the right side.

Options highlighted in blue are considered to be In-the-money, in this example, SPY’s price per share is $452.64.

You can also edit this default view by jumping into the Settings at the top right of the widget. Pick from custom colours, fonts, and much more.

- On the top left, we’ll see the expiration date for the 4 strike prices shown.

- You can also click to hide this specific expiration date, or click to expand any other dates below.

- On the top right, we’ll see the amount of days left until expiry.

- Click on any of the Bid or Ask prices to quickly add this specific option to a new order entry widget.

- Clicking the Bid or Ask will set up a limit order with that specific price.

Can’t see the strike price you’re looking for? Try changing the view using the button at the top. If the strike price still isn’t available, it’s possible there are no options contracts available at that price, and the open interest might be zero.

Tip: You can also ‘link’ this widget with any other widgets (level 1, order entry, charts..) by clicking the chain icon in the top right, and choosing a colour. This widget will then be associated with that colour, and if you link any other widgets such as a level 1 quote with the same colour, both widgets will automatically update to the same symbol. (I.e. Green link for options and green link for chart.)

Please note: The following section, and securities are for example, educational purposes only, and should not be taken as any form of trading or investment advice.

Example 1 - Buying a Call:

Josh is an investor who’s closely following company ‘XYZ’ trading at $100 per share and expects them to rise in price. In anticipation of this price increase Josh buys a call option on XYZ with a strike price of $120, and an expiration date 2 months out. This gives Josh the right, (but not the obligation) to buy 100 shares of XYZ for $120 per share before his call option expires worthless.

If XYZ rises in price sharply to $130 per share, Josh can exercise his option contract’s rights, and buy 100 shares of XYZ at $120 from the original seller of the options contract. In this example, Josh could profit $10 per share since he can buy XYZ at $120, and immediately sell it into the market for $130 per share. In a real-world scenario, Josh would subtract the premium he paid originally from his overall profit. If he paid a $2 premium for the call option, this reduces his profit to $8 a share.

Rather than exercising his call option, Josh can also choose to sell it back into the market before the expiration date. He could potentially profit off the increase in intrinsic price since the option is now in-the-money. This way he doesn’t have to deal with exercising the call, taking delivery of the shares, then having to sell them.

If XYZ only rises to $122, or lower, ($120 strike price + $2 premium paid) Josh’s call option would not be profitable to exercise, and his contract would likely expire worthless. He can try to sell it back to the market before the expiration date, but due to the time decay, he will most likely have booked a loss on the trade.

Example 2 - Buying a Put:

Nia is a trader who currently owns 500 shares of ‘ABC’ trading at $50 per share, and is worried about the shipping delays affecting the company’s manufacturing. Anticipating a drop in share price, Nia buys five put contracts (representing her 500 shares) with a strike price of $45, and an expiration date 6 months out.

In this example, Nia is using Puts as a Hedging strategy, protecting her original investment of 500 shares by creating a “price floor” or minimum price she can sell at. Nia pays $2 per put contract for a total of $1,000 in option premiums ($2 * 5 contracts * 100 options multiplier).

If ABC drops in price to $30 with increasing manufacturing problems and shipping delays, Nia can exercise her 5 put contracts to sell her shares at the strike price of $45. With this strategy, Nia will only book a $3,500 loss ($1,000 options premium + $2,500 loss in share price), instead of a loss of $10,000 if she had to sell at $30.

If ABC does not drop in price, but rather increases to $60, Nia’s puts will most likely expire worthless, and she will lose the $1,000 premium paid. If she chooses to sell her shares however, she can lock in a gain of $5,000 (minus the $1,000 premium for the puts).

Example 3 - Selling a Call:

Yang is an investor who currently owns 200 shares of ‘XYZ’ trading at $100 per share, and does not anticipate the price to move significantly in either direction. He’d like to earn some additional income while his shares of XYZ are ‘trading sideways’ so he sells 2 call contracts at a strike price of $110, with an expiration date 1 month away, for a premium of $1.25 each.

