Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Researching investments

Research - Questrade Edge Web

Learn more about the Research tools available in the Questrade Edge Web platform

In the Research sections of Questrade Edge Web, you’ll be able to access the following pages:

Trending stocks

Events calendar

News

You can also access more research tools on the Stocks page under the Level 1 trading quote. These include: Analyst ratings, News sentiment analysis, and Smart Score.

Check out the sections below for more detailed information about each research tool.

Don't have Questrade Edge yet? Follow the instructions in this helpful article to add it to your platform.

Please note: Research, daily ratings, trending stocks, and Smart Score are provided by TipRanks. The availability of these services and the information that may be conveyed through them do not constitute any form of trading or investment advice by Questrade. Questrade cannot guarantee the timeliness, accuracy, and reliability of these Tipranks services and the information that may be conveyed through their use. Questrade will not be held liable nor assume any liability for any loss or damages arising directly or indirectly from the use of these Tipranks services. Any liability, whether direct, indirect or consequential loss or damage is explicitly disclaimed.

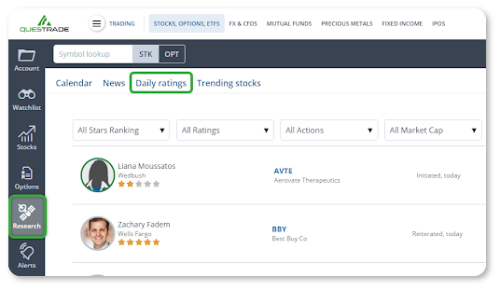

To access the Daily analyst ratings in the Questrade Edge web trading platform, please:

- Log in, and navigate to Questrade Edge web

- Click “Research” from the left navigation menu

- Navigate to the Daily ratings tab

The Daily ratings tab will show you recent analyst guidance & ratings for publicly traded stocks. Analyst ratings try to measure the performance of a stock over a given time period, and will issue a Buy, Sell, or Hold recommendation with a predicted price target.

Analysts arrive at their ratings after extensive research into companies’ financial statements, and other in-depth research on products or services offered. Most analysts will issue a new rating 4 times a year, usually every 3 months.

The Daily ratings tab will show you the newest analyst ratings from today, and is updated constantly throughout the day. You can also use the filtering tools at the top to focus on the exact recommendations you’re looking for.

Filtering tools

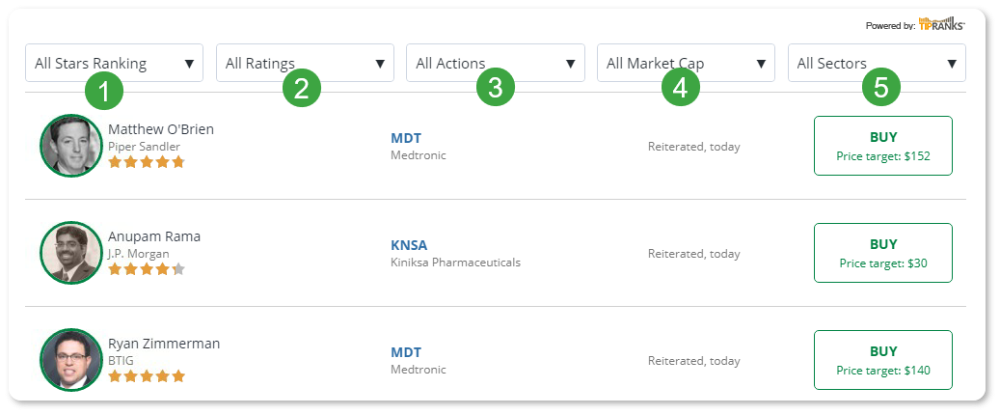

Use the buttons at the top of the page to filter between different Analyst ratings.

- The Stars Ranking tool allows you to focus on Analysts with a star ranking from 1 to 5

- Read more about TipRanks’ Star Ranking system here

- Ratings lets you choose between Buys, Sells or Holds

Analysts and ratings shown are for example educational purposes only and may not reflect current market conditions.

