Note: The information in this blog is for information purposes only and should not be used or construed as financial, investment, or tax advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson The RoundUP and Cashback Rewards programs

RoundUP automatic savings program

Learn more about the RoundUP automatic savings program and how it can help put your spare change to work.

Questrade’s RoundUP program puts your spare change to work, and helps make saving and investing easier.

Looking for an automatic solution to save a little more each month for your future?

You’ve come to the right place.

Link any eligible credit card and bank account to any of your Questrade accounts, and watch your savings grow automatically when your purchases are rounded up. That extra 10 cents here and 40 cents there can add up over time, and you can put your change to work in a Self-directed or Questwealth account.

How does it work?

You can link one Canadian Visa or Mastercard to any of your Questrade accounts, and the purchases you make throughout the month are rounded up to the nearest dollar.

The dollar value of the purchases made on your credit card will be tracked to calculate your RoundUP amount at the end of the month, then withdrawn automatically from the bank account of your choice at the start of the following month. (I.e. RoundUP amounts from November are deposited in the first week of December.)

Note: The visual above is for informational and educational purposes only, and may not indicate real world RoundUP or market conditions. Depending on how often you use your card, the amount you spend, and what you’re invested in, your returns may vary.

When you enroll, you can set up your minimum and maximum monthly withdrawal amounts. The program minimum is only $10 (but you can set a higher minimum if you want), and the maximum is up to $2,000.

Please note: The RoundUP amount from your credit card purchases is not taken from the credit card, but rather from your bank account. The linked credit card is simply used to calculate the amount of the RoundUP.

Due to regulations in Canada, credit cards of any kind cannot be used for deposits into an investment account.

You can also pause the program at any time. Big holiday spending season coming up? No worries, check out the section below on editing your program enrollment for more information.

When you sign up for the RoundUP program, you can also enable Cashback Rewards from our retail partners.

Signing up

To sign up for the RoundUP program:

- Head to the PROGRAMS page from the top navigation menu

- Click the green SIGN UP NOW button at the top of the page.

- Select which program (RoundUP or Cashback Rewards) you’d like to sign up for, or choose both.

What you’ll need

Before you start, you’ll need your Canadian credit card and bank account information to complete your signup process.

The dollar value of the purchases made on your card will be tracked to calculate your RoundUP amount at the end of the month, and the designated bank account of your choice will be used for the deposit.

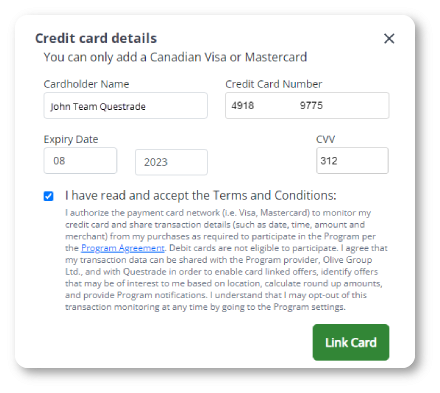

Adding your credit card

The first step is adding your credit card information to track your purchases and calculate your monthly savings.

Please note: If you’re signing up for both RoundUP and Cashback Rewards, you will be able to add 2 credit cards. Only the first card can be used for the RoundUP program, but both cards can be used for the Cashback Rewards program.

Please enter the credit card number, expiry date, card holder name, and the CVV code (usually on the back).

Once you’re done, please read and accept the terms and conditions.

Note: Debit cards (including Visa Debit), and prepaid credit cards (I.e. Koho, Stack, Vanilla Mastercard) are not eligible.

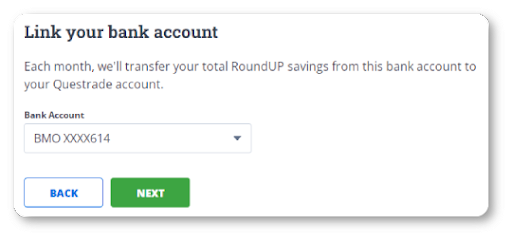

Adding your bank account

Adding your bank account for RoundUP is easy.

If you’ve already set up a Pre-Authorized Deposit (PAD), or an Electronic Fund Transfer (EFT) withdrawal in the past, your linked bank account(s) will be listed in the drop-down menu.

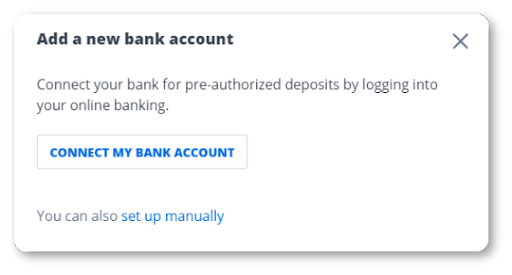

If you haven’t linked a bank account electronically yet, you’ll have the option to Add a new account. You can either connect through our secure online portal, or choose a manual set up.

Secure online connection

If you choose to add your bank account using your bank’s secured connection, you’ll be directed to a new screen to choose your institution.

Here, you’ll have to log in using your online banking login details.

Once completed, your bank account will be added to the signup process.

Manual connection

If you choose to add your bank manually, you have to complete the following:

- Choose the type of account you wish to set up (personal, or corporate).