His total income from selling the calls is $250 ($1.25 * 2 contracts * 100 options multiplier).

If by the end of the month, XYZ has not reached a price per share of $110, the calls will expire worthless, and Yang will keep the premium as profit.

If by the end of the month, XYZ is trading at $115, it is very likely that Yang’s calls will be exercised and he will be assigned to sell his 200 shares of XYZ to the buyer of the calls at only $110 per share (the strike price).

In this example, Yang will profit on the initial $250 in premiums, and the $10 increase in share price from $100 to $110 for a total profit of $2,250. However, Yang will lose the ability to profit on the per share increase from $110 to $115 for a total of $1,000 in missed potential gains.

This strategy of combining stock ownership with selling a call is also known as a Covered Call strategy.

Example 4 - Selling a Put:

Fatima is a trader who is looking to buy shares of ‘ABC’ that is currently trading for $50, but would like to buy the shares at a discount - around $40 if possible. She can simply wait and see if the shares drop in price to $40, however she can also sell a put as part of a strategy.

Fatima decides to sell 1 put contract on ABC with a strike price of $40 for a premium of $3, she immediately books a profit of $300 in total premiums ($3 * 100 options multiplier).

If ABC declines in price below $40, it is very likely that Fatima’s put will be exercised and she will be assigned to buy 100 shares of ABC at the strike price of $40.

Because Fatima booked the $3 profit per share in premiums earlier, this reduces her cost basis for ownership of ABC to only $37 per share ($40 strike - $3 premiums received). If she plans to own ABC all along, this strategy enables her to collect the premium while waiting for her opportunity to buy shares at a discount.

If ABC however does not reach $40 in price before the put expires, Fatima will keep the premium as profit, however she may lose the opportunity to buy the shares at the price she’s looking for.

This strategy Fatima is using is sometimes called a Cash-secured Put, and also comes with some inherent risks. If ABC drops suddenly in price all the way to $20, Fatima could be forced to purchase shares for a strike price all the way at $40. If ABC continues to decline even further, Fatima could be forced to book a significant loss, or wait and see if the share price recovers.

Options trading can be an incredibly useful, versatile tool once you understand the basics. But they can also carry significant risk depending on how you use them, and how they can fit your trading strategy.

Options can be used speculatively to maximize profits, while potentially limiting the amount of capital you have to risk, or they can be used as hedging strategies to reduce risk on an already existing position.

As Warren Buffett once famously said “Risk comes from not knowing what you’re doing.” Before trading Options, make sure you understand the potential risks, obligations and rights that come with buying, or selling Calls and Puts.

Here are some common tips and tricks, and common risks to watch out for when getting started with options trading:

Watch the Volume, and the Bid-Ask spread

When buying or selling options for the first time, many traders will notice that the difference between the Bid price and the Ask price can be quite large (sometimes called a ‘wide’ spread) compared to the underlying stock. This all depends on the volume of the options contract (how many contracts are trading hands between traders), and the open interest (how many contracts are ‘out there’ in the market).

Since the same underlying asset will have hundreds of different combinations of Strike prices, and Expiration dates, the open interest, and volume can vary significantly between options for the same security.

Between different underlying assets, how “popular” the Stock, ETF or Index is can also have a big effect on the volume and open interest.

For example: Options contracts on a small-cap Canadian company will have much lower volume and open interest than options contracts on the SPX.in (SP500 index).

When buying options, you risk losing the entire premium

Many Call or Put options will expire worthless if they are not “in-the-money” by the end of the trading day on expiration. Therefore as the buyer of the option, you risk losing your entire investment (the premium you paid originally).

Zero-day or 0DTE Options are more complex

Zero-day (sometimes called 0DTE or ‘days till expiration) Options are Calls and Puts that expire on the same day they’re bought or sold.

Since these options will have little to no Time value, their prices are completely determined by the percentage of implied volatility, and any intrinsic value (whether it’s in, or out-of-the money).

Whether you’re an option buyer, or seller, this “ticking clock” of zero-day options adds an additional element of risk (or protection in rarer cases). A zero-day option can have some time value at the start of the trading day, but if it’s “OTM” as 4pm approaches, this rapidly drops to $0.