- The Actions filter allows you to choose the type of Analyst Rating:

- Initiated means the analyst or firm is covering this stock for the first time

- Resumed means the analyst is resuming coverage after a period of inactivity

- Upgraded means the analyst has improved their rating, for example: from “hold” to “buy”

- Downgraded means the analyst has lowered their rating, for example from “hold to sell”

- Reiterated means the analyst has kept their earlier recommendation the same

- Assigned means this is the first rating TipRanks has for this analyst on the stock

- Read more about the types of analyst ratings here

- Market Cap allows you to choose between various sizes of companies from Micro to Mega, depending on their overall Market capitalization. (The number of shares issued, multiplied by the price per share)

- Sectors will allow you to focus on the specific segments of the market you’re looking for

- I.e. Consumer goods, Technology, Utilities, and etc.

You can also click on the stock’s Ticker Symbol in the middle column to jump directly to the Stocks page.

If you’re looking to read the specific Analyst report, please click the ticker, then navigate to the Analyst ratings tab at the bottom of the page. Check out the section below for more details on that page.

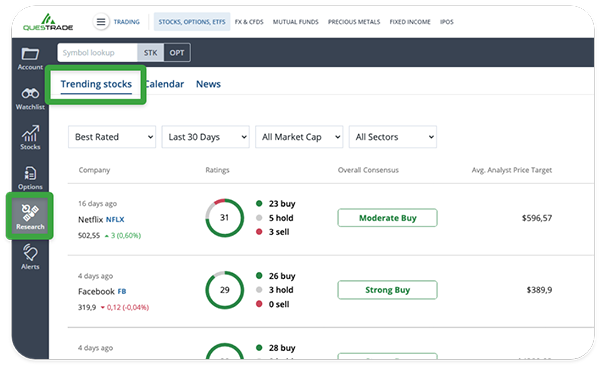

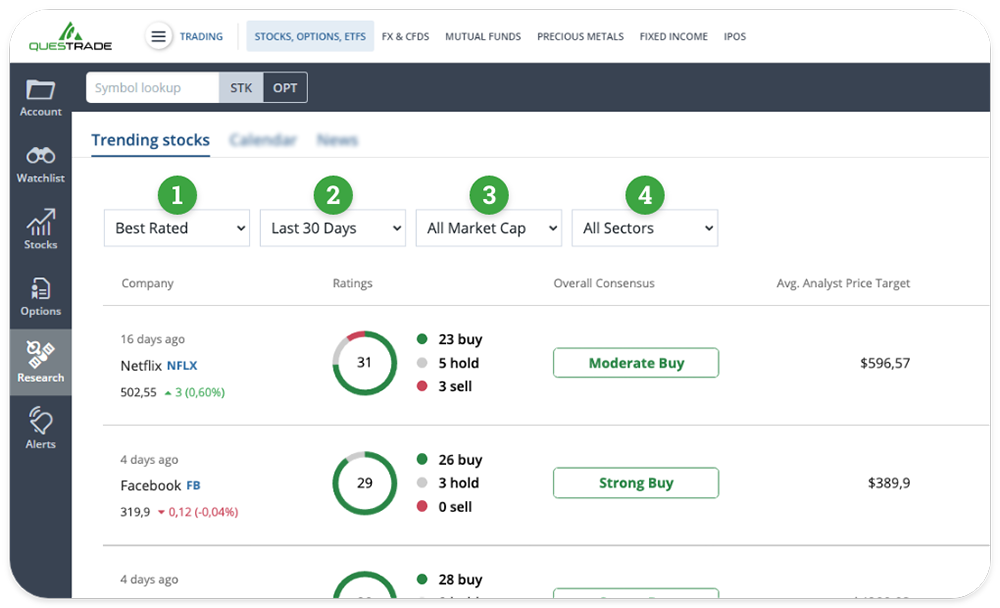

To access the Trending stocks page in the Questrade Edge web trading platform, please:

- Log in, and navigate to Questrade Edge web

- Click “Research” from the left navigation menu

- Click the “Trending stocks” tab

Please note: All companies and ticker symbols shown are for example and educational purposes only.

