Note: The information in this blog is for information purposes only and should not be used or construed as financial, investment, or tax advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Currency conversion

Exchanging funds in registered and non registered accounts

Understand how to exchange funds between Canadian and US dollars.

- Since Questrade accounts support dual-currency investing in both Canadian and U.S. Dollars, from time to time, you may need to exchange currencies in your account.

- Depending on which account type you trade from, (non-registered Margin, or registered) you may or may not need to manually place requests to exchange your funds.

Check out the sections below for more information on the 2 account types:

One of the most popular account types is the non-registered Margin account. This account offers many unique features that are not available in registered accounts, notably:

- Buying on margin (borrowing funds from Questrade to invest/trade)

- Short-selling (borrowing shares you don’t own to sell)

Because Margin accounts allow you to borrow funds to invest or trade, Questrade will not convert your currencies for you automatically. This allows you to have more flexibility with your account, and borrow or convert currencies as needed.

For example:

You hold $2,000 CAD in your margin account, and would like to buy some US stocks or ETFs, but currently your USD cash balance is $0.

If you place a trade for an investment that trades in USD, your currency is not converted for you. Instead, after your trade executes, your CAD cash remains untouched, and your USD cash balance will be negative.

In this scenario, unless you take action, you will continue to borrow USD cash (while maintaining your CAD cash as collateral) and will be charged interest after the trade has settled.

Tip: Trade settlement is the two business day period where a stock, option or ETF trade is considered “official” and finalized. At Questrade, you don’t have to wait for your trades to settle to use your cash for new trades - it is available right away.

In the earlier example, while the buy order is settling (T + 2 business days), you can place a request to manually exchange CAD cash to cover the negative USD balance. The 2-day settlement period gives you the opportunity to cover your debt without being charged interest.

Additionally, if a negative cash balance is not held overnight (past 4pm ET after the trade has settled), you are not charged interest. This allows for more flexibility in margin accounts for traders who ‘close their positions’ before the end of the trading day, or if you exchange your cash before the trade settles.

Check out the section at the bottom for a step-by-step guide on placing a currency exchange request manually.

Registered accounts like the TFSA, FHSA, or RRSP offer many special tax benefits that are not available in margin accounts. These benefits however, come with some rules that have been put in place by the CRA.

One of the key differences between registered and non-registered accounts is that with registered accounts, you cannot borrow funds to invest, and cannot hold negative balances indefinitely.

For example:

You hold $2,000 CAD in your TFSA account, and decide to buy some USD stock. (Your USD cash is $0 before the trade.)

After your trade executes, your USD cash balance will be negative for the total cost of the trade plus commissions, and your CAD cash balance will initially remain unchanged.

Since you cannot borrow funds in registered accounts, Questrade will automatically convert the required amount of CAD cash to cover your negative USD cash balance at the end of the trading day. (~4pm ET)

The next morning, your USD cash balance will be brought back up to $0, and your CAD cash will be decreased by the amount needed for the conversion.

If you choose to sell your shares later on, the USD cash proceeds will not be converted to CAD automatically by default.

This allows you to use your new USD cash for other USD trades without having to convert back and forth constantly.

Check out this article on currency settlement preferences for more information.

You can also manually convert your cash between currencies ahead of time if you’d like, check out the section below for detailed instructions.

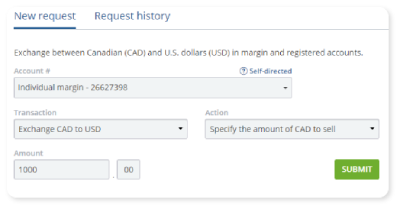

Placing a request online is easy, follow these steps to exchange the cash in your account between CAD and USD (or vice-versa).

- Log in to your account

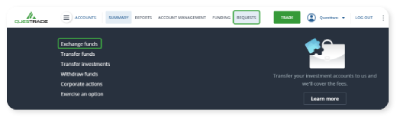

- Hover over the “Requests” navigation menu at the top of the page, and click “Exchange funds”

- Select the account you’re placing the request for in the drop down menu at the top.

- Choose your desired transaction, the two options are:

- Exchange CAD to USD

- Exchange USD to CAD

- Specify the amount of CAD or USD you’d like to either buy or sell, in the action field

- If you’re exchanging CAD to USD, you can either choose a specific amount of CAD to sell, or USD to buy

- If you’re exchanging USD to CAD, you can either choose a specific amount of USD to sell, or CAD to buy

- Enter the dollar amount you’d like to exchange

- Click the green Submit button when you’re ready

Congrats, you’ve finished placing your currency exchange request. You can view your Request history by clicking the tab at the top.

Important to know:

- Requests placed before 2:30pm ET will be processed around 4pm ET the same day

- Requests placed after 2:30pm ET are processed on a best effort basis the same day

- If the request is not able to be processed the same day, it will be exchanged the following business day

- Due to conditions beyond our control such as exchange volume, we cannot guarantee that your request will be processed on the same day if placed after 2:30pm ET

- If you hold a negative cash balance in a registered account past 4pm ET, and have sufficient cash available in the other currency, a forced conversion will take place due to CRA rules about negative balances in registered accounts

- You do not need to manually place a currency exchange request in this scenario, please see the section above for more details

- You can cancel a request that has not been processed yet by heading to the Request history tab

- You cannot exchange funds in a Questwealth Portfolio account

Related lessons

Want to dive deeper?

How to open an account

Learn what you need to know when opening a self-directed or Questwealth Portfolios account.

View lessonRead next

Balances and Reports

Understand how to read your account balances and the reports pages to know more about your investments.

View lessonExplore

Navigating market volatility

Take a look at the different ways in which you can invest during a volatile market.

View lesson