Check out our Options FAQ below for more information on common questions about zero day options.

Writing an option is inherently much riskier

Compared to buying (or going long) an option, where the maximum loss is the premium paid, writing (or going short) an option is much riskier (in most scenarios).

When you write an option, you take on the obligation to buy or sell shares at the strike price if called upon to do so (assignment), no matter what the current price per share is.

For example: You write a Call option on Stock XYZ trading at $10 with a strike price of $12, and you don’t own shares of XYZ (this is referred to as an “uncovered, or naked call”).

Due to unexpected popularity on online message boards, XYZ unexpectedly rises in price to $100. As the original Call writer, you will be assigned, and due to your obligations, you now must sell 100 shares of XYZ at the strike price.

But since you don’t own the shares, you are forced to immediately take a short position of -100 shares of XYZ to satisfy the obligations of the Call. When you take this short position, the 100 shares are sold to the Call buyer at the Strike price of only $12.

The short position will start off with a negative P&L of -$8,800.

If the short position is not possible (due to inventory, liquidity, or volume), you may be forced to buy 100 shares at $100 each in the open market for $10,000 (representing 1 call contract). Which are then sold for only $12 each for a total loss of -$8,800.

Writing “Uncovered Calls” exposes you to unlimited losses, while the maximum profit will only be the premium received.

Options are organized by level

Writing options is limited by an account’s Options Level. Generally speaking, only a limited number of short/writing strategies are permitted in Registered accounts.

To trade options, you must first enable this in your account. Check out the article linked above for more details on enabling options, the various strategies and what level they’re organized under.

What happens to my Call/Put on expiration day?

Depending on if your option is ITM, or OTM, and whether you’re the buyer, or the writer, you may have certain obligations, or rights on expiration day.

These actions you take on the expiration date can have a significant impact on your overall profit and loss.

Please check out our Options FAQ below for more information about what happens to your option on expiration day.

This article does not disclose all of the risks and other significant aspects of trading in options. In light of the risks, you should undertake such transactions only if you understand the nature of the contracts (and contractual relationships) into which you are entering and the extent of your exposure to risk.

Trading in options is not suitable for many members of the public. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances.

Transactions in Options carry a high degree of risk. Purchasers and sellers of Options should familiarize themselves with the type of Option (i.e. put or call) which they contemplate trading and the associated risks.

You should calculate the extent to which the value of the Options must increase for your position to become profitable, taking into Account the premium and all transaction costs.

The purchaser of Options may offset or exercise the Options or allow the Options to expire. The exercise of an Option results either in a cash settlement or in the purchaser acquiring or delivering the underlying asset.

If the purchased Options expire worthless, you will suffer a total loss of your investment which will consist of the Option premium plus transaction costs.

If you are contemplating purchasing deep out of the money Options, you should be aware that the chance of such Options becoming profitable ordinarily is very remote.

Selling (‘writing’ or ‘shorting’) an Option generally entails considerably greater risk than purchasing Options.

Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that amount. The seller will be liable for additional Margin to maintain the position if the market moves unfavourably.

The seller will also be exposed to the risk of the purchaser exercising the Option and the seller will be obligated to either settle the Option in cash or to acquire or deliver the underlying asset.

If the Option is ‘covered’ by the seller holding a corresponding position in the underlying asset or another Option, the risk may be reduced.

If the Option is not covered, the risk of loss can be unlimited.

Certain exchanges in some jurisdictions permit deferred payment of the Option premium, exposing the purchaser to liability for Margin payments not exceeding the amount of the premium.

The purchaser is still subject to the risk of losing the premium and transaction costs. When the Option is exercised or expires, the purchaser is responsible for any unpaid premium outstanding at that time.

Related lessons

Want to dive deeper?

Advanced options trading

Get a comprehensive introduction to options trading strategies, and how options levels work.

View lessonRead next

Margin 101

Learn about using a non-registered account and important information when leveraging it for your investments.

View lessonExplore

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lesson