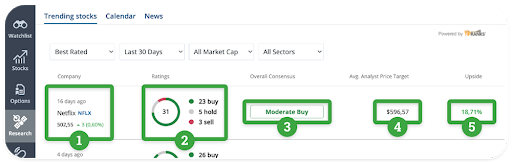

Trending Stocks is a screener, and your go-to area to help you find fresh trading ideas and opportunities. It offers a number of filtering tools allowing you to focus on Buy, Hold or Sell recommendations.

Let’s take a look at some of the filtering tools:

- Switch between best, worst and most rated.

- Filter between the last 30 days, last 7 days, and the last 72 hours.

- View different market caps of companies from Micro to Mega.

- Swap between common market sectors such as Consumer goods, Services, Utilities and more.

Company ratings and quotes:

- On the left, we can see the company’s name and a recent quote.

- You can also click on the ‘ticker’ beside the name to go directly to the Stocks page for further research.

- You’ll also see the last traded price, dollar and percentage changes since market open.

- In the Ratings column, we’ll see the number of analyst ratings, and the breakdown of whether they have rated the stock a buy, sell or a hold.

- You can also see the Overall Consensus, this can range from a Strong Buy, to a Strong Sell.

- The Average Analyst Price Target is also shown, this consolidates all the analyst price targets into one neat average.

- Lastly, you’ll see the potential percentage upside, or downside. This is the difference between the current price, and the average analyst price target.

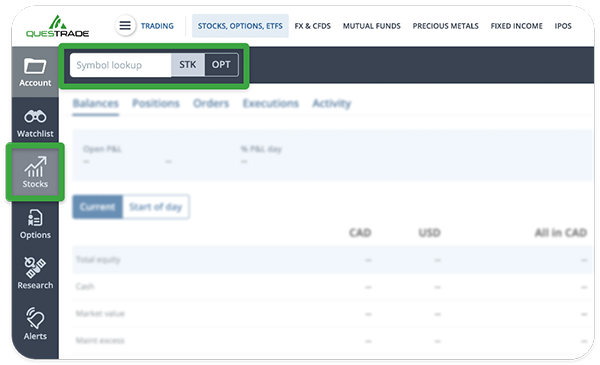

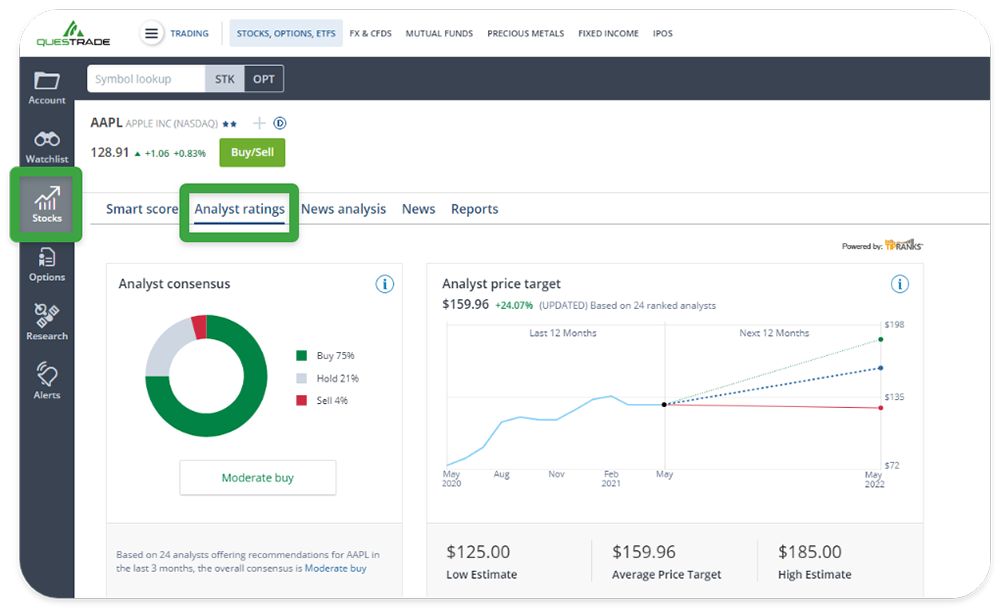

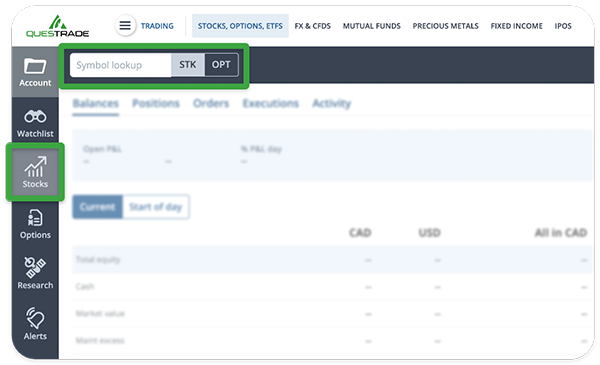

To find the Analyst ratings page for a specific stock in the Questrade Edge web trading platform, please:

- Log in, and navigate to Questrade Edge web

- Click “Stocks” from the left navigation menu and enter a ticker symbol in the lookup box

- Scroll to the bottom of the page under the chart and level 1 quote to view recent and historical analyst ratings

At the top of the tab, you’ll see the overall Analyst consensus on the left, which aggregates all of the analyst ratings from the last 3 months.

Please note: All companies and ticker symbols shown are for example and educational purposes only.

On the right, you’ll see the average Analyst price target shown both as a dollar and percentage value, and in a graph.

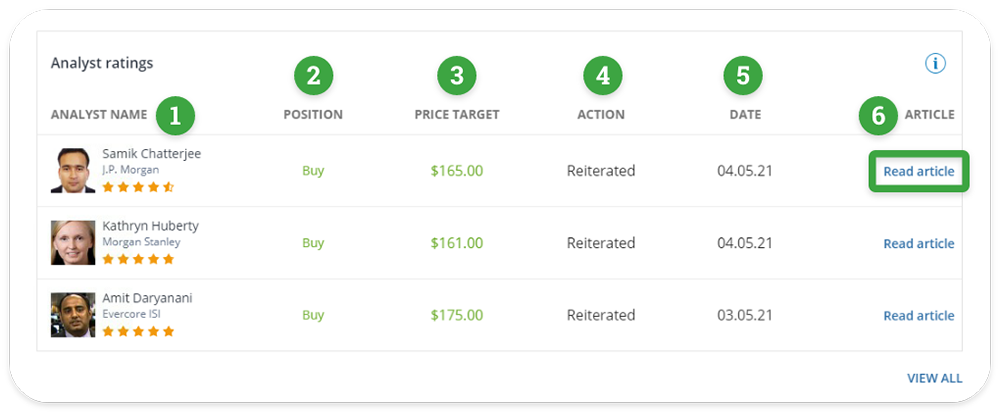

You can see the individual Analyst Ratings below these graphs.

Let’s take a closer look at the Analyst ratings section below:

- The left column shows the Analyst’s name and the firm or publication they represent, along with the Analyst’s Star rating.

- The Star rating combines both the success rate (how many predictions the analyst has gotten right) and average return of each financial analyst; however the success rate is secondary to the ability of the analyst to generate positive returns.

- Learn more about Analysts and their recommendations here.

- Here you can see the Analyst’s recommendation or Position, and whether it’s a Buy, Sell, or Hold.

