Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Margin 101

How buying power is calculated

When investing in margin, it’s important to understand how buying power is calculated. Learn how buying power is calculated, and how market movements affect your margin holdings.

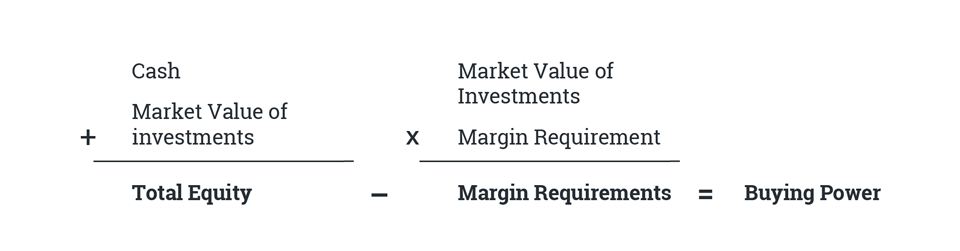

The buying power, or amount of margin available in your margin account, is calculated with one straightforward formula:

Understanding how this works can help you make sure your buying power remains positive, as a negative balance will trigger a margin call.

Example 1:

You deposit $10,000 CAD cash into your new margin account, and have not made a trade yet. Your cash equals $10k, market value is $0, therefore your buying power is equal to your cash at $10,000 CAD.

Example 2:

With your $10,000 deposit from earlier, you buy $20,000 of stock ABC with a margin requirement of 30%.

Here is how you calculate your buying power:

Your cash balance from the above trade is now -$10,000, while the market value of your investments is $20,000.

Therefore, your total equity is still $10,000 (-$10,000 + $20,000).

The margin requirement of your new shares is $6,000 ($20,000 * 30%)

Now you subtract the margin requirement, $6,000, from your total equity, $10,000, to see your new buying power: $4,000 ($10,000 - $6,000)

Example 3:

Continuing from the earlier scenario, your $20,000 investment unexpectedly increases in value by 10% to $22,000.

Your cash balance is still -$10,000, but now your total equity is $12,000 (-$10,000 + $22,000). Your margin requirement is: $22,000 * 30% = $6,600.

Therefore, your buying power is now $5,400 ($12,000 -$6,600).

Example 4:

Let’s say instead of the 10% gain we saw in Example 3, stock ABC is affected by a major scandal and drops by 32.5% to $13,500.

Your cash balance remains at -$10,000, but now your total equity is $3,500 (-$10,000 + $13,500). Your margin requirement is $4,050 ($13,500 * 30%).

Therefore, your buying power is now -$550 ($3,500 - $4,050).

Since the balance is negative, you would then be in a margin call, and would need to deposit funds or sell shares to bring this value up to a positive amount.

These examples highlight how borrowing (also known as using leverage) while trading can magnify our gains, but also our losses. In these scenarios, because we leveraged our cash by 2x to purchase the initial investment, the gains and losses were both magnified by 2x. With a 10% gain in share price, your account goes up +20%. However, with the 32.5% loss in example 4’s negative outcome, your account would be down 65%.

When investing on margin, it’s important to understand the risks as well as the benefits. Understanding how margin is calculated can help you find a strategy that might keep you out of margin call.

Related lessons

Want to dive deeper?

TFSA 101

Discover what a Tax-Free Savings Account is and how it can benefit your investment goals.

View lessonExplore

Accounts 101

Explore the different account types available in Questrade and determine the right account for you.

View lesson