- Enter the primary account holder information. Please ensure your bank account name matches the name on your Questrade account exactly.

- Enter bank account information including:

- Financial institution

- Transit number

- Bank account number

- Currency used (CAD or USD) on that account

If you choose a manual setup, you will also need to upload a void cheque or direct deposit form to verify your bank account’s details.

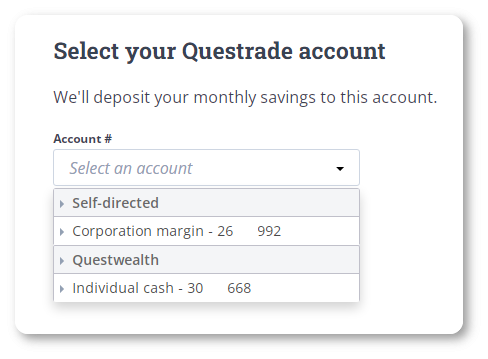

Next, choose the Questrade account you’d like your RoundUP savings to be paid out into.

Most self-directed and Questwealth accounts are supported with the exception of Retirement income (RIF, LIF...) and FX & CFD accounts, which are ineligible.

Please note: If you choose a registered account like a TFSA, FHSA, or RRSP for your RoundUP or CashBack rewards deposits, these will be counted as contributions for tax purposes.

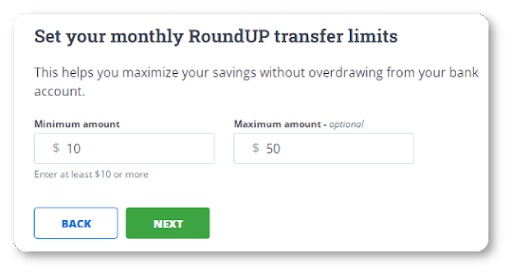

RoundUP transfer limits

Enter your minimum amount: The minimum monthly amount is $10 CAD for you to enroll in the program, but you can also enter a higher amount if desired.

Enter your maximum amount. Even if your RoundUP purchases exceed this amount, your deposit will never be higher than your maximum.

Note: You can edit the minimum and maximum amounts anytime after you finish the set up from the program homepage. Check out the section below for more information about pausing or editing your program enrollment.

Agreements

The last step to finish your signup is to review and agree to the terms and conditions.

Congrats, you’ve finished signing up for RoundUP.

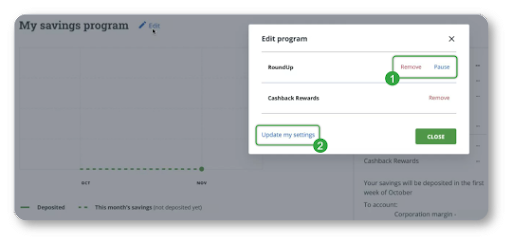

After you’ve signed up, you can edit your settings from the main Programs page at any time. Simply click the blue pencil icon beside Edit to open the menu with all the available options.

You can remove either program from this menu, or simply pause your RoundUP program at any time.

To edit your credit card information, banking details, or your minimum/maximum amounts, please click the Update my settings button.

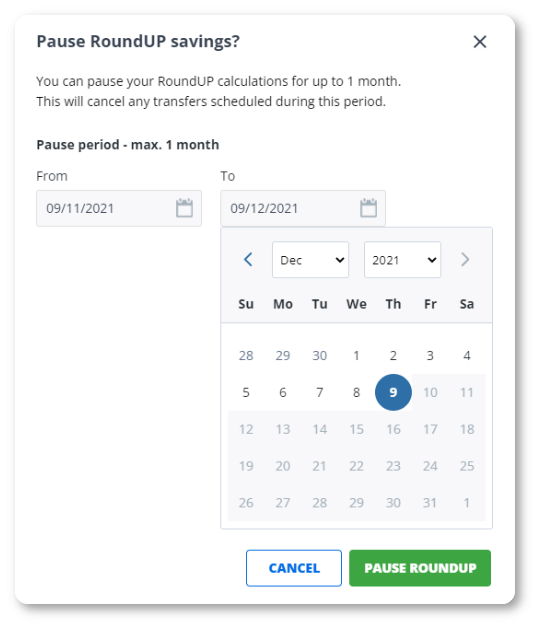

Pausing RoundUP

If you choose to pause RoundUP, the purchases made so far in that month will still be calculated for the next month’s deposit.

For example: If you pause RoundUP on Dec 15th, your RoundUP amounts from Dec 1-14 will still be tracked, and the amount deposited in the first week of Jan.

Purchases made after the program has been paused, and until it resumes will not be calculated for the deposit.

You can choose how long you’d like to pause for, with a maximum pause of one month. The program will automatically resume after your chosen date.

If you would like to pause for longer, you can simply remove the RoundUP program and register again when you’re ready.

Please note: If you choose to remove RoundUP completely, any purchase calculations from that month will be cancelled, and the graph showing your RoundUP and Cashback Rewards will reset.

Your card will no longer be linked, and any transactions made that month will not qualify for either RoundUP or Cashback Rewards.

Related lessons

Want to dive deeper?

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lessonRead next

Investment tools at Questrade

Learn more about the tools available through our API Partners to unlock new research, trading, and portfolio optimization capabilities.

View lesson