- The Price Target shows the approximate price target of the Analyst.

Analysts and ratings shown are for example educational purposes only and may not reflect current market conditions.

- The Action column shows whether the Analyst has either:

- Reiterated one of their earlier recommendations

- Upgraded the stock

- Downgraded the stock

- The Date shows what date the Analyst has made their recommendation.

- Lastly, in the Article column, you can click Read article to view the Analyst’s report on their website.

The Analyst ratings window will show a small sample of the most recent analysts that made a recommendation. You can also click the View All button at the bottom right to view all available Analyst ratings.

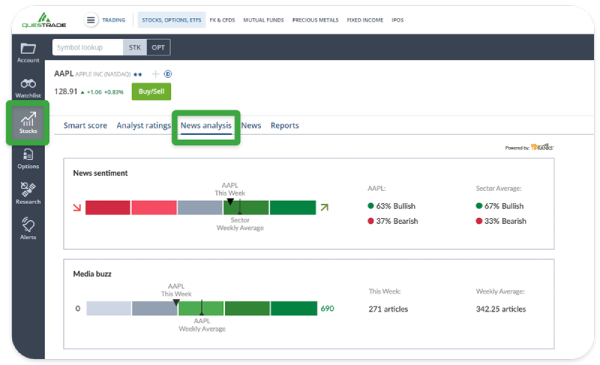

To find the News analysis page for a specific stock in the Questrade Edge web trading platform, please:

- Log in, and navigate to Questrade Edge web

- Click “Stocks” from the left navigation menu and enter a ticker symbol in the lookup box

- Click the News analysis tab under the level 1 quote and chart

On the News analysis tab, you can see the overall News sentiment at the top, and the Media buzz below.

Please note: All companies and ticker symbols shown are for example and educational purposes only.

The Media buzz section shows how many recent news articles have been published mentioning this company. You can also see the weekly average here, and whether there’s a significant amount of news for this specific ticker.

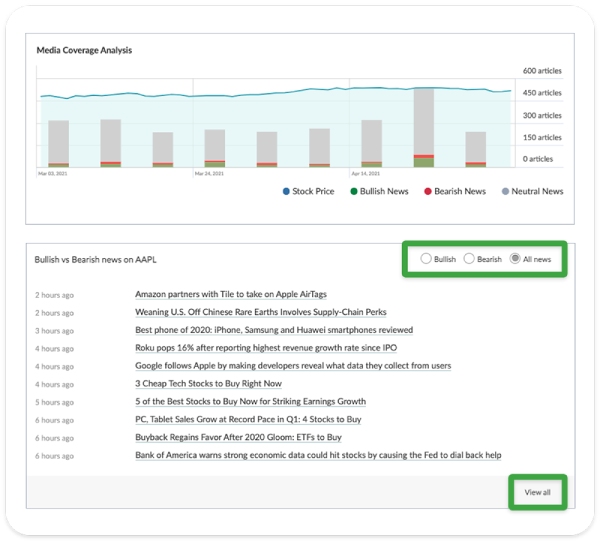

Below this, you’ll see the Media Coverage Analysis which shows a breakdown of news articles compared against the stock price over time.

You can also click on any headlines to read specific news articles below, these are sorted by most recent.

Using the filtering tools at the top right, you can also swap between viewing All news, Bearish, or Bullish.

To view all available articles for this company, simply click the View all button at the bottom right.

To find the Smart Score page for a specific stock in the Questrade Edge web trading platform, please:

- Log in, and navigate to Questrade Edge web

- Click “Stocks” from the left navigation menu and enter a ticker symbol in the lookup box

- Click the Smart score tab under the level 1 quote and chart

Please note: All ticker symbols and companies shown are for educational and display purposes only.

You can also click see more under Analyst Ratings, and News sentiment within the Smart Score to be taken directly to that research page.

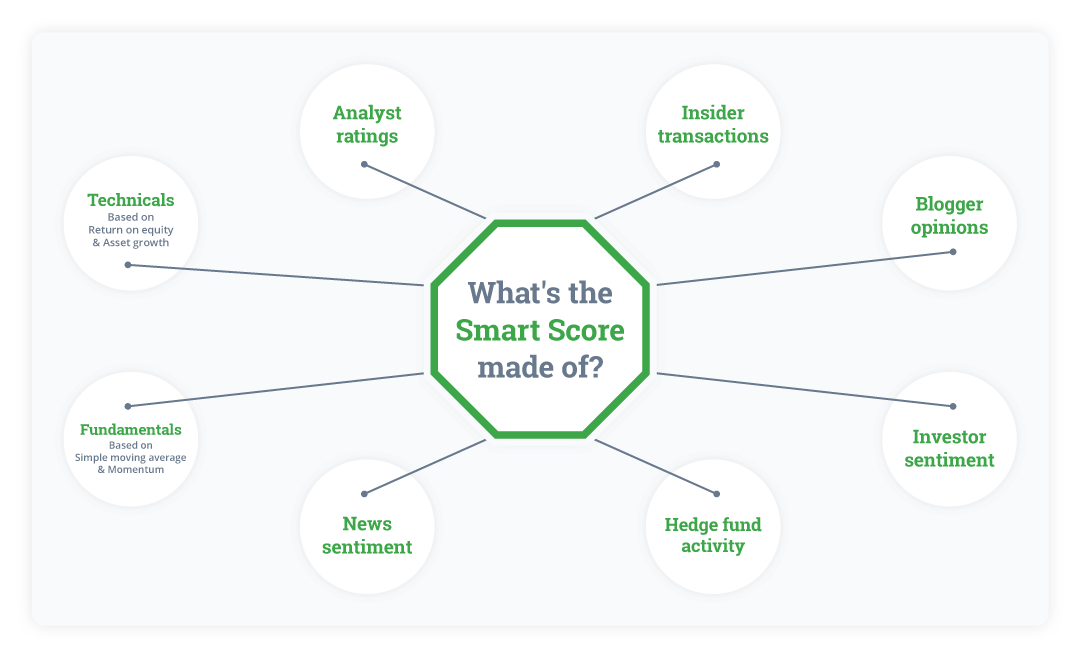

What is the Smart Score?

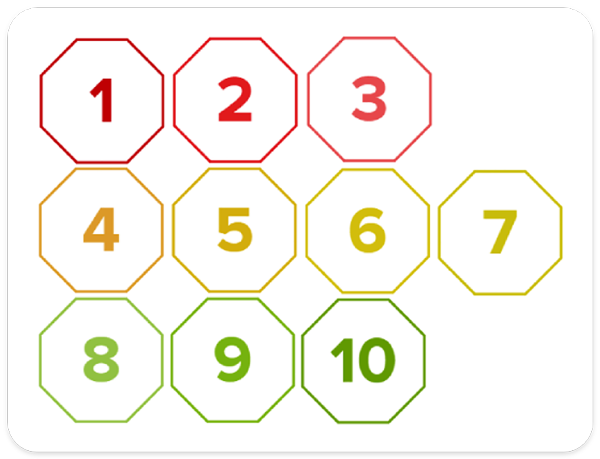

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It rates stocks from one to ten, based on 8 key market factors. The lowest score is a 1 and the highest is 10. The scoring system works as follows:

Stocks with a score of 1, 2, or 3 are considered to be Underperforming

Stocks with a score of 4, 5, 6, or 7 are considered to be

Neutral

Stocks with a score of 8, 9, or 10 are considered to be Outperforming

The score is data-driven and does not involve any human intervention. Let’s take a deeper-dive on exactly how TipRanks calculates the Smart Score:

How is the Smart Score calculated?

The 8 market factors that contribute to the rating are: analyst ratings, insider transactions, blogger opinions, investor sentiment, hedge fund activity, news sentiment, technicals, and fundamentals.

These individual components are explained in more detail below.

These eight factors equally contribute to the rating, and each factor makes up 12.5% of the Smart Score.

The Fundamentals, and Technicals are divided into two sub-categories each representing 6.25%

- Technicals: SMA - 6.25% (simple moving average at 20 and 200 days), and Momentum - 6.25% (12 months change)

- Fundamentals: Return on equity - 6.25% (trailing 12 months), and Asset growth - 6.25% (trailing 12 months)

If any of the eight factors are not available, they are considered to be contributing a neutral value to the Smart Score.

The Smart Score ranking is also relational. This means that once the score is calculated based on the 8 factors, the stocks are arranged from highest to lowest.

The top ranking ~4% of stocks receive a Smart Score of 10. The next ~7% get a Smart Score of 9 and so on.

As the number of securities analyzed by TipRanks changes (due to new coverage, listings or IPOs) the Smart Score may also change, even if the 8 market factors remain the same.

Market factors contributing to the Smart Score

These are the eight market factors that contribute to the Smart score:

Financial analyst ratings

Analyst consensus is based on sell side analyst ratings issued within the last 3 months.

Corporate insider transactions

Insider Activity provides you with insight into whether corporate insiders are net buyers or sellers of the company’s stock.

Financial blogger opinions

Blogger sentiment is based on blog posts analyzed by TipRanks’ natural language processing technology.

Please note: Bloggers publish their own personal opinions and may not have any formal education or qualifications.

Bloggers consensus is based on tracking and measuring the performance of over 50,000 individuals. Data is based on Tipranks’ three tier proprietary formula, which ranks them based on the following:

- Success Rate - This measures the win-to-loss ratio

- For example: The number of accurate vs inaccurate picks. 10 losing transactions cannot be offset by one winning transaction with a high profit

- Average Return - a bloggers overall performance

- Statistical Significance - a measure of the blogger's consistency based on the number of submissions received

- For example: A blogger with a 1000% average return but with 1 submission would rank very low. A blogger with a 2% average return with many submissions would rank very high.

Individual investor sentiment

Sentiment is based on the percentage of portfolio increase or decrease in the last 7 and 30 days by hundreds of thousands of individual portfolios of TipRanks subscribers.

Hedge fund manager activity

Hedge Fund Activity is an indicator of the net Hedge Fund purchases or sales in the previous quarter.

News sentiment

Sentiment is based on the last seven days of news stories analyzed by TipRanks’ natural language processing technology, and can show you the trends in current news sentiment for this specific ticker.

Fundamentals

The fundamentals measurement is split into 2 categories: Return on Equity, and Asset growth. Both of these are measured for the last 12 months trailing when corporate earnings information is publicly available.

Technicals

The technicals measurement is also split into 2 categories: SMA (Simple moving average) over 20 and 200 days, and the Momentum (12 months change).

Six of the eight market factors incorporated into the Smart score are unique to TipRanks, only the technicals and fundamentals are not.

Please note: Research, daily ratings, trending stocks, and Smart Score are provided by TipRanks. The availability of these services and the information that may be conveyed through them do not constitute any form of trading or investment advice by Questrade. Questrade cannot guarantee the timeliness, accuracy, and reliability of these Tipranks services and the information that may be conveyed through their use. Questrade will not be held liable nor assume any liability for any loss or damages arising directly or indirectly from the use of these Tipranks services. Any liability, whether direct, indirect or consequential loss or damage is explicitly disclaimed.

Related lessons

Want to dive deeper?

Options trading

Get a comprehensive guide to Options trading using the different Questrade Edge platforms.

View lessonRead next

Questrade trading platforms

Discover all of Questrade’s trading platforms and decide which one is best suited for you, and your investment style.

View lessonExplore

Introduction to options trading

Get a comprehensive introduction to trading options, how they work and answers to common questions and terminology.

